6 Better Benefits Business Valuation for Finance Managers

6 Better Benefits Business Valuation for Finance Managers

Introduction: Why Valuation Matters for Finance Leaders

The business valuation practice should never be seen as an exclusive feature of the work of investment bankers or external consulting companies anymore; it has turned into the direct responsibility of the finance department on the contemporary global community-based and unstable markets. An effectively performed valuation allows a firm to achieve alignment of financial strategy and business development, capital investment, as well as management of risks. To finance leaders, compliance is not the sole aspect of valuation, but rather a strategic tool, which can help negotiate mergers and acquisitions, attract investors to fund the business, plan a succession strategy, and make long-term investments.

Being in a tremendously competitive universe, where the price of capital and ability to access funds are critical issues, it is vital to be aware of how to rate and translate the results of valuation. It enhances accountability in dealing with stakeholders, enhances its credibility in a boardroom discussion, and enables organizations to justify their decisions concerning strategic aspects. A finance leader with valuation skills is in a better position to reap the benefits of protecting the interests of the shareholders, regulatory compliance, and identifying chances of sustainable value creation.

Understanding the Purpose of Business Valuation

Any valuation process begins with an intent. Valuations would aid both the buyers and the sellers to come to a reasonable price in transactions. In fundraising, they provide an assurance of potential in a company to the investors and exert equity placement.

Strategic planning is also supported by valuation. Having information about what motivates enterprise value, leaders are able to know where to expand, where to reduce, and how to overcome risks. Regulations further provide valuations that are right when it comes to tax reporting, accounting standards and compliance audit.

Goals that are clear act as a deterrent to defeat and have mapping carried out in a manner that is consistent with the performance of the organization as well as other outside influences.

Key Valuation Approaches

The modern use of valuation is dominated by three valuation approaches, i.e. income, market and asset-based approaches of valuation.

Income approach is considered as a future income flow that is discounted to the present. Such models as DCF put emphasis on intrinsic value and are effective when there are clear forecasts of the business.

Market approach compares itself with similar companies or or recent deals. It gives actual reference points but can ignore strengths or weaknesses.

The asset-based approach appreciates a company based on the difference between the asset and the liabilities. It is best applied in the case of asset-intensive or liquidation and under-estimates intangibles like brands or IP.

Realistically, it is common for the leaders in finance to place more than just a single technique of establishing credibility and assumptions balancing.

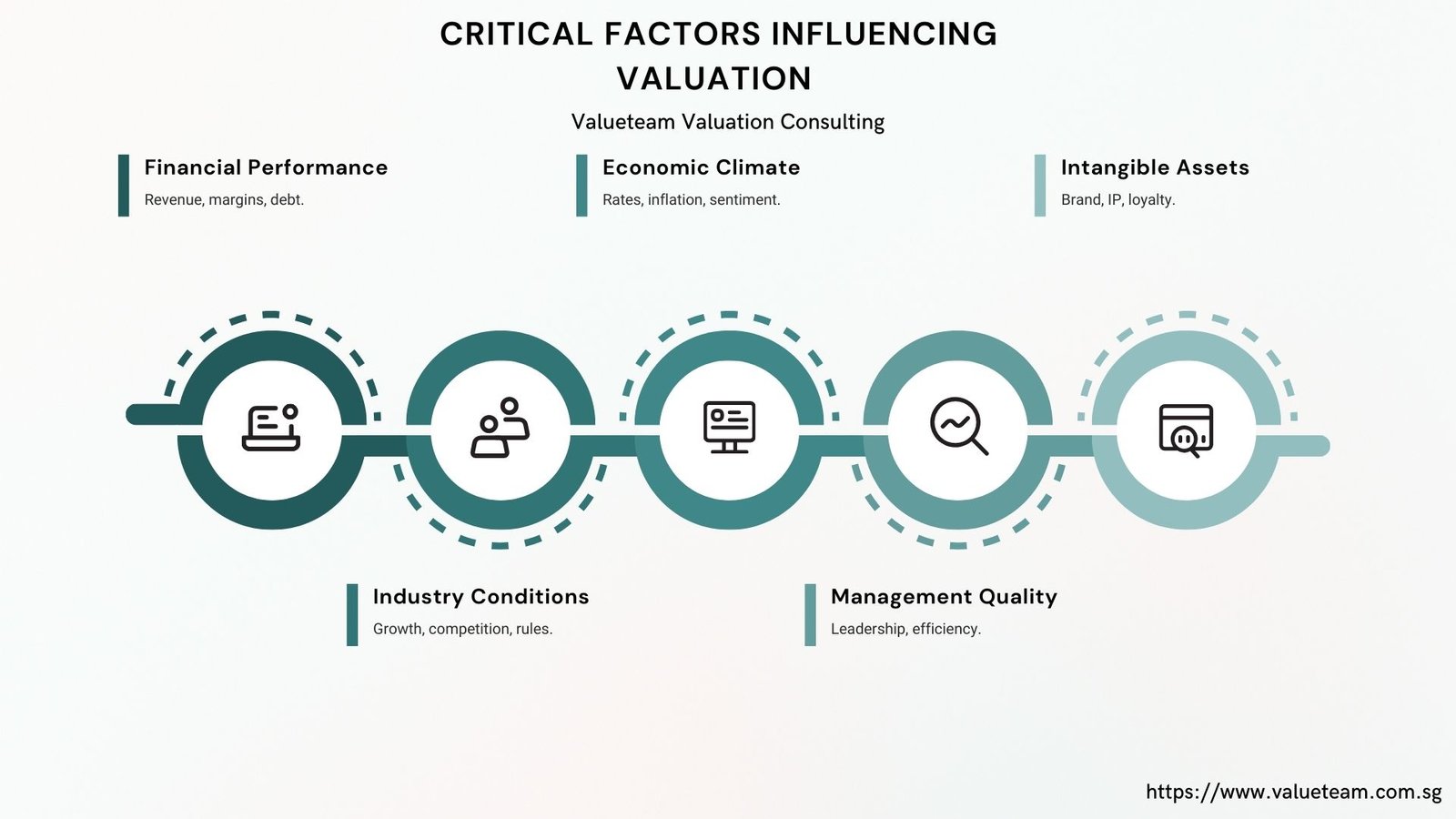

Critical Factors Influencing Valuation

The results of valuation are determined by figures and situations. It remains based on financial performance in terms of revenues, margins and debt. However, the industry forces, including growth potential and competition, are also significant factors.

Discount rates and value. Discount rates and value are subject to macroeconomic variables such as inflation, interest rates and investor sentiment. Meanwhile, a premium can be explained by leadership, governance and brand reputation.

Intellectual property, customer loyalty and talent are intangibles and usually possess a hidden value. Finance leaders should consideration both quantitative and conservatory drivers in order to reach realistic conclusions.

Common Challenges in Business Valuation

There are numerous pitfalls of Valuation of business. Poor financial statement due to incomplete or inaccurate accounting can give misleading results. The assumption might be invalidated instantly when there is volatility in the market. The application of a single method like DCF leads to bias and a lack of flexibility.

Another common problem is underestimation of intangible assets which are at the centre of a contemporary business. Failure to pay attention to them can result in heavy misprice.

In order to address those difficulties, the leaders of finance ought to merge the approaches, stress-test the assumps and whatever is left in writing. This way, the amount of arguments will be minimized, and their credibility will be improved.

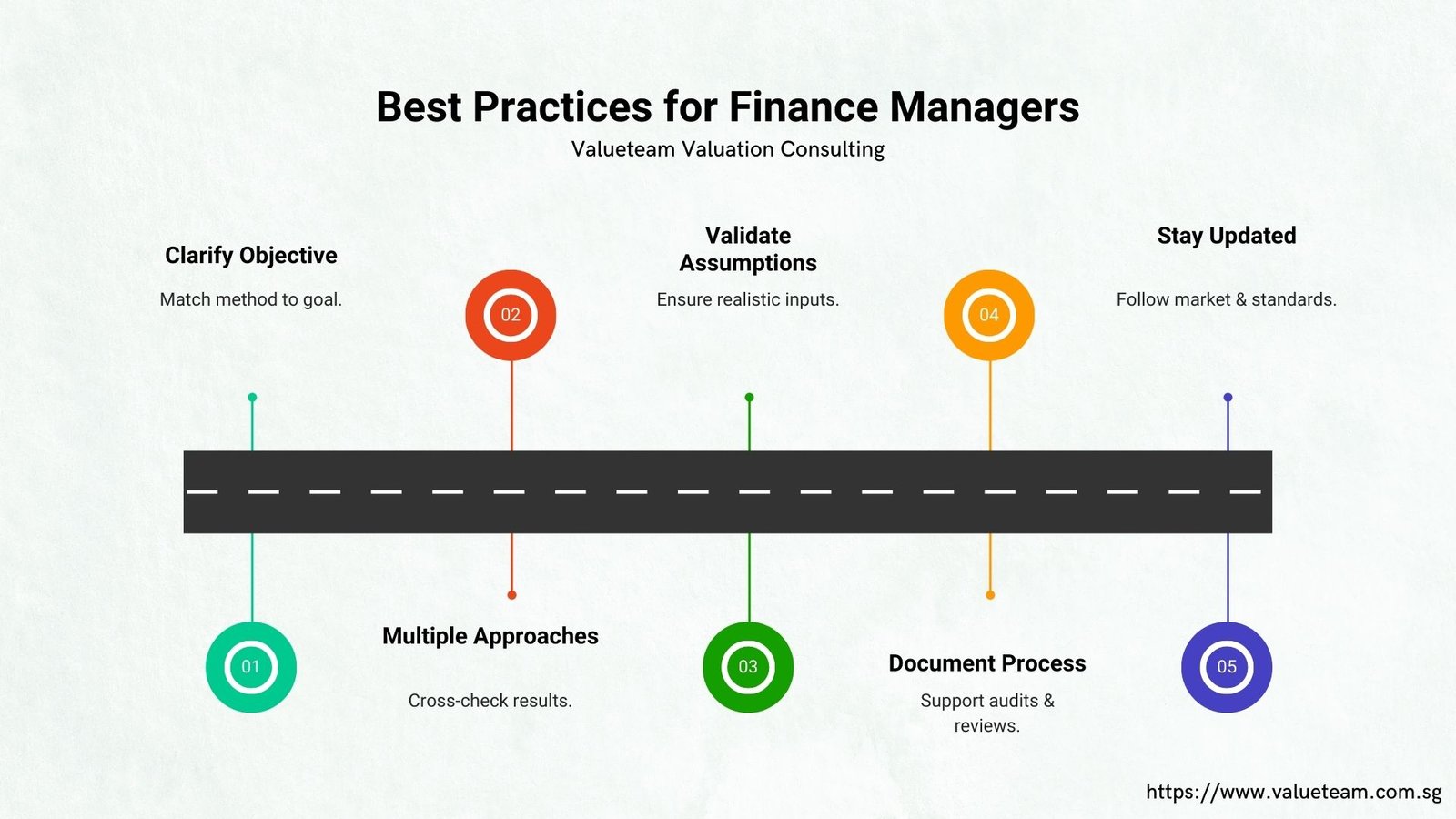

Best Practices for Finance Managers

It takes time to be a strong valuation practitioner. What the finance managers should do is combine viable purposes of valuation to align with the strategic goals, use various techniques, and base their assumptions on actual data of the market.

This is done by keeping good records that generate an audit trail and enhance investor confidence. Adherence to current standards and trends in the industry makes a valuation still relevant.

The integration of these practices will bring valuation to the strategy and to shareholder trust by making this a technical procedure rather than a driver of strategy.

Conclusion: Valuation as a Strategic Tool

Valuation goes beyond giving figures in the mind of finance leaders as it is the activity of giving business valuation. Sound valuations give negotiating grounds, fundraising and compliance. They also give transparency to the risks and opportunities such that the managers can act swiftly upon market changes.

Valuation correctly provides leaders with deeper understanding of the real state of a company as well as its future possibilities. It shows the motivation of value, weaknesses, and resource allocation. This is an important point in either a merger or a fundraising when you may choose a deal or a step followed by a big failure.

Valuation is also a source of confidence among investors and other stake holders. Clear practices and justified assumptions lead to trust, not only of financial management, but also of the leadership representative. In a competitive market where capital availability and investor loyalty are the key factors in distinguishing the survival of the business organization in the long term, this underpinning is fundamental.