6 Business Valuation Strategy and Why It Matters

6 Business Valuation Strategy and Why It Matters

Introduction: Why Knowing Your Business’s Worth Matters

In the current competitive economy, information about what a business is actually worth being is no longer an option of choice but rather a strategic factor. Business Valuation is used to make important decisions either in the process of a merger, acquisition, fundraising or succession planning.

Valuation has not merely become a figure on a piece of paper it also shows the general health, risks and opportunities of the company. The resultant is the financial performance, market conditions, growth opportunities, and intangible assets in forms of brand reputation or customer loyalty. You can make a sound decision knowing where to go with business when there is a good valuation by the business owners, business investors, and advisors.

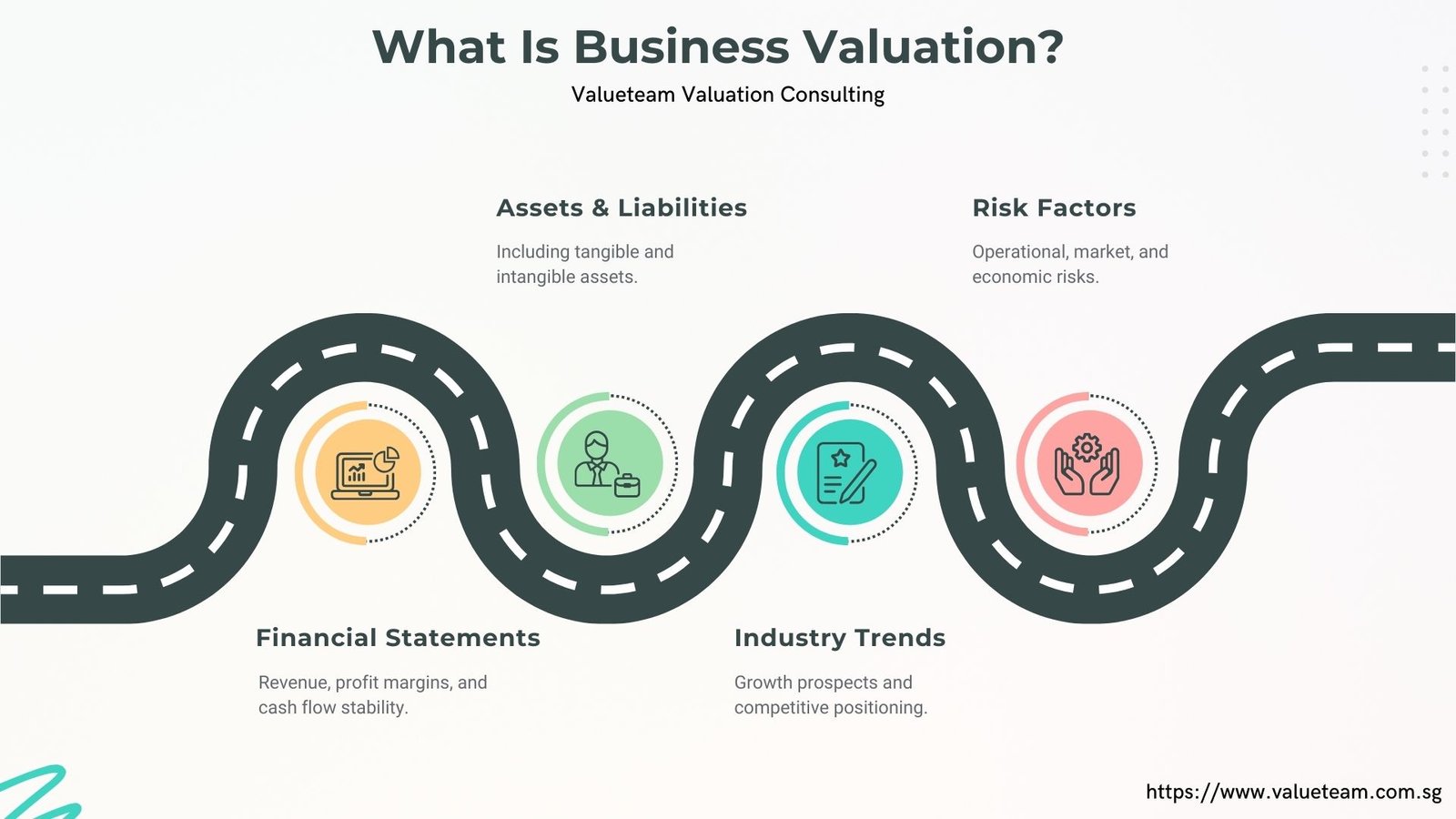

What Is Business Valuation Strategy?

Business value refers to arriving at the fair market value of an entrepreneurship. It involves the curriculum of studying financial reports, our assets and liabilities, the functioning of the industry, and risk exposure.

The baseline measurement is the Financial statement , and approaches are to calculate revenues, profit margins, and the stability of cash flow. However valuation is more than figures in a balance sheet. The brand strength, intellectual property, and human capital (intangible assets) is often an enormous portion of value in the modern companies.

The Valuation of business are conducted for numerous reasons: to facilitate the business sales, attract the investment, be relevant to the taxation and accounting systems, be managed by the need to investigate the shareholders dispute, or provide succession planning. A true valuation in every case is the foundation to transparency and credibility which creates a firm ground on the foundation of negotiation and long term planning.

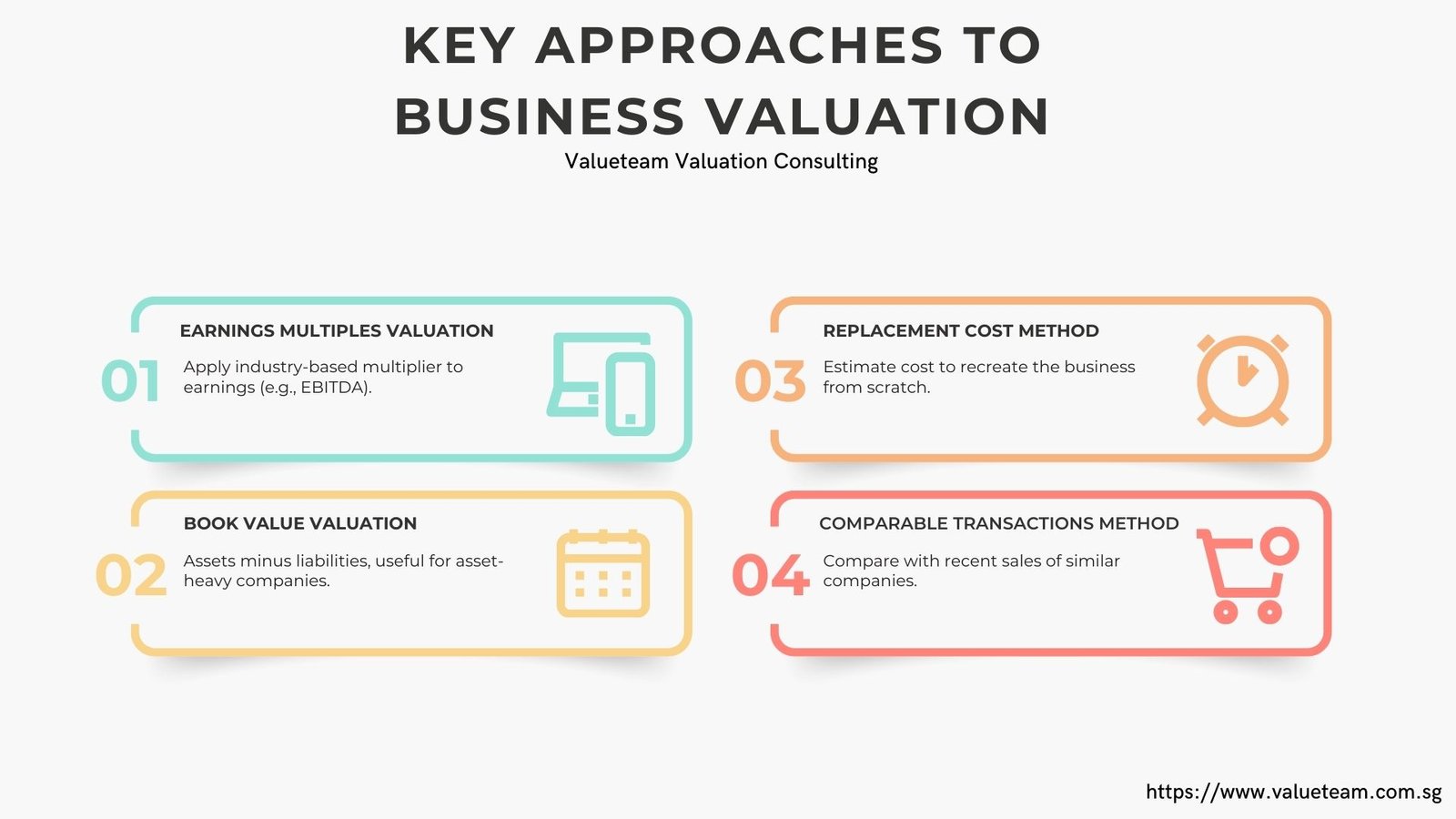

Key Approaches to Business Valuation

There are drawers of different methods applied to valuation with each being applied in a given business environment.

Earnings multiple method uses a multiplier, which is an industry standard, applied to earnings including the EBITDA. It is common in firms that have a similar recurring income.

Value is calculated through the book value method wherein the former operations of the balance sheet are computed by the difference between total assets and the liabilities. This works well with businesses in which the asset is high but it does not take into account how the business can grow.

Through the replacement cost method, the cost is estimated as the cost that is required to restore the business back to its original position including facilities, infrastructure and operations. It is applicable in terms of insurances or substituting expensive assets.

Similar transaction method places a business at the same value of the recent purchases of similar businesses. This is most effective in industries where there is a high rate of M and A and the data on transactions.

Practically, it is common to use more than one method to come up with a result that provides a defensible valuation.

Why Business Valuation Matters

The significance of valuation is the fact that almost all important financial and strategic decisions are based on it. In its absence, companies will be at risk of pricing their products too low in the sales segment, paying even exorbitantly in acquisitions, or losing funds pursuing investors.

To make strategic decisions, valuation brings out strengths and weaknesses, so there is where to go with growth, restructuring or investment.

To invest and to raise funds, investors must have realistic valuations to commit to the funds. Proper valuation empowers the negotiations and creates investor trust.

Valuation in mergers and acquisitions also results in fair pricing and avoids wrangles. It aids the buyers and sellers to come to terms that resonate with real business value.

Valuation assists in compliance with legal and tax regulations, shareholder contracts down to divorce settlements and estate planning. Last but not least, as a way of exit and succession planning, valuation offers business owners their part with a fair how much to transfer ownership and compensation.

Factors That Influence Business Value

Value of business is a multi-factorial variable and is based on a variety of non-monetary and monetary factors.

The most direct driver is the financial performance. Other firms have steady revenues, superior margins and fixed cash flows enhancing their valuation whereas inconsistency or dwindling performance lowers such values.

The economic climate is also very significant. During growth-ST times, access to capital and optimism on the part of investors drive the valuation upwards. They are normally deflated during a downturn period when they are in the state of uncertainty, inflation and where interested rates are raised.

Value is also defined by industry forces. Examples of premium multiples include fast-paced area companies such as technology or renewable power business or major corporations that belong to stagnant industries like tobacco or petrochemical.

Many intangible values are provided by the brand strength and customer loyalty. Customer retention levels are high which is an indicator of reduced risk to revenue and investor appeal.

Finally, there is the decisive role of management quality and stability of leadership. An effective leadership with an established vision is confidence-inspiring amongst investors whereas poor or confused leadership kills the confidence.

Conclusion: Valuation as a Strategic Advantage

Business valuation is not a mere technical process, it is a strategic solution, which minimises risks, maximises potential and unearths opportunities to exploit them. Having knowledge of the real value of a company, the stakeholders are able to make appropriate decisions with regard to its acquisition, investments, compliance and long-term planning.

Numbers are just a part of the story; valuation is indicative of strengths, obstacles, and opportunities of a business. It is a reflection of the present levels of performance and the future growth strategy. The viewpoint enhances bargaining, develops confidence among investors, and eliminates chances of ranked chances.

The capability of defining business value has become not just a choice in a competitive marketplace. Well crafted valuation is a competitive advantage that will allow businesses to think of the future, acquire investment and ensure success in the long run.