Core Business Valuation Approaches for Companies in Singapore

Core Business Valuation Approaches for Companies in Singapore

Understanding Core Business Valuation Approaches

Business valuation plays the role of the cornerstone in strategic decision-making, be it the target to acquire or sell a business, toward obtaining financing, in anticipation of litigation, or as a part of compliance. As much as valuation can be perceived as a mathematical endeavor, it is also an art and science which involves a profound study of financial concepts, market forces as well as industry conditions. There are three methods that are normally used by professionals, they are the market, the income, and the asset-based approaches.

All the methods offer alternative strategies to calculate the worth of a business and learning to recognize their differences can assist business owners, investors, and advisors in choosing the framework that would best suit their requirements. This paper discusses these three approaches, how they are used and the factors that affect the accuracy of their results.

Understanding the Role of Valuation Approaches

The baseline of any valuation process is to be aware that there is no amount of money that can be used to signify the accurate and absolute value of a business. Value is determined with the mixture of the measurable financial performance and in-measurable factors like brand strength, customer loyalty and industry positioning. It is because of this that professional valuation experts choose a methodology-or group of methodologies-that suits the intended purpose of valuation, the amount of data available and the type of business under consideration.

These three fundamental approaches were worked out after decades of professional practice and are well known within the framework of financial reporting standards, tax regulations, and negotiation of transactions. They establish guidelines in terms of valuation following the provisions of bodies like the international valuation standards council (IVSC) and are recognized by regulatory authorities and courts all over the world. All these ways have their advantages and drawbacks and valuation is an art of using the one, or combining a number of them, to most effectively reflect the economic reality of the business under consideration.

The Market Approach

In the market method value is arrived at by benchmarking the subject business against other businesses that are similar in nature of whose value is known, usually public market information or recent transaction price. This takes place under a principle of substitution: a rational buyer would exercise the principle of substitution by not paying more money buying a business than it would cost to buy a similar business at risk with similar earning potential.

There are two main different ways in which the practice of the market approach can be applied. The first option is the guideline public company whereby the price is calculated in terms of price earnings ratio or enterprise value-earnings before interest, taxes, depreciation and amortization of publicly traded companies in the same sector. The other is the precedent transactions approach where current sales of existing similar privately held or publicly traded businesses are used to find a valuation multiple. The multiples that have been chosen are then used with the financial figures of the company under consideration to come up with a figure of the value.

Market approach is efficient in instances where the company closely matches others in the market and people can buy it, including merger and acquisition activities in an industry. It is frequently applied to variants of small to mid-sized businesses where comparative transactions occur and they are quite dependable. It however, requires that the choice of comparables be of a high quality. Inconsistencies in market coverage, profitability, and prospects, or fast growth, between the subject business and its peers may drive major adjustments to the valuation. Moreover, an economic condition, one that might exist during the time of sales transactions, can exert a significant impact on derived multiples hence it can be prudent to adjust economic or industry specific variables.

The Income Approach

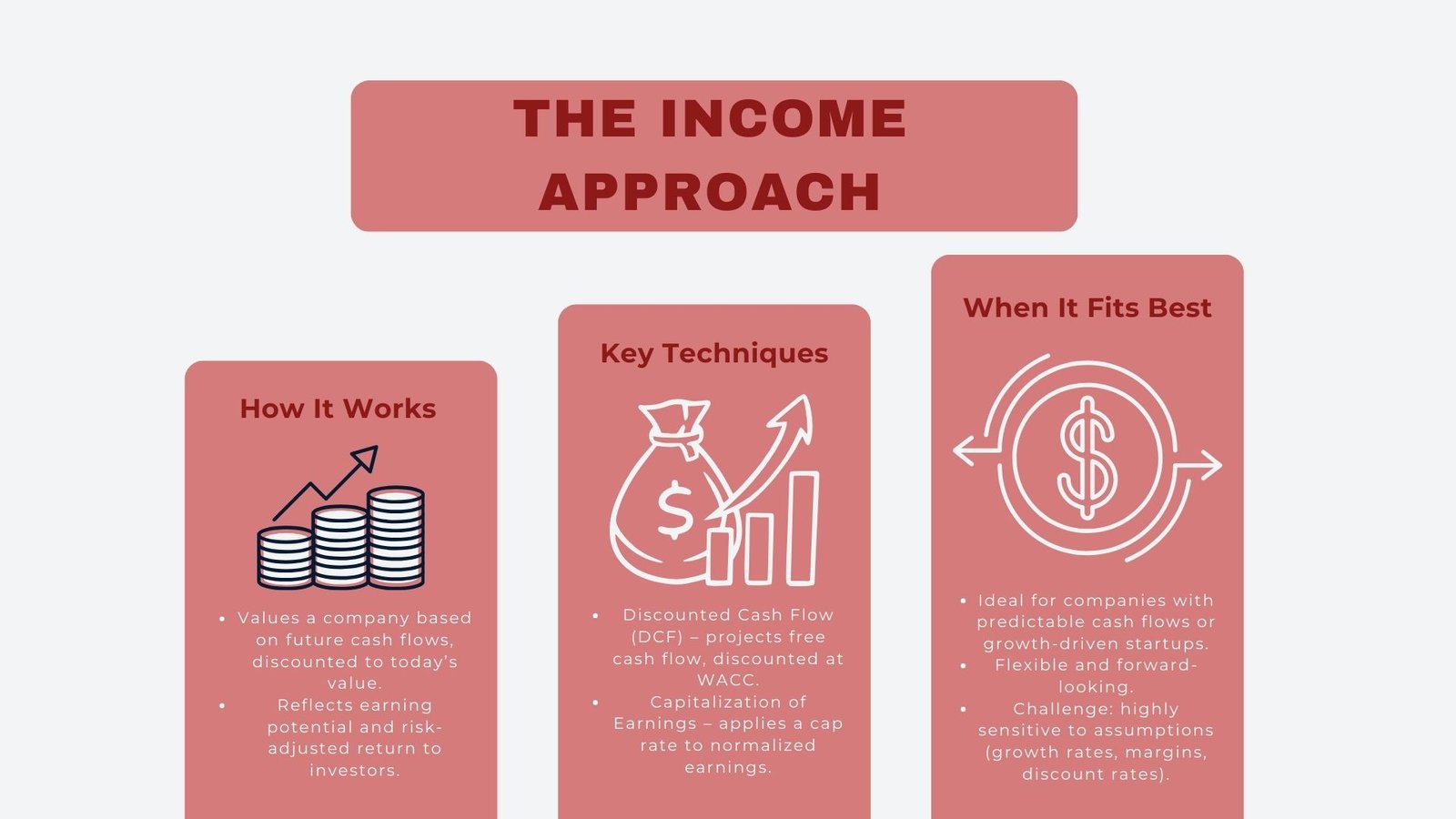

The income approach is used to estimate the value through the present value of the future economic returns to be received by a business. The rationale behind this technique is that the worth of a business will depend directly on its capacity to generate a cash flow to its owners. It has become commonly applied in corporate finance and investment analysis due to the fact that it clearly considers the earnings of the company expected and risk incurred in realising them.

Learn Discounted cash flow (DCF) method is one of the most used applications of the income approach. Under DCF, an expert in valuation estimates the free cash flows of the company in a specified projection period, discounts these cash flows to the current value applying a rate that is commensurate to the risk of the cash flows.

This discount rate could be based on the weighted average cost of capital (WACC) of the company which is a combination of the cost of debt financing of the company and cost of equity financing of the company. In others, capitalization of earnings techniques is applied whereby a particular representative figure of earnings is capitalized at a rate reflecting growth as well as risk propensity.

The income approach is particularly suitable to businesses that have reliable and crystallized cash flow or where the future earning potential is one of the primary sources of value as is the case with startups that have just entered a growth period. Its advantage is because of its futuristic orientation and it is therefore adaptive to various situations in business. Nevertheless, it also needs an in-depth and credible financial forecast, and the outputs may be very sensitive to sensitivity analysis. Minor differences in growth rates, discount rate or margins can translate to sizable variance in the final valuation.

The Asset-Based Approach

The asset-based approach quantifies value making use of total assets on the foundation of the business. This implies evaluation of the fair market value of the assets owned by the firm and deduction of the liabilities. To a certain extent, such an approach can be implemented based on the book values included in the balance sheet of the company, although in most situations, accounting can be recalculated according to the current market values instead of historical costs.

The asset-based approach also has two typical variations: the going concern method and the liquidation method. The going concern method applies where a business will make further operations and assets list is measured in opportunity to generate revenue. A difference between liquidation methods is that it assumes that the company will be liquidated and therefore the assets are estimated in terms of how much they might achieve in sale within a short time.

This method most suits asset intensive companies which can be manufacturing firms or firms operating in industries where tangible assets like real estate, equipment or inventory is high on the value scale. It may also be applicable where earnings are erratic or negative and thereby methods based on the earnings will not give a reliable conclusion. Nonetheless, asset-based approaches tend to underestimate businesses with large intangible assets that include intellectual property, brand reputation, or relationships with customers, as they are more difficult to match in an asset value.

Choosing the Right Approach

The choice of the valuation method must be thoroughly judged by evaluating the nature of the business, the intent of the valuation exercise and the accessibility of related information. It is common practice to use more than one valuation method and reconcile the outcomes to an ultimate conclusion even by valuation professionals. An example is the market method applied together with an income method that could be employed to obtain validation of findings, particularly in mergers where both present market feeling and future earnings potential is a factor.

Valuation plays a significant part due to its purpose. There can be statutory or regulatory requirements that determine the acceptable methods of reporting, taxation, regulatory compliance, or financial reporting. Courts can be inclined toward legal strategies, depending on the jurisdiction, in litigation or shareholder disputes. In developing the negotiation techniques to use during M&A negotiations, the approach adopted can be influenced by the buyer or the seller. Understanding the required financial information for business valuation is therefore essential to ensure accuracy, compliance, and fairness in these processes.

The context of industry is also important. Companies in industries that experience dynamic technological changes and have high waiting times might be more inclined to make use of income measures to predict the future, although asset-reliant industries such as a bank might utilize asset-based valuation more frequently. At the end of the day, professional judgment and experience are crucial in the selection and applicability of the correct method.

The Interplay Between the Approaches

Each of the three approaches is conceptually different, although they may occur in a combined manner. Market approach can be used to inform assumptions in income approach which includes discount rates or terminal growth rates. The asset-based approach is usable as a floor value wherein the minimum mark can be used in negotiations or strategic planning. The reconciliation of the findings of more than one approach may ensure partial overcoming of the weaknesses of a particular approach and offer a stronger view of value.

Consideration of these methods can usually entail the cross-referencing of these valuation methods to allow consistency and reasonableness. As an example, if the income method indicates that there is a large disparity between them and the market and asset-based methods, it can be explored as to whether growth estimates are overestimated or whether comparables are underestimated. On the same note, when the asset-based method achieves far more compared to the income methods, it may show unused assets or its inefficient running of its operations.

Final Thoughts

Knowledge of the three main applications of business valuation namely market approach, income approach, and asset based approach is a must to those in strategic business decisions. Both of these approaches provide distinct points of understanding the value of a company, and they could be evaluated in terms of its implementation, modification, and interpretation in the framework of a business environment.

There is no one method that is always right, so combining a delicate use of one or more of the approaches to valuation results in optimum findings, depending upon the factors surrounding the valuation. When the best of every is acknowledged and its weaknesses reviewed, business owners, investors, and advisors will be in a better position to make wiser, certain, and strategic decisions that will keep in line with reality in terms of finance and long-term.