Better Business Valuation Techniques Singapore: Revenue Multiples, Comparable Sales & More

Better Business Valuation Techniques Singapore: Revenue Multiples, Comparable Sales & More

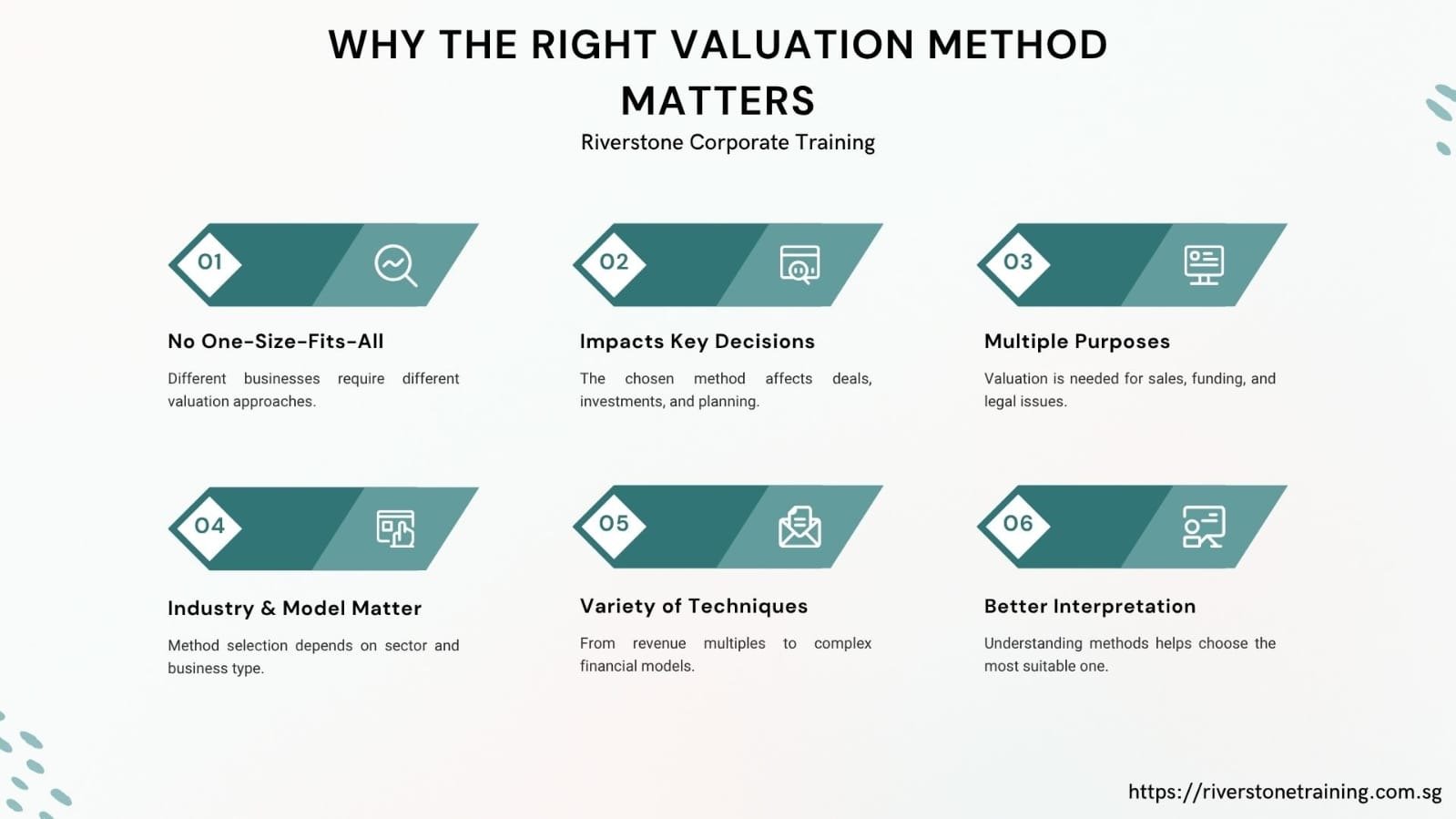

Introduction: Why the Right Valuation Method Matters

No units are generalized when it comes to determining the worth of a company. Whichever approach you take may greatly affect the end value, which in the process alters negotiations, investment and strategic planning. However, you can be about to sell your business, bring it to investors, find funding sources, address legal issues, and various valuation methods need to be understood.

Specific strategies to use will depend on your industry, business design and what you are trying to accomplish through valuation. Since simple revenue multiples and market-based related sales are some of the simplest, others can derive remarkable knowledge on more advanced forms of financial modeling in company business Singapore. Understanding the mechanism of these techniques, you will be able to interpret the results in the field of valuation better, and even select the most appropriate of them in your specific case.

Revenue Multiples: Business Valuation Techniques Singapore Quick and Scalable Estimates

Revenue multiples technique estimates value through the application of industry specific multiples on the revenue obtained by a business and finance course Singapore on an annual basis. This model works well when the company has a close to takeoff time in terms of market share and profitability; particularly in the technological or the subscription-suing industry.

To illustrate, a SaaS enterprise could be assessed at 4-8 times yearly recurring at the same time as a retail store may be rated lower as a result of slimmer margins. Revenue multiples are relatively straightforward to implement, and they would be well-suited in a context where revenue is both consistent and is predictable and representative of long-term opportunities.

Comparable Sales (Market Approach): Real-World Benchmarks

The similar method that is also referred to as the market approach examines the recent sales of similar businesses to derive a fair market value. It is common among businesses that enforce high frequency and availability of market information, like real estate, retail, or some franchise requirements.

This method portrays that which is being paid on the market by the buyers at the moment and is thus very practical. Nonetheless, it can be difficult to identify actually comparable sales in practice. The fact is that the differences in size, location, clients base, or efficiency of operation may cause gaps in valuation.

EBITDA Multiples: Profitability at the Core

EBITDA (Earnings Before Interest, Tax, Depreciation and Amortization) multiples are considered in terms of profitability as opposed to leading revenue. In this method, a multiplier is added to the EBITDA of valuation technique according to the industry standards, thus making the valuation of the company based on the operating performance.

It is particularly handy in stable-companies that have stable incomes. EBITDA multiples are popular in any private equity deal, merger or dealings, due to their capacity to estimate the capacity of the business in terms of cash generation.

Discounted Cash Flow (DCF) Analysis: Future-Oriented Precision

The DCF method is used to project the cash flow in the future and discount it back to the present time at a specific discount. This method will provide a more in-depth analysis of the long term potential of a company plus putting in the growth and the risks.

DCF should be used when cash flows are quite predictable and stable of the business which presupposes proper forecasting. Even minor adjustments in the assumptions (e.g. growth rates, cost structures etc.) can change the results significantly.

Asset-Based Valuation: Tangible Value First

The asset-based legacy instruments determine the value of an asset by the difference between the assets and fixed liabilities, both in households (such as property and equipment) and the un-classifiable legacy (such as patents and trademarks).

This method is effective with asset-based firms that operate within the manufacturing sector, property, or even the natural resources sect. It can however overvalue companies in which intangible assets or growth potential are more significant than tangible assets.

Choosing the Right Technique for Your Situation

There is no perfect approach to any business. A combination of techniques is often applied by professionals to audit findings and can offer a better estimation. The right choice depends on:

Unfortunately, the purpose of the valuation (sale, investment, litigation, strategic planning)

The existing market statistics and practices.

Business development level and financial opportunity.

Both Availability and Accuracy of financial records.

Conclusion: A Strategic Tool for Better Decisions

Calculation methods alone are not a type of valuation techniques but rather a tool that determines important business consequences. The advantages of revenue multiples and analogous sales are presented in short-term-market-oriented insights, profitability through the use of the EBITDA multiplier, long-term prospect bridging in the DCF analysis and tangible value in the use of asset media.

Knowing these tactics and choosing the correct one in your goals, you will be able to negotiate effectively and can find the partners he or she wants and make more strategic decisions. The appropriate valuation approach is not only a gauge of value in the business transactions arena, but it makes growth, investment and success in business occur on a long term basis.