M&A Valuation Training Determining the Right Acquisition Price

M&A Valuation Training: Determining the Right Acquisition Price

Introduction to M&A Valuation Training Determining the Right Acquisition Price

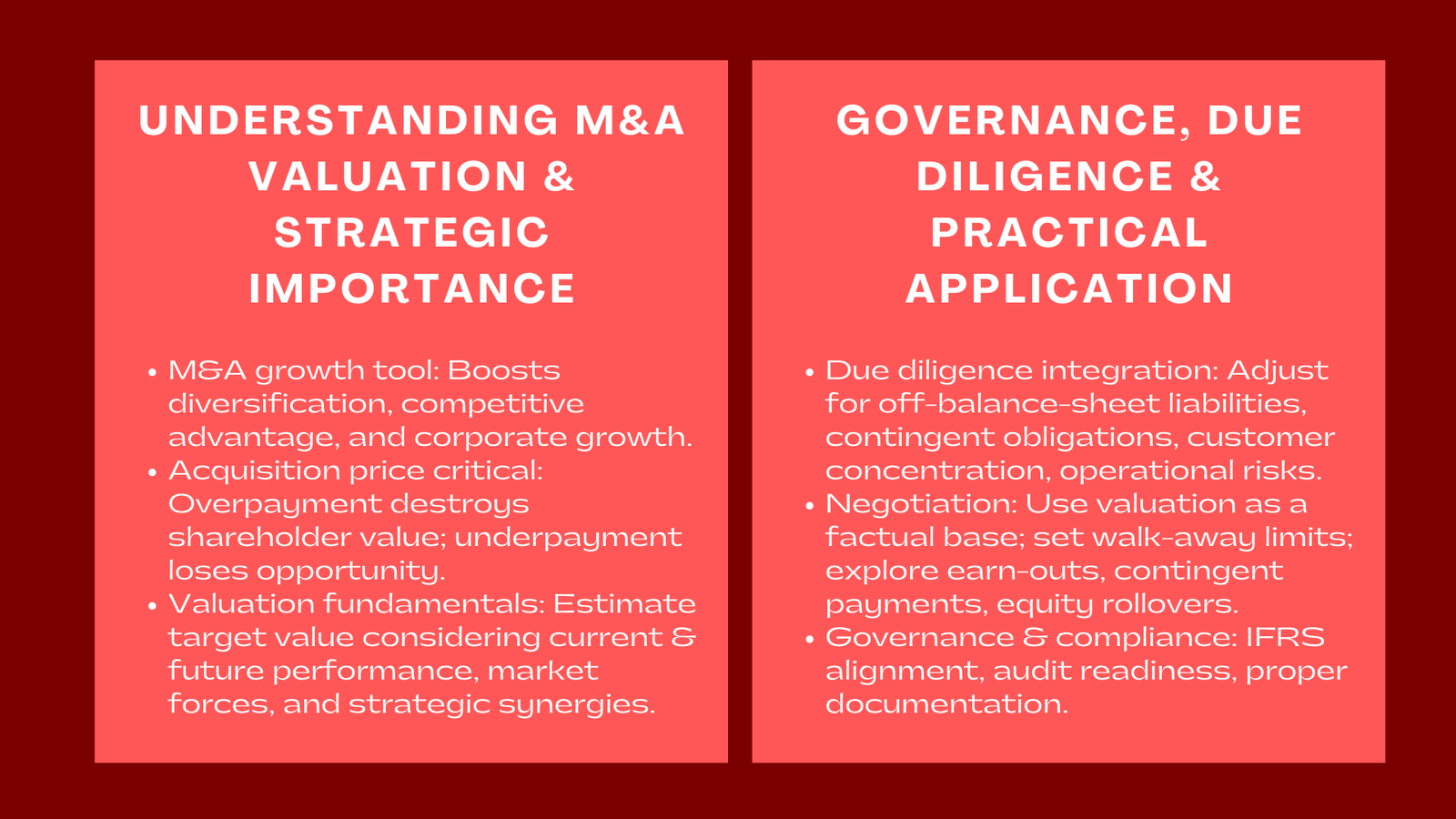

Mergers and acquisitions (M&A) are increasingly being used in the modern dynamic corporate world to bolster growth, diversification and competitive advantage. Nevertheless, identifying the appropriate price of acquisition is one of the most important issues in the M&A process. Excessive payment will ruin shareholder value, whereas underpayment can result in the loss of an opportunity. This is why M&A valuation training for finance professionals has become a vital component of corporate learning — equipping executives and analysts with the skills needed to accurately assess value, structure deals effectively, and make informed investment decisions.

Knowledge of the M&A Valuation Essence.

The basis of all acquisition decisions is valuation. It entails coming up with an actual value of a target company, depending on its current performance and potential future performance. A good job in valuation does not just focus on figures, but relates to strategic reasons, market forces and synergies that will enable the deal to be successful, which is why investment decision-making training Singapore is crucial for finance professionals.

Finance professionals are taught through professional training on how to use the basic methodologies of valuation like Discounted Cash Flow (DCF), Comparable Company Analysis, and Precedent Transaction Analysis. These methods aim at estimating the intrinsic value of a company taking into account the market comparables and the past transaction records. The participants also address the issues of how to modify the valuation of non-operating items, the risk that is risky using weighted average cost of capital (WACC), and forecast uncertainties.

The good knowledge of these frameworks allows M&A teams to be able to justify their pricing decisions built in the process of negotiations and stand up to these decisions when questioned by boards, auditors or investors.

The Strategic Synergies in Valuation.

Valuation is a strategic exercise and not a financial exercise. The price that is right is usually based on the level of extra value the acquirer can generate after the merger. An example of this is the target company may value at $100 million as a standalone company, but as the acquiring company is able to create economies of scale, gain market share, or cut costs, the real value may be much more.

Training programs are focused on how to identify and measure the synergies – cost and revenue based. The participants are taught how to project possible savings in economies of scale, better procurement, and streamlined operations and predict incremental revenues in cross-selling or increased customer bases.

Nevertheless, it is also advised that professionals should be cautious in estimate of synergy value. One of the most widespread causes, as to why M&A deals do not live up to the hype are overstating the synergies. A strict, fact-based methodology will make sure that the payments of premiums that exceed intrinsic value can be justified and made possible in reality.

Financial Modeling: Transforming Data into Decision Makers.

Valuation is technically supported by financial modeling. It puts business assumptions into quantifiable insights that determine acquisition pricing. Training gives the professionals the ability to assemble whole-scale financial models combining income statements, balance sheets, and cash flow forecasts into dynamic valuation models.

Scenario and sensitivity analysis is also taught to the participants, and these are methods of testing the sensitivity of assumptions to the valuation outcome. As an illustration, they may assess the impact of variations in interest rates, commodity prices, or rates of growth of revenue on the value of the enterprise. This assists deal teams to realize the possible spectrum of fair values and make more informed decisions.

The models are also well constructed and hence form of communication. They enable M&A professionals to show the outcomes of valuation to the stakeholders in a clear way such that each assumption is reflected in the overall price of the acquisition. This way, financial modeling does not only serve an analytical point but also an organizational alignment to making important decisions.

Due Diligence is Important in the Accuracy of Valuations.

Without good due diligence, valuation cannot be accurate. Financial statements of a target company can not necessarily give the complete picture – off-balance-sheet liabilities, overstated assets, or desperate revenue recognition can alter value.

Through corporate acquisition price determination techniques, trainees learn how to integrate due diligence findings into their valuation process. An example is that non-recurring income, non-recurring debts or underfunded pension liabilities may have to be adjusted. In the same manner, the knowledge of customer concentration risk, lawsuits, and contingent obligations based on capable knowledge will make sure that the valuation models resemble the reality and do not represent an ideal image of possible future projections.

Besides financial considerations, operational and strategic knowledge of the business on the basis of due diligence like competitive positioning or cultural fit may influence the price of acquisition. Successful valuation training will help the participants to learn how to put this information together as a whole so that the majority of the money spent is supported by evidence and sound strategic logic.

The Relationship between Negotiation and Valuation.

Negotiation strategy is based on valuation. The price at which a buyer will be willing to purchase often does not match with the expectations of the seller. Through learning finance methods, financial experts will be able to establish an actual negotiation base, setting walk-away limits, and be able to prove their stand.

The training programs tend to create real-world negotiation environment, which enables participants to feel the dynamics of the deal-making process. They are taught on how to present valuation results in a convincing way, counterargument, and support pricing decisions with factual and financial evidence. Such a combination of analytical and interpersonal skills is crucial to have a positive outcome of the deals.

An adequately trained valuation staff may also be able to discover innovative deal designs that may fill pricing gaps, like earn-outs, contingent payments, or a rollover of equity, and in the process, facilitate transactions that are of mutual benefit without sacrificing the value discipline.

Integrating Governance and Compliance in Valuation.

Valuation is not only an exercise in technical but also a corporate governance issue. There is a growing transparency requirement among regulators, auditors and shareholders over the determination of the acquisition prices. In order to live up to these expectations, organizations need to be well-crafted in their valuation processes, which need to be organised consistently and in line with the accounting and reporting standards.

The training programs cover issues on documentation best practice, IFRS compliance, audit readiness. Participants get to know how to note down assumptions, justify methodologies, and generate comprehensive reports about the valuation that can pass the test. Such a governance is not only accountable but also secures the reputation of the business when there are issues in the post-acquisition or regulatory audit.

Real-Life examples and applications and advantages.

Institutions that train on M&A valuation are enjoying the fruits of their labor. Finance professionals that attend such programs develop a better skill in evaluating investment opportunities, negotiating with assurance, and reducing financial risks. They too understand how to play a more strategic role in corporate growth debates, which allows the management to make decisions on the basis of justifiable valuation concepts, as opposed to baseless intuition or market hype.

Case studies It is a mandatory component of such training sessions where real-world case studies expose the participants to real-life transactions and valuation issues. Through the examination of successful and unsuccessful mergers, trainees can have the vital experience of what to consider when stipulating the price of acquisitions based on economic cycles at the macroeconomic level to the post-merger integration issues.

In addition, in-house training programs foster uniformity within the valuation departments. By using the same criteria and processes in decision-making, organizations are able to make the process more efficient and establish a healthy culture of internal valuation that contributes to the long-term development.

The Benefit of Life-long learning.

The M&A valuation is an ever-changing sphere. Market conditions, the interest rates and investor expectations keep changing with time and thus a professional must keep on updating his or her knowledge. Ongoing learning keeps finance teams dynamic and effective and therefore able to respond to new valuation scenarios – such as digital business models and measurement of intangible assets.

Companies willing to emphasize constant professional growth also enhance their internal capacities. Rather than involving external consultants only, they develop internal capabilities that are able to analyze the potential acquisitions with accuracy and vision. This brings about a long-term value and minimizes dependence on external advisory costs.

Conclusion

The process of arriving at the appropriate price to acquire is an analytical and strategic process that requires knowledge, judgment and discipline. M&A valuation training of finance professionals enables them to have the technical expertise and practical understanding to evaluate target companies correctly, model various complex situations and negotiate. The techniques used in setting the corporate acquisition price help companies to make wiser investment choices, safeguard shareholder value, and have a sustainable growth by merging and acquiring companies.