Due Diligence in M&A Corporate Training for Finance Professionals

Due Diligence in M&A: Corporate Training for Finance Professionals

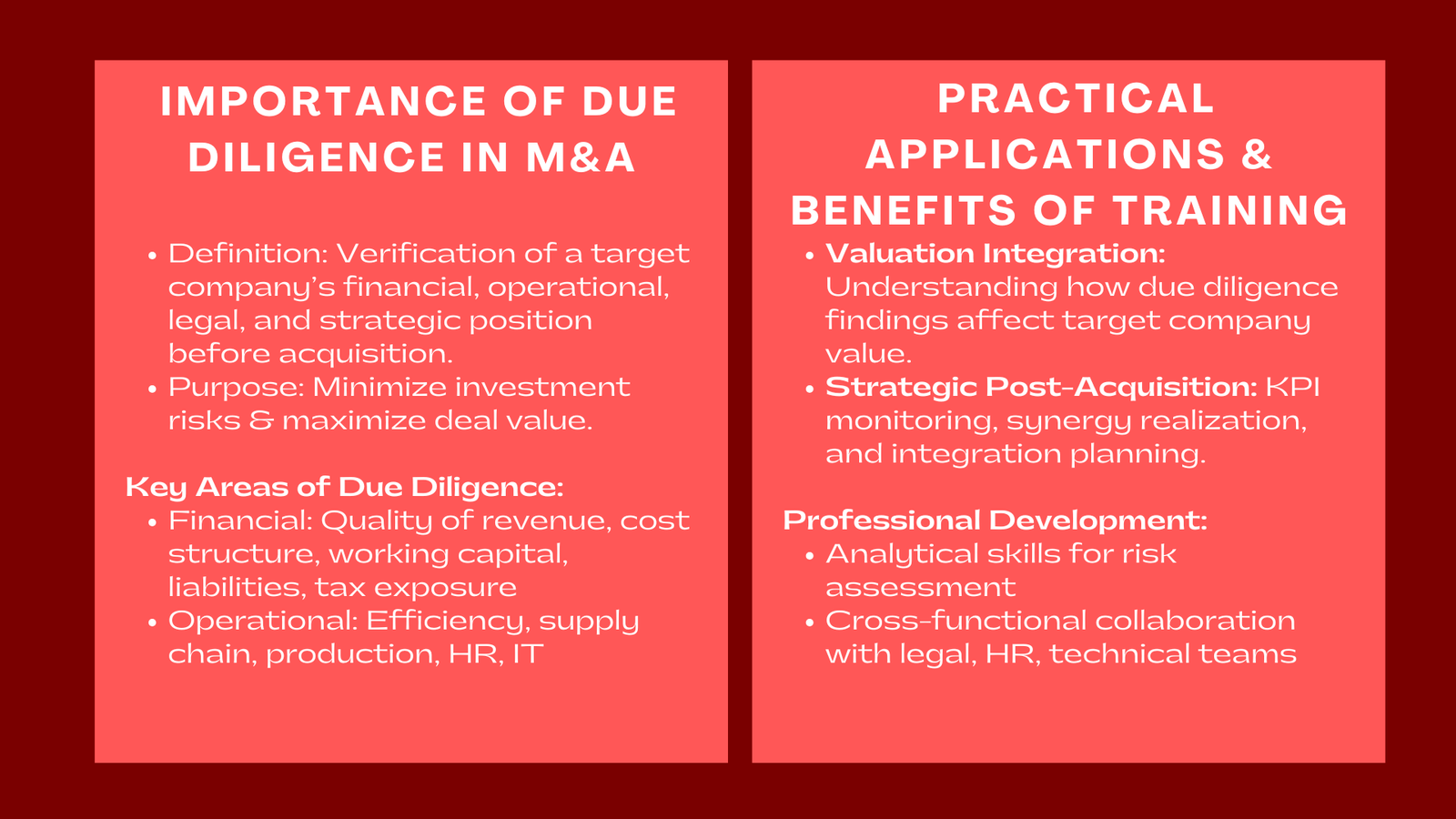

Due diligence is the key to informed decision-making in mergers and acquisitions (M&A). Acquisition companies should carefully analyze the financial status, operations, legal and positioning of the target company before signing any deal. To the finance experts, learning how to master the due diligence process is a guarantee that the risks incurred by the investment are kept at a minimum and the value of their deal is maximized. Therefore, due diligence training has become the part and parcel of professional development of analysts, CFO, and M&A professionals.

Learning the Role of Due Diligence in M&A.

The due diligence process can be referred to as the verification of information concerning a target company prior to closing a deal. It is more than a check of balance sheets, it is a comprehension of how the business of a firm operates, its outlook and any possible liabilities that may influence the cost of an acquisition or even post merge integration.

Due diligence in an M&A situation is normally comprised of a few areas:

- Financial due diligence: assessment of the quality of revenues, cost structure and working capital trends.

- Operational due diligence: evaluation of the efficiency of the business, supply chains and production capacity.

- Compliance due and legal diligence: Contracts, intellectual property rights and litigation risks.

- Strategic due diligence: evaluating the market positioning, market prospects and synergies of the target and the acquiring company.

All these elements play a role in deciding the viability of the deal based on the goals and the risk undertaken by the acquirer. In the absence of due diligence, firms may end up paying too much or acquiring unexpected undesired issues that may devalue shareholders.

Why Finance Professionals Need Due Diligence Training

For finance professionals involved in M&A transactions, due diligence is both an art and a science. It requires analytical precision, strategic thinking, and cross-functional collaboration. Corporate training in due diligence for finance professionals helps individuals acquire the necessary frameworks, tools, and mindset to conduct thorough evaluations and present findings effectively.

Within the framework of the structured training programs, the participants are taught how to:

- Determine red flags in financial accounts and business information.

- Appreciate the relationship between the findings of due diligence and valuation findings.

- Evaluate the effect of possible risks on pricing and structure of deals.

- Share the knowledge with the senior management or investors.

The possession of well trained finance teams can be both an analyst and advisor, such that the acquisition does not focus on short-term gains but long-term strategic objectives.

The Economic Aspect of Due Diligence.

Any M&A investigation is based on financial due due diligence. It pays attention to financial performance of the target, stability of its cash flow, as well as its accounting policies. A professional does not just see the numbers but he/she reads the patterns, and sees inconsistencies that can influence the deal.

Critical Financial Areas to consider :

- Quality of revenue: It is important to make a distinction between recurring and non-recurring revenue. One time contract has the effect of boosting revenues in the short run but it is not sustainable.

- Profit margins and cost structure: It would measure the operational efficiency by comparing the cost structure and the fixed and variable costs.

- Working capital management: By knowing the cycles of receivables and payables and inventory, one gets an idea of the liquidity and financing requirements.

- Debt and contingent liabilities: Recognizing off-balance-sheet and concealed liabilities helps avoid future surprises.

- Tax compliance and exposure: Evaluating the past tax returns will ensure that they are not in an unsettled state with the authorities.

When one learns how to do such tests, it would give them a complete picture of the financial health of the company and how it will affect valuation.

Operational and Legal Due Diligence.

Although finance is the foundation of due diligence, legal and operational reviews are also important. Financial due diligence services for buyers Singapore ensure that legal due diligence is complemented by thorough financial analysis. Legal due diligence is concerned with the ownership rights, contracts, and compliance with regulations. It makes sure the target company is not prone to possible legal suits, breach of contract, or failure of compliance.

On the other hand operational due diligence scrutinizes the effectiveness and scalability of its day to day business operations. This can be supply chain resilience, IT infrastructure, human resource, and customer relationship.

As an example, whereby the production of a given manufacturing company is dependent on one supplier, it presents a concentration threat. Early detection of such dependencies enables the acquirers to strike greater bargains or lay down integration plans.

Training programs also educate professionals on how to liaise with legal, HR and technical teams in order to have a comprehensive picture of the strengths and weaknesses of the target.

The Interconnection between Due Diligence and Valuation.

A financial professional; one of the most crucial links that should be known is how the findings of due diligence affect valuation. The value of a company is not fixed, but rather it evolves according to the risks and opportunities that are brought out in the due diligence process.

As an illustration, when a target company is found to have overstated revenues or understated liabilities, this would directly affect the valuation of a target company. On the other hand, finding hidden or underutilized assets, growth or operational synergies may give reason to a higher purchase price.

That is where the interdependence of analysis and valuation lies at the heart of good decision-making of an M&A. M&A due diligence training for corporate finance teams ensures that professionals can connect financial findings to valuation models, scenario testing, and deal structuring.

Strategic and Post-Acquisition Factors.

The due diligence does not cease when the purchase agreement has been signed. Indeed, post-acquisition monitoring and integration are applications of the same analysis rigor as applied in pre-deal analysis.

Best practices in training programs focus on:

- Making due diligence understandings consistent with post-merger integration strategies.

- Measuring important performance indicators (KPIs) set in the valuation.

- Dealing with the synergy realization and post-acquisition risk.

- Recording lessons learned to be used in future transactions.

In cases where due diligence findings are used by finance professionals after the deal stage, the professionals assist in making sure that the anticipated value creation is realized.

The Increasing Proliferation of Continuous Professional Development.

The international M&A environment has been getting complex. The scope of due diligence has been widened with the areas of digital transformation, compliance with ESG, and cross-border regulations. The old checklists do not suffice any more, the new due diligence is a set of financial skills, legal knowledge, and strategic visions.

Ongoing education will also keep the finance professionals informed of the changing standards, including the accounting rules of the IFRS, data protection policies, and anti-corruption regulations. It is also able to allow organizations to keep in-house skills rather than depending on external consultants.

Training programs conducted by companies (in-house or external certification) cultivate an analytical excellence system and a culture of moral decision-making.

Application and Benefits in the real world.

Firms investing in due diligence training derive positive returns. Improved skills of those in the field of finance result in more precise valuations, superior risk determination, and enhanced integration results. In addition, the capability to perform in depth analysis within the company enhances quicker decision-making and minimizes the cost of advisory services.

In real world training it may include:

- Real-life case studies of M&A deals.

- Practical activities in financial modeling and data analysis.

- Negotiation and integration simulator.

- Team work to achieve cross-functional knowledge.

The participants are exposed to realistic deal situations through corporate training to make sure that theory is transferred to practical information.

Conclusion to Due Diligence in M&A Corporate Training for Finance Professionals

The success of any merger or acquisition is due diligence. In the case of finance professionals, mastering its principles means making good investment decisions, good valuations, and integration. With the help of holistic training, organizations can create teams, which are able to discover risks, opportunities, and protect shareholder value.

With the M&A environment constantly changing, due diligence experience will still be among the most desirable commodities in corporate finance – not only to ensure the success of a deal but also to facilitate long term success.