Cross-Border M&A Valuation Training Adjustments and Best Practices

Cross-Border M&A Valuation Training: Adjustments and Best Practices

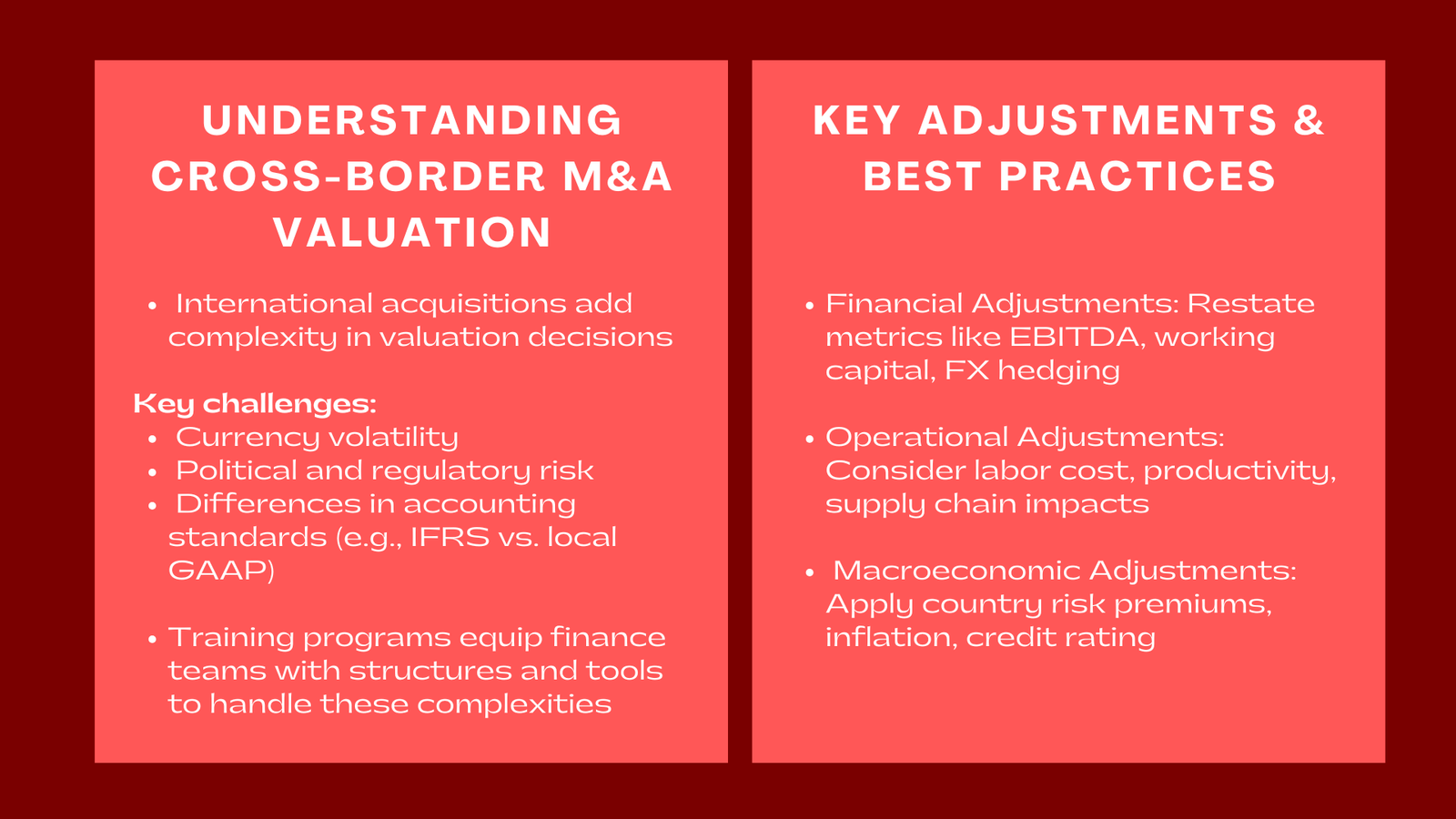

Cross-border merger and acquisition (M&A) has become an iconic characteristic of the current international business environment. Businesses also engage in international acquisitions to access the market, obtain technology, as well as improve their competitiveness. Nonetheless, valuation of international targets brings in new elements of complexity – foreign exchange fluctuations and tax regimes in addition to accounting standards and regulatory risks. Evaluating these has rendered accuracy in valuation and key to deal success, including understanding the benefits of purchase price allocation in M&A transactions when determining fair value in cross-border deals. The corporate training programs on cross-border M&A provide the finance professionals with the structures and analysis instrument to address such complexities with confidence.

The Multifacetedness of Cross-border Pricing.

The appreciation of a target company in the same jurisdiction has already necessitated an in-depth appreciation of its financial performance, industry dynamics, and its operational risks. The appearance of new variables when the transaction crosses the borders are currency volatility, political uncertainty, and differences in financial reporting practices.

The major aim of the training on cross-border M&A valuation training to finance teams is to assist the participants in the process of locating these international differences and quantifying and adjusting them. As an example, the discrepancies between International Financial Reporting Standards (IFRS) and local accounting regulations may result in the variations in the methods of value of assets, revenues or depreciation. Training assists professionals to harmonise these differences and standardise financial data to allow meaningful inter-jurisdiction comparison.

Moreover, the situation in the market is also dissimilar in every country. A discount rate that is applicable in a stable and developed economy might not apply in an emerging market where the country risk and inflation are high. The finance experts who have been trained on cross-border valuation get to know how to revise the cost of capital estimates to capture such differences.

Cross Border M&A key valuation adjustments.

The trans-border valuations are mostly associated with elaborate adjustments to make sure that the findings are based on economic values and not the accounting distortions. The adjustments are normally divided into three categories, which are financial, operational, and macroeconomic.

Financial Adjustments

Financial adjustments act to minimise the differences in accounting standards and financial reporting. Training programs also focus on balancing the major metrics like EBITDA, working capital and non- recurring items. As an example, the local accounting standards may have different treatment of leases, provision or asset impairments than IFRS and entail restatement prior to valuation.

A second significant financial modification would be currency conversion. Movement in the exchange rates between the signing of a deal and closing of the deal may materially change the value of the deal. Finance departments should know about hedging techniques and apply forward rates, or parity conditions to reduce foreign exchange exposure in the models of valuation.

Operational Adjustments

Operational variations, like the cost of labor, the supply chain structure, and the level of productivity, influence valuation, also. The experts get to know how to bring in local cost drivers and operational efficiencies to discounted cash flow (DCF) models. An example is a manufacturing acquisition in Southeast Asia, which can be cheaper in terms of labor but has logistics issues, which add to working capital requirements.

Knowing these operation peculiarities allows finance specialists to estimate realistic cash flows and not to overestimate synergies. It also leads to better integration planning of mergers, where assumptions of the operations that are present in the valuation are usually used to form future performance standards.

Macroeconomic Adjustments

The country-specific risks that cross-border deals need to take into consideration include inflation, political stability, and changes in interest rates. International M&A valuation training workshops for corporate professionals teach participants how to apply country risk premiums, inflation differentials, and sovereign credit ratings to refine discount rate estimates.

The above macroeconomic factors play a critical role in making correct valuation, in particular in comparing the opportunities in the emerging and developed markets. In the absence of these adjustments, there is a possibility of overpricing potential returns or underpricing underlying risks.

Differences in culture and Regulations in cross border deals.

In addition to financial modeling, cross-border M&A success relies on the knowledge of cultural and regulatory settings. There can be a great difference in legal frameworks that govern mergers, taxation and foreign investment. In certain states, foreign ownership or profit repatriation may have an impact on the deal structure and post-acquisition profitability.

Training programs underline the crucial role of undertaking the regulatory review and due diligence at an earlier stage. In finance, it is taught that finance professionals should work with lawyers to determine what restrictions may arise on their valuation assumptions that may include antitrust scrutiny, transfer pricing laws or capital control policies.

The cultural factors are also very crucial. The imbalance in the management styles, communication standards or labor relations may have an influence on the success of integration and eventually on whether the projected synergies can be achieved or not. The valuation professionals therefore have to include qualitative aspects in their risk evaluations, as they have realized that the numbers alone will not be enough to the complexity of a cross-border acquisition.

Best Practices in Cross-border M & A Valuation.

Standardize Financial Data

Finance teams should make all financial statements consistent before conducting any valuation on any given financial statements, preferably to a similar standard of reporting, e.g. IFRS. This makes sure that the key performance indicators (KPIs) and multiples of valuations are cross-border comparative.

Use Local Market Inputs

Relying on reliable valuation implies that it is essential to have country-specific information, such as local interest rates, inflation expectations, and industry standards. It is easy to be misled and draw conclusions only using global averages.

Country Risk Adjust Discount Rates.

A country risk premium added to the cost of equity represents the macroeconomic uncertainty in the market of the target. This change is a match between valuation results and the actual investment environment.

Inc. Tax and Regulatory Impact.

It is essential to comprehend local tax incentives, withholding taxes and compliance costs. The factors directly affect the cash flow forecasts and post-tax returns.

Make Sensitivity Analyses.

Since the uncertainty in cross-border dealings is higher, sensitivity analysis or scenario analysis assists in quantifying the sensitivity of deal value to variation in key variables,including the exchange rate or regulatory approvals.

Developing Expertise in Cross-Border Building by Training.

In the contemporary globalized markets, finance practitioners can no longer continue to utilize conventional methods of valuation. Specific training in cross-border M&A prepares the participants of both technical and strategic viewpoints. These programs incorporate both theory and case studies based on actual transactions so that the attendees can practice the implementation of adjustments in real world situations.

Examples of things that are covered in the training modules include:

- International alignment in financial reporting and accounting.

- Currency risk management and exchange rate modeling.

- Countries risk and political stability analysis.

- Multinational deal structuring of tax.

- Combination of qualitative and quantitative aspects of valuation.

By completing cross-border M&A valuation training for finance teams, professionals enhance their ability to produce defensible valuations that satisfy auditors, investors, and regulatory authorities. More to the point, they get to have a comprehensive knowledge of the influence of local conditions on global deal dynamics.

Combining Strategic Decision-Making and Valuation Insights.

Valuation cannot be seen as an independent activity. It is part of a larger strategic analysis, which takes into account the market entry goals, competitive positioning and cultural presentation in cross-border M&A. The finance professionals who are knowledgeable about valuation change can provide a more insight into the manner in which the transaction is a fit to the long-term objectives of the company.

As a case in point, a deal may seem costly based on financial analysis alone but may have massive strategic benefits – e.g. new customer base or proprietary technology. On the other hand, seemingly appealing valuation could be a veil of undiscovered risks of governance, compliance or local volatility on the market.

Training will enable the finance teams to be able to communicate these insights and therefore decision-makers can consider both financial and strategic factors and decide whether to commit to a deal.

Conclusion to Cross-Border M&A Valuation Training Adjustments and Best Practices

The cross-border M&A valuation is a skill that requires a level of technical expertise but it also necessitates contextual awareness, flexibility and foresight. Finance teams can also learn to make the adjustments, the techniques and the analytical model which will help them to analyze international transactions with accuracy, through well-organized professional training. With organizations increasingly going international, individuals who have knowledge in cross-border valuation will be of significant importance in ensuring fair pricing, sound decision-making, and sustainable success of post-merger.