Scenario and Sensitivity Analysis Training for Business Valuation

Scenario and Sensitivity Analysis Training for Business Valuation

Introduction to Scenario and Sensitivity Analysis Training for Business Valuation

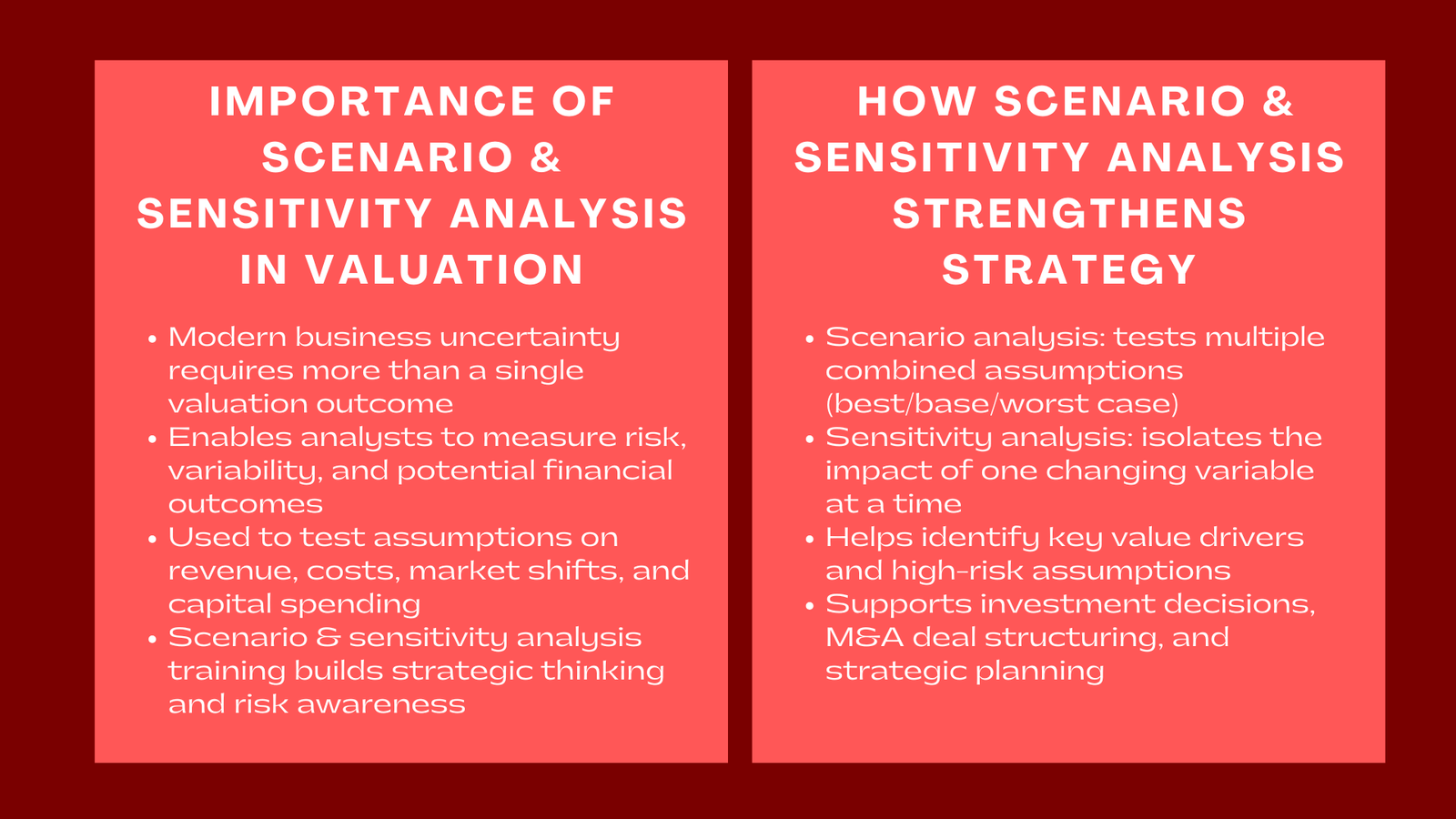

In business valuation, understanding the potential variability of financial outcomes is just as important, if not more, than calculating the base value itself. Modern business environments are increasingly dynamic, with rapid market fluctuations, technological disruptions, and changing regulatory landscapes. In such a context, scenario and sensitivity analysis are indispensable tools that allow analysts, investors, and corporate managers to quantify uncertainty, assess risk, and make informed strategic decisions. These analytical methods transform assumptions about revenue growth, cost structures, market dynamics, and capital expenditures into measurable impacts on a company’s financial performance and overall valuation.

Training scenario analysis in business valuation Singapore and sensitivity analysis equips professionals not only to model financial performance under a wide range of conditions but also to interpret and communicate the implications of these analyses effectively. Beyond technical skill, structured training fosters strategic thinking, risk awareness, and a mindset oriented toward proactive decision-making. By mastering these methods, finance professionals gain the confidence to evaluate complex investment opportunities, support management decisions, and enhance the reliability of valuations. Ultimately, proficiency in scenario and sensitivity analysis strengthens both analytical rigor and career readiness, making it a highly sought-after capability in finance, corporate strategy, and advisory roles.

Understanding Scenario and Sensitivity Analysis

What Is Scenario Analysis?

Scenario analysis is a structured approach that evaluates a business’s financial outcomes under different predefined conditions. Analysts often develop multiple scenarios, typically including best-case, base-case, and worst-case situations, to reflect variations in revenue growth, profit margins, operating costs, or broader macroeconomic factors. The process involves integrating multiple assumptions simultaneously, such as changes in sales volume, pricing strategies, cost structures, or capital expenditures, to understand how they collectively impact the company’s financial health.

The primary value of sensitivity analysis training for finance professionals Singapore lies in its ability to provide insight into potential future states rather than a single deterministic outcome. It allows professionals to anticipate both opportunities and risks, quantify the range of possible results, and prepare contingency strategies. Scenario analysis is especially valuable for companies operating in volatile markets, launching new products, or pursuing mergers and acquisitions, where uncertainty can significantly affect business outcomes. By systematically exploring a range of plausible scenarios, analysts can identify critical factors that influence performance, enabling management to make proactive decisions rather than reactive adjustments.

What Is Sensitivity Analysis?

Sensitivity analysis complements scenario analysis by isolating the effect of individual variables on valuation outcomes. Unlike scenario analysis, which examines combined assumptions, sensitivity analysis focuses on one input at a time to determine how changes in that specific factor influence the overall result. For example, an analyst may measure how a one percent increase in the cost of goods sold or a five percent change in revenue growth impacts net present value, internal rate of return, or cash flow projections while holding other assumptions constant.

This targeted approach provides clarity on which assumptions are the most influential, helping decision-makers prioritize areas of risk and focus on the variables that drive the most significant financial impact. Sensitivity analysis also enhances the credibility and robustness of financial models by demonstrating how outcomes respond to realistic variations in key assumptions. When used alongside scenario analysis, sensitivity analysis contributes to a comprehensive understanding of both systemic and isolated risks, allowing finance professionals to evaluate the stability and reliability of their valuations across multiple dimensions of uncertainty.

Practical Applications in Business Valuation

Investment Decision-Making

Scenario and sensitivity analysis are crucial for investment decision-making because they provide a structured way to assess potential returns, downside risks, and the likelihood of achieving financial objectives. Investors can simulate different market conditions, operational challenges, or regulatory shifts to determine whether an investment meets return expectations and aligns with risk tolerance. By evaluating both best-case and worst-case scenarios, investors gain insight into potential upside opportunities while understanding the magnitude of potential losses. Sensitivity analysis further complements this by identifying which factors, if misestimated, could have the most significant impact on value, allowing investors to focus on monitoring and mitigating key risks.

Mergers and Acquisitions

In mergers and acquisitions, scenario and sensitivity analyses are essential for structuring deals and supporting negotiations. Analysts use these techniques to project enterprise value under different assumptions about revenue growth, cost synergies, integration expenses, and operational efficiencies. Scenario modeling allows deal teams to plan for multiple outcomes, ensuring that strategic decisions are informed by realistic projections rather than overly optimistic estimates. Sensitivity analysis further supports M&A decisions by revealing which assumptions are critical to achieving targeted returns. This insight enables deal teams to prioritize diligence efforts, manage integration risks, and negotiate deal terms that reflect a comprehensive understanding of potential outcomes.

Strategic Planning

Corporate managers leverage scenario and sensitivity analysis to enhance the quality and reliability of strategic planning. These techniques allow executives to quantify the financial implications of strategic initiatives such as market expansion, product diversification, cost optimization, or capital investment projects. By systematically evaluating how different variables affect key performance metrics, managers can allocate resources more efficiently, anticipate challenges, and make evidence-based decisions that align with long-term corporate objectives. Training in these analytical methods ensures that leaders are capable of integrating quantitative insights with operational strategy, improving communication across departments and fostering a culture of data-driven decision-making.

Key Components of Training Programs

Model Construction and Integration

Effective training programs begin with the fundamentals of model construction, emphasizing the integration of income statements, balance sheets, and cash flow statements. Participants learn to link assumptions directly to financial statements, ensuring internal consistency and accuracy across all calculations. Proper model integration is crucial because it allows changes in key assumptions to propagate automatically throughout the financial model, generating reliable outputs that reflect interdependencies among variables. Training often includes hands-on exercises in Excel or financial modeling software to build dynamic models that can adapt to multiple scenarios and inputs.

Assumption Setting and Validation

A critical focus of training is the definition and validation of realistic assumptions. Professionals learn to establish parameters for revenue growth, operating expenses, capital expenditures, and financing costs based on historical performance, market benchmarks, and industry data. Emphasis is placed on the importance of validating assumptions through comparison with external data sources and historical trends to ensure the reliability of the analysis. Rigorous assumption validation reduces the risk of biased or overly optimistic projections and reinforces the credibility of scenario and sensitivity analyses for decision-making purposes.

Scenario and Sensitivity Techniques

Comprehensive training programs introduce participants to a variety of techniques, including the creation of best-case, base-case, and worst-case scenarios, as well as one-way, two-way, and tornado sensitivity analyses. Trainees learn to employ dynamic modeling tools to automate recalculations, assess the impact of assumption changes, and visualize the results effectively. By practicing these techniques in real-world case studies, participants develop the ability to identify key value drivers, quantify risk, and communicate analytical insights with clarity. This practical exposure ensures that professionals can apply these methods in both corporate and investment contexts with confidence.

Interpretation and Reporting

An essential component of training involves translating numerical outputs into actionable insights and strategic recommendations. Professionals learn to evaluate which assumptions have the most significant influence on valuation, assess the range of potential outcomes, and communicate findings to stakeholders, including executives, investors, and clients. Training emphasizes the importance of presenting results in a clear, concise, and persuasive manner, ensuring that the outputs of scenario and sensitivity analysis directly inform decision-making and support evidence-based strategic planning.

Benefits of Scenario and Sensitivity Analysis Training

Structured training in scenario and sensitivity analysis provides multiple benefits for both professionals and organizations. It enhances risk awareness by enabling analysts and managers to understand which assumptions have the greatest impact on business valuation. Professionals gain the ability to make better-informed decisions by providing structured options under conditions of uncertainty. Career advancement opportunities increase significantly, as expertise in these analytical methods is highly valued in investment banking, corporate finance, private equity, consulting, and strategic management. Additionally, training improves modeling efficiency, equipping participants with the skills to create dynamic, flexible models that can adapt to changing data, market conditions, or strategic assumptions. Overall, scenario and sensitivity analysis training strengthens analytical capabilities, improves decision-making quality, and positions professionals for leadership roles in finance and business strategy, especially when combined with learning from a core business valuation approaches course Singapore.

Conclusion

Scenario and sensitivity analysis are fundamental tools for rigorous business valuation, offering a systematic approach to understanding uncertainty, quantifying risk, and guiding strategic decisions. Structured training ensures that professionals can build integrated financial models, define and validate assumptions, test multiple scenarios, and communicate results effectively. For analysts, investors, and corporate leaders, proficiency in these techniques enhances the quality of financial insights, builds credibility, and provides a strategic advantage in complex business environments. In today’s dynamic financial landscape, scenario and sensitivity analysis is more than a technical skill; it is a strategic competency that enables professionals and organizations to transform analytical precision into actionable decision-making, anticipate risks, and seize growth opportunities with confidence. Mastery of these techniques not only improves financial performance but also cultivates leadership, analytical rigor, and career advancement in high-stakes business environments.