Training on the Impact of Market Conditions on Share Price and Company Value

Training on the Impact of Market Conditions on Share Price and Company Value

Introduction to Training on the Impact of Market Conditions on Share Price and Company Value

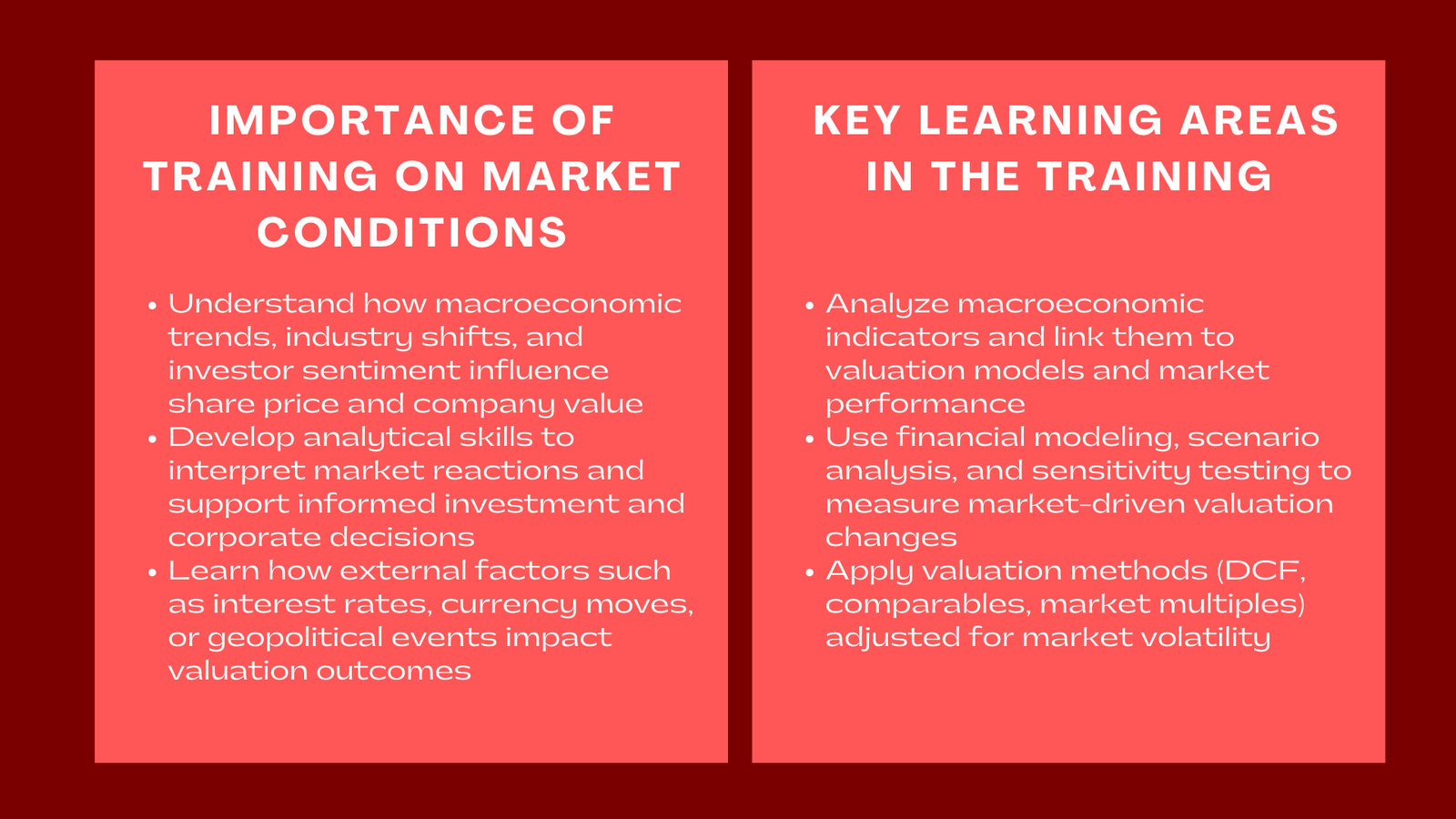

In modern finance, understanding how market conditions affect share prices and overall company value is crucial for investors, analysts, and corporate managers. Stock prices do not exist in isolation; they reflect the interplay of macroeconomic trends, industry-specific developments, investor sentiment, and company-specific financial performance. Training that focuses on the impact of market conditions equips finance professionals with the analytical tools and strategic insights necessary to interpret these dynamics, anticipate market reactions, and make informed investment and business decisions.

Such training emphasizes the relationship between external factors and internal performance, enabling impact of market conditions on share price professionals to bridge financial modeling, valuation techniques, and real-world market behavior. By mastering these concepts, participants learn to assess risk, identify opportunities, and evaluate how fluctuations in interest rates, commodity prices, currency movements, or geopolitical developments can influence share prices and corporate value. The insights gained are not only applicable in investment and trading contexts but also in strategic corporate planning and investor relations.

Understanding Market Conditions and Their Influence

Macroeconomic Factors

Macroeconomic indicators such as GDP growth, inflation, unemployment rates, and interest rates play a significant role in shaping investor expectations and share price movements. For example, rising interest rates generally increase the cost of capital, reduce future cash flow valuations, and may negatively affect stock prices, particularly for highly leveraged companies. Conversely, periods of economic expansion tend to boost consumer demand, improve profitability, and enhance investor confidence, which often translates into higher valuations. Training programs focus on teaching participants how to interpret macroeconomic data, quantify its effects on discounted cash flow models, and incorporate these insights into financial projections.

Industry-Specific Dynamics

Beyond macro factors, each industry has unique drivers that influence company value and share price volatility. For instance, commodity-dependent businesses are highly sensitive to price fluctuations in raw materials, while technology companies may react more to innovation cycles, regulatory changes, or market adoption rates. Understanding these industry-specific dynamics allows analysts to contextualize financial performance and market reactions. Training emphasizes sector analysis techniques, including peer benchmarking, industry trends, and competitive positioning, which help professionals evaluate how external market shifts may affect relative valuations and investor sentiment.

Investor Sentiment and Behavioral Influences

Market conditions are not driven solely by fundamental financial data; investor behavior and sentiment often amplify price movements. Market optimism, fear, herd behavior, and risk appetite can cause share prices to deviate temporarily from intrinsic values. Professionals trained in market psychology and sentiment analysis learn to identify potential overreactions or undervaluation, allowing them to adjust investment strategies or corporate communication. This skill is particularly important for managing expectations during earnings announcements, macroeconomic shocks, or market speculation.

Analytical Tools for Assessing Market Impact

Financial Modeling and Scenario Analysis

Training emphasizes the use of financial modeling for market sensitivity Singapore to quantify how market conditions influence company value. Scenario analysis allows professionals to model different economic or industry scenarios, such as recession, rapid growth, or commodity price shocks, and evaluate their effect on revenue, cash flows, and valuations. By linking these scenarios to share price models, analysts gain insights into potential upside and downside risks, preparing them for informed decision-making under uncertainty.

Sensitivity Analysis and Risk Assessment

Sensitivity analysis complements scenario modeling by isolating the impact of individual variables on company value. For instance, analysts can measure how a 1% change in interest rates, a 5% shift in commodity prices, or a currency fluctuation impacts net present value (NPV) or internal rate of return (IRR). This approach helps professionals prioritize risk factors, focus monitoring efforts on critical drivers, and develop contingency plans. Training programs often include exercises using dynamic Excel models or financial software to automate these calculations and visualize risk exposure effectively.

Valuation Techniques Linked to Market Conditions

Valuation methods such as discounted cash flow (DCF), comparable company analysis, and precedent transactions can all be influenced by market conditions. Training provides professionals with guidance on adjusting discount rates, growth assumptions, and multiples to reflect changes in macroeconomic or industry environments. Understanding how market factors feed into valuation calculations ensures that analysts can provide accurate, defensible assessments of company value, even during periods of volatility.

Practical Applications in Finance and Corporate Strategy

Investment Decisions and Portfolio Management

Investors use insights from market condition analysis to make better portfolio allocation and risk management decisions. By anticipating how external factors influence share prices and corporate value, professionals can identify investment opportunities, hedge against potential losses, and optimize returns. Training teaches techniques for scenario-based portfolio modeling, allowing investors to assess the impact of market shocks or cyclical trends on asset performance.

Corporate Finance and Strategic Planning

For corporate managers, understanding the relationship between market conditions and company value supports better strategic planning. Leaders can evaluate financing decisions, capital allocation, and expansion strategies with an awareness of market sensitivity. Training equips executives to incorporate market data into budgeting, forecasting, and investment appraisal processes, ensuring that strategic initiatives are robust to external fluctuations.

Investor Relations and Communication

Transparent communication with investors is vital, especially when market conditions create volatility in share prices. Training emphasizes how to present complex financial information, explain valuation assumptions, and contextualize market impacts in earnings calls, investor presentations, and reports. Professionals skilled in this area can maintain investor confidence, improve credibility, and facilitate informed dialogue between the company and its stakeholders.

Components of an Effective Training Program

Understanding Market Drivers

Programs begin by teaching participants to identify and analyze macroeconomic, industry-specific, and behavioral factors that influence share prices. Trainees develop the ability to differentiate between systemic trends and company-specific signals, ensuring their assessments are grounded in data and market realities.

Financial Modeling Integration

Participants learn to integrate market condition variables into comprehensive financial models, linking assumptions about revenue, costs, capital structure, and cash flows to valuation outcomes. This approach enables professionals to test different market scenarios and evaluate their effect on share prices and enterprise value.

Scenario Planning and Sensitivity Testing

Training includes advanced techniques for scenario planning, one-way and multi-way sensitivity testing, and stress testing. Professionals practice creating realistic best-case, base-case, and worst-case scenarios, as well as quantifying the impact of changes in key market variables on company value. This practical experience strengthens analytical rigor and decision-making confidence.

Interpretation and Reporting

Finally, training emphasizes the ability to interpret model results and communicate actionable insights. Participants learn to identify key value drivers, assess risk exposures, and present findings in a clear, structured manner to senior management, investors, or clients. The goal is to ensure that market-driven insights are translated into meaningful strategic recommendations.

Benefits of Market Condition Impact Training

Training in the impact of market conditions on share price and company value provides numerous advantages for finance professionals and organizations. It enhances analytical skills and risk awareness, improves the quality of investment and strategic decisions, and fosters credibility in communicating complex financial insights. Professionals gain the ability to anticipate market shifts, model multiple outcomes, and develop strategies to mitigate risks or capitalize on opportunities. Moreover, mastering these skills strengthens career prospects across investment banking, corporate finance, equity research, portfolio management, and strategic consulting, positioning participants as trusted advisors in volatile markets.

Conclusion

Understanding how market conditions affect share prices and company value is essential for professionals who seek to make informed investment decisions, optimize corporate strategy, and communicate effectively with stakeholders. Training programs that focus on these dynamics equip participants with the analytical tools, modeling techniques, and strategic insights necessary to quantify risk, assess uncertainty, and anticipate financial outcomes. By combining financial modeling, scenario and sensitivity analysis, and practical applications, professionals are better prepared to navigate complex market environments and contribute to organizational success. This approach is further strengthened through structured learning such as a share price analysis and valuation course Singapore, which equips participants with the skills to interpret market dynamics and apply them effectively in real-world decision-making. Proficiency in analyzing market-driven impacts is more than a technical skill it is a strategic advantage that enables professionals and companies to transform market insights into actionable decisions, enhance valuation accuracy, and strengthen long-term performance in increasingly dynamic financial landscapes.