Emerging Trends in Business Valuation and Deal-Making Advanced Training Module

Emerging Trends in Business Valuation and Deal-Making: Advanced Training Module

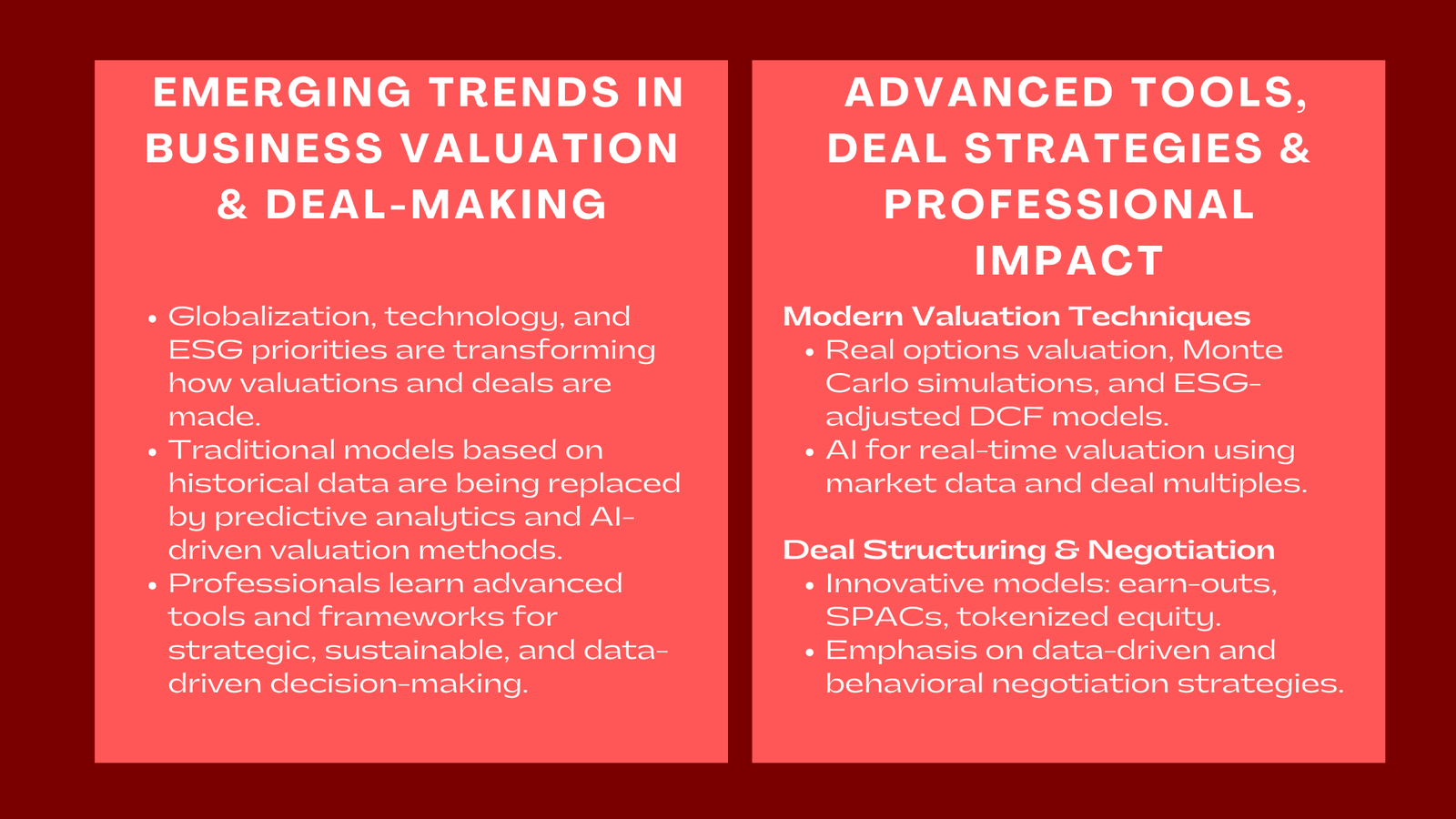

In the current dynamic financial environment, the process of business valuation and deal-making is changing at its core due to globalization, technological advancement, and evolving priorities of investors. Modern markets are evolving at such a fast pace that traditional valuation paradigms that rely mostly on historical data and static models are yielding to dynamic, technology-based approaches that are able to grasp the intricacy and momentum of today. As corporations engage in mergers, acquisitions, joint ventures and financing activities, the ability to understand emerging valuation trends has become an imperative for finance professionals, investment bankers as well as corporate strategists.

This intensive training module advanced business valuation and deal-making training for investment professionals Singapore will support participants in learning the best tools, analytical frameworks and digital techniques that are covered by business valuation and transaction structuring in today’s world. It balances theory and practice and takes students through the cutting-edge practices of pricing, negotiation, and decision-making. Participants will acquire the ability to measure the changing landscape of markets, limit sustainability and ESG related concerns, and manage transactions with both monetary accuracy and urban acumen.

The Changing Nature of Valuation and Transactions

From Historical Models to Predictive Analytics

Historically, valuation models had been devised based mainly on retrospective data – analysing past performance, trending of cash flow and comparing similar cases. However, in an era dominated by big data and artificial intelligence, forward-looking and predictive analytics as well as forward looking metrics play an increasing role in contemporary valuation. Participants of this module learn how predictive algorithms, machine learning, and alternative sources of data, such as market sentiment, social media trends, and macroeconomic indicators, are changing the way companies are valued.

Through a hands-on approach, trainees learn how predictive analytics can help to identify the early signals of money tree growths or trees going sour for a better time and accuracy in deal execution. Reinventing Your Approach: By incorporating forward-looking scenarios into valuation models, professionals can transcend historical bias and make data-driven investment decisions that are not merely resilient, but going forward able to make a statement which no longer comes from a historical perspective.

Sustainability, Intangible Assets, and New Value Drivers

The other significant change in the valuation business is the increased focus on the intangible assets and considerations of sustainability. Environmental, social, and governance (ESG) standards have become critical criteria of value and not only investors but also regulators and non-disclosure models were also influenced by them.

The participants are taught to determine the contribution of the intangible drivers like intellectual property, brand equity, human capital, and digital assets to the valuation of a company. The training shows the way how the ESG metrics and non-financial ones finally come into the valuation models to show the data-driven valuation and sustainable deal-making course for finance professionals Singapore long-term sustainability of a company and its social license to operate. As an example, the promise of a company to be carbon neutral, supply chain transparent, or diverse may have a significant impact on its multiple or attractiveness to investors.

Core Areas of the Advanced Valuation and Deal-Making Training

Innovative Valuation Methodologies

This training module will center on training the professionals with the latest and superior valuation techniques that can be used to represent realities in the market today. As part of the Singapore company valuation course for deal making, the participants test on the capabilities of the traditional models (such as discounted cash flow (DCF), analysis of similar companies and pre proceeds) to be improved by utilizing stochastic modeling, simulation and scenario analysis.

They learn such techniques as real options valuation, which reflects the flexibility inherent in strategic choices such as that of expansion, deferment, or divestment, which would not be recognized by the conventional DCF models. On the same note, the uncertainty and risk are recorded through Monte Carlo simulations, which produce a more sophisticated and probabilistic picture of fair value of the thousand possible valuation outcomes.

The development of artificial intelligence in valuation is also looked into in the training. It is possible to use AI-based models to automatically screen large data sets of similar firms, deal multiples, and market sentiment and come up with valuation ranges in real-time. These techniques are not only more efficient, but also more accurate, with less human influence and the use of constantly updated inputs of the market.

The other innovation discussed as a part of the program includes the creation of ESG-adjusted DCF models. It is the models that incorporate biological elements of the environmental and social performance into the cash flow projection, discount rates and terminal value projection. The outcome is a holistic value that covers both financial and non-financial risk elements which is in tandem with the expectations of investors in the sustainability era.

Modern Deal Structuring and Negotiation

The art of deal-making has never been complex and strategic. The module gives the participants an in-depth insight into the way the novel transaction structures are transforming the deal scene. The usual all-cash mergers are now accompanied by earn-outs, contingent value rights, and stock-for-stock swaps as well as special-purpose acquisition company (SPAC) mergers, which balances the risk and reward between parties.

The participants gain knowledge in dissecting the implication of each structure on valuation, dilution of ownership and integration of post-deal. Indicatively, in new economy markets, earn-out contracts enable the acquirers to make payments later depending on future performance thereby aligning the incentive of both parties and reducing the risk of valuation. Likewise, SPAC transactions are analyzed as an increasing alternative to private firms when they request to get access to capital in the market through normal IPOs.

In addition to financial modelling, negotiation is a very vital part of the deal-making. The training gives information on how to develop negotiation strategies that not only incorporate both quantitative reasoning, but also behavior. The participants are taught to figure out the psychology behind perception of valuation, the art behind telling their data in order to have a stronger bargaining ground, and managing cross-cultural peculiarities in international dealings.

Data-Driven Due Diligence

The computerization of corporate information has transformed the due diligence procedures. The participants will be presented with the current day due diligence applications using artificial intelligence and natural language processing capable of automatically identifying insights in vast amounts of written reports. The tools point to possible red flags, e.g. compliance risks, and liabilities that had not been disclosed, or financial statements irregularities.

Trainees exercise a combination of due diligence findings and valuation models and risk assessment through simulated case studies. They also know how to compare the performance of target companies with the peers with automated analytics, to make sure that the valuation is based on the sound data, which could be verified. It is a hybrid of digital due diligence and analytical modeling that makes the deal more transparent, limits the risk of transactions, and shortens the deal timeline.

Integrating Technology in Valuation Practice

Advanced Analytics and Visualization Tools

When the digital age has come, the way in which a presentation of the valuation findings are made is as critical as the analysis of the findings. The module will enable the participants to apply high-quality visualization platforms like Power BI, Tableau, and Python-based dashboards to transform complex data on valuation into human-usable interactive visual output. This can enhance the delivery of the narrative of valuation to non-technical parties such as board, investors, and regulatory authorities by converting financial information into understandable, graphical information.

The participants also get to know how to create dynamic dash boards, which automatically refresh the most important metrics like revenue expectations, the multiples of EBITDA and sensitivity analysis. This enables the decision-makers to search in the waters of what-if scenarios and analyze alternative deal outcomes on the fly. Through this type of visualization, valuation work becomes more accessible and enhances the collaboration of informed decision-making among the stakeholders.

Blockchain and Digital Deal Execution

The use of blockchain in the deal-making process is a technological revolution that was discussed in the module. The use of blockchain technology is transforming the manner of transaction execution, validation and recording of transactions through the provision of immutable, transparent, and secure digital ledger. The participants consider the potential of smart contracts, which are self-executing contracts that have to be coded on blockchain, to simplify the execution of deals by automatically executing a payment or a share transfer once a certain criteria have been fulfilled.

The training examines practical uses of tokenized equity, and transactions of digital assets, which make fractional ownership, liquidity, and increased barriers to investment participation possible. Through an insight into these new processes, participants can get more ready to work in a financial reality where transactions based on blockchains are becoming more mainstream. This is not only more efficient and trustworthy in carrying out of these deals but also places the professionals in the field of finance as pioneers in technological innovation in valuation.

Emerging Strategic Dimensions in Valuation and Deal-Making

Expanding Beyond Traditional Financial Analysis

The contemporary valuation and deal-making have transcended well beyond the scope of financial model and quantitative analysis. In the globalized economy today, valuation needs to be put into perspective with regards to wider strategic, macroeconomic and regulatory dynamics of direct relevance to transaction undertakings and the long run performance. The participants analyze the impact of the changes in the main macroeconomic factors, including changes on interest rate, inflation, exchange rate, and commodity cycles on enterprise value and deal structuring choices.

Another issue that is raised in this module is the increased role of the geopolitical processes and regulatory governance of valuation. As the governments are increasingly exerting greater scrutiny over foreign investment, antitrust compliance, and data sovereignty, the deal professionals must consider the legal and political factors in their analyses. The case study with simulations provide the participants with the ability to understand how regulatory risk can be evaluated, how valuation models can be adjusted to compliance costs, and the way it is possible to structure deals, in order to comply with the changing international trade and competition laws.

Strategic Alignment as the Core of Value Creation

The course helps to put forward the idea that it is much more than financial synergies that can make a successful deal-making, it is a matter of strategic coherence and organizational fit. The subjects under discussion by participants include how acquirer and target-business model alignment contribute to the creation of value (both long term and short term). In this sense, valuation would be more of a strategic intent than a number.

Participants determine the role of strategic variables like market positioning, integration of technology, proliferation of customer base, and synergy created in operations on the outcome of the transaction. They learn real-life mergers and takeovers to know the effect of the compatibility of different cultures, continuity of leadership, and planning of integration on post-deal value creation. Through successful and unsuccessful transactions, trainees will better understand the impact of intangible aspects, such as the capacity to innovate to brand fit on the outcome of valuation.

Shifting Focus Toward Sustainable and Long-Term Value

With the current market instability and investment based on ESG, the concept of what value entails is growing. The participants will be directed to transcend the short-term financial performance and introduce sustainability, quality of governance, and effects on stakeholders in the valuation frameworks. This wider prism indicates how deal-making needs to not only give back to the shareholders, but also provide long-term sustainability, ethics in governance and responsibility in societies.

With the help of practical tasks, professionals train operating with non-financial metrics, like with environmental risk exposure, supply chain stability, and social capital, in the valuation models. This multi-dimensional method makes them ready to assess deals in a holistic manner and strikes the right balance between quantitative and qualitative understanding. This strategic and sustainable thinking will help the participants to act in ways that boost their capacity to recognize deals that will provide sustainable value in an ever-complicated global economy.

Advantages of the Advanced Training Module

Professional Mastery

Upon this advanced training, the participants will obtain well-equipped technical, analytical and strategic skills that are rare with an average individual. They come out with how to construct sophisticated valuation models, elicit data-driven clarification and how to design creative deals that suit investor and market expectations. This will give access to senior Investment Banking, private equity, venture capital, and corporate development roles.

Strategic Insight and Market Readiness

By comprehending the new developments in valuation and deal making, professionals are able to predict the shifts in the market and react to the regulatory fluctuations and respond promptly regarding the strategies on investment. By engaging in this approach, the participants will get to think strategically in relation to the effects of the digital transformation, sustainability, and macroeconomic volatility on the valuation outcomes, which will enable them to remain ahead in a rapidly growing competitive environment.

Institutional Competitiveness and Value Creation

An organization that generates a team competent to perform current valuation techniques is accorded a unique edge in the market place. It will result in improved analytical skills that will make decisions more informed, decrease transaction risks, and negotiate with better results. The training stimulates institutions to proceed with a culture of valuation of data enabled technology that enhances investor relationships and develops resilience that creates long-term value.

Conclusion to Emerging Trends in Business Valuation and Deal-Making Advanced Training Module

The business environment of the financial world is evolving at an alarming rate. The markets are becoming new as technological, sustainable and innovation transform existing valuation and deal-making approaches. The Emerging Trends in Business Valuation and Deal-Making Advanced Training Module provides professionals with the instruments, understanding and foresight needed to manage this change with ease.

Individuals who are graduates of this program are not analysts, advisors, they are strategic partners who can make the orchestration of data to the decision-making processes, technology to the accuracy of valuation and wisdom to the excellence of the execution process. In a time of uncertainty and possibilities, these new trends will enable financial professionals to make transactions that will not only be sound financially, but also prospective, accountable and resilient.