Accurate Business Valuation Cost Singapore

Accurate Business Valuation Cost Singapore

Introduction: Why Knowing the Price Matters

Price tacking your business valuation Singapore is not mere assignment of a dollar on your firm, business valuation is a process, it ideally represents how hard you have worked, as well as your prospects of expanding in the future and position in the market. You may be about to sell your business, raise new capital, raise new funds, solve a shareholder disagreement, or may be about to undergo succession planning, a professionally calculated valuation is essential. It is the base making sure business decisions are confident and understandable.

However, the question that most business owners want to get the answers to before they begin the process is: How much is it going to cost? The answer is yes, and no; it depends. The prices that are imposed on valuation depend on several factors which include the reason for doing the valuation, the business complexity, the depth that it needs and the skills of the individual you contract. With such cost drivers, you will be able to save a lot of money on irrelevant details yet get the valuation to your needs and goals.

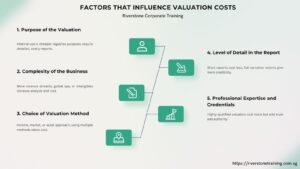

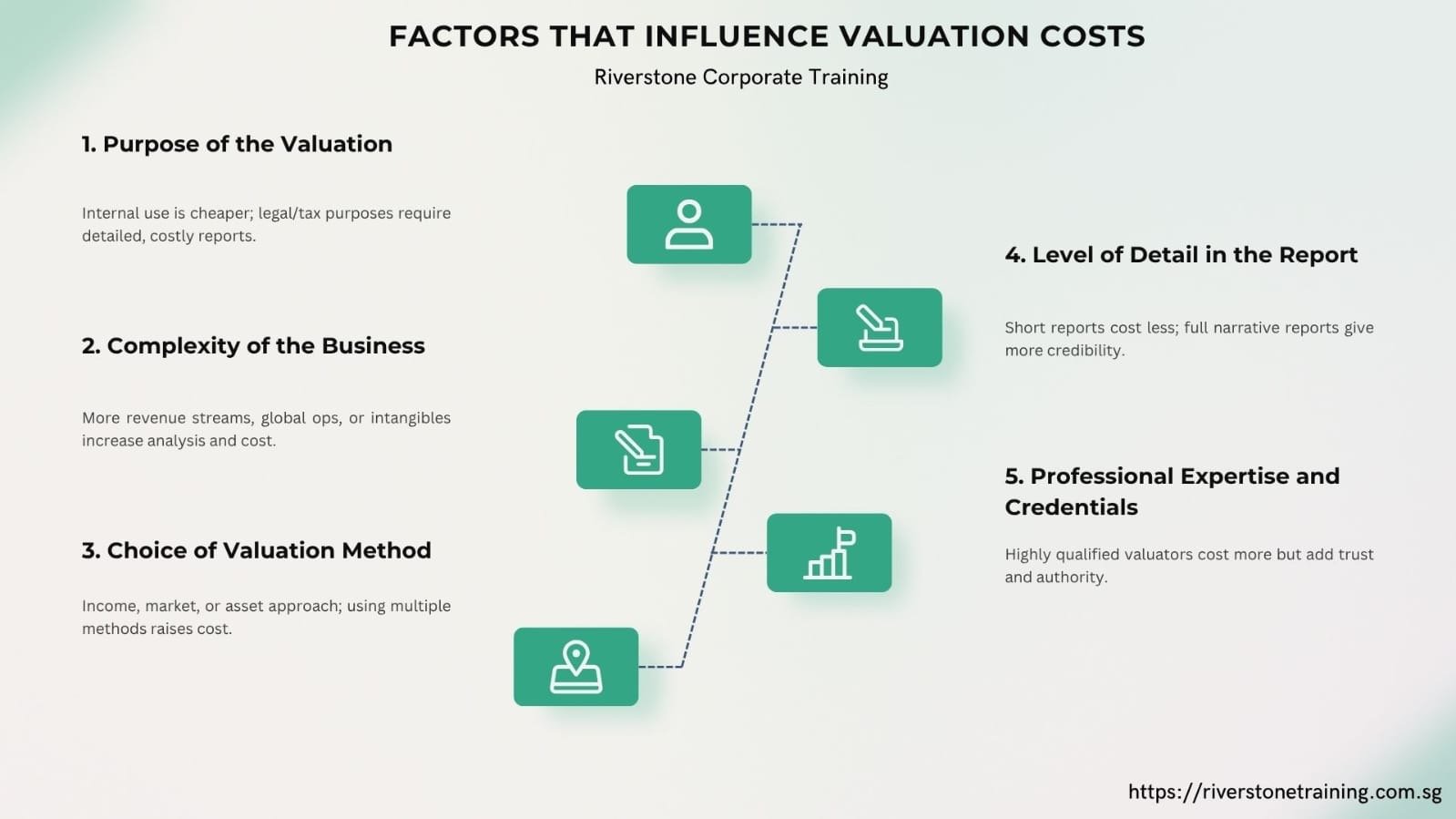

Factors That Influence Business Valuation Cost Singapore

The prices of business valuation course may vary widely, between a small number of hundreds of household money to value the business and a report with the most sophisticated technologies or highly debated in court but a heavy cost of thousands of dollars or over. These price differences are fuelled by various important factors:

Purpose of the Valuation

The depth of analysis depends on how the analysis is intended to be used. Internal strategic planning valuation may be less elaborate, and consequently, will offer a lower cost. However, a pro forma financial statement presented to the court, taxes, or regulatory filings will have to emerge to high standards and contain detailed documentation and be able to be stood up to scrutiny, thereby adding additional expense.

Complexity of the Business

Companies that have several sources of revenue, international work, a large number of employees or have a lot of intangible resources (patents, trademarks, proprietary technology, etc.) need an in-depth study. This is a frequent sign of more financial modeling, more market research and benchmarking of the industry as well that would be added to the overall price.

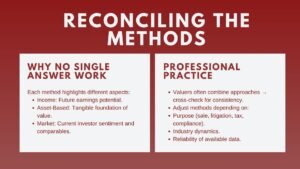

Choice of Valuation Method

Income Approach – It is very capital-intensive in the liquidity forecasting and risk assessment.

Market Approach – It entails the recognition and investigation of similar dealings.

Asset-Based Approach – Raises concern on value of assets and liabilities.

Other engagements torture cross-checking of results by multiple methods, which may be an increase to the workload and cost.

Level of Detail in the Report

Calculation or short-form valuation report will be cheaper but cannot hold a stand in negotiations or legal matters. The complete narrative valuation report, with its complete industry analysis, detailed assumptions and appendices, is expensive, and the reports are more credible.

Undergraduate Qualifications and experience.

More fees are usually charged when a Certified Business Valuator (CBV), Chartered Financial Analyst (CFA), or CPA who is a specialist in valuation are brought on board. Nonetheless, their status and qualification may prove crucial in case the valuation is to be examined by some third-party, like by a bank, court or investor.

Hidden Costs You Should Be Aware Of

In planning a budget on valuation, business owners always forget about indirect expenses, including:

Data collection time- The internal work done by creating the data to develop the correct balance sheet, personal financial statement of cost business owner projections, and documents.

Follow-up analysis -the valuation has to be updated in the case of a market changes or a company changes that require the updated valuation.

Expert witness fee- It can require the valuators to testify, and that can increase the amount of their fees per hour in litigation or shareholder dispute.

The awareness of these numerous extras may help to prevent the unpleasant unexpected surprises and put a sufficient budget aside.

How to Choose the Right Valuation Service Provider

An appropriate selection that matches the valuation is equally vital in the selection of the profession itself. The tips that can give you the best value of the investment are as follows:

Identify your goal to contact providers, this will make them provide an accurate quote.

Enquire on their approach so as to establish their compliance to your expectations.

Ask a sample to provide reports and see how much the information is detailed and professional.

Credential Bonafide and experience particularly in your industry.

The lowest price is not always the best; compare deliverables as well

overall the frugality of the cheapest competitor might not offer as much richness and reliability as you require.

Conclusion: View It as an Investment, Not Just a Cost

Though it may be no good news about having the price of a company valuation Singapore, it increases as an investment in lucidity and tactical benefit. An effective valuation would aid in bargaining better selling prices, find friendlier conditions of financing or cushioning your interests in disputes. On the other hand, when basing your operations on a faulty or unfinished estimating, you will end up losing out on a lot more opportunities or less advantageous apps.

It is simply a matter of selecting a valuation service that suits your intent, will provide the appropriate level of detail and which will be supported by reputable experience. Ultimately, the price of proper business valuation is usually well-calculated by its value.