Corporate Training How to Value a Company Accurately

Corporate Training: How to Value a Company Accurately

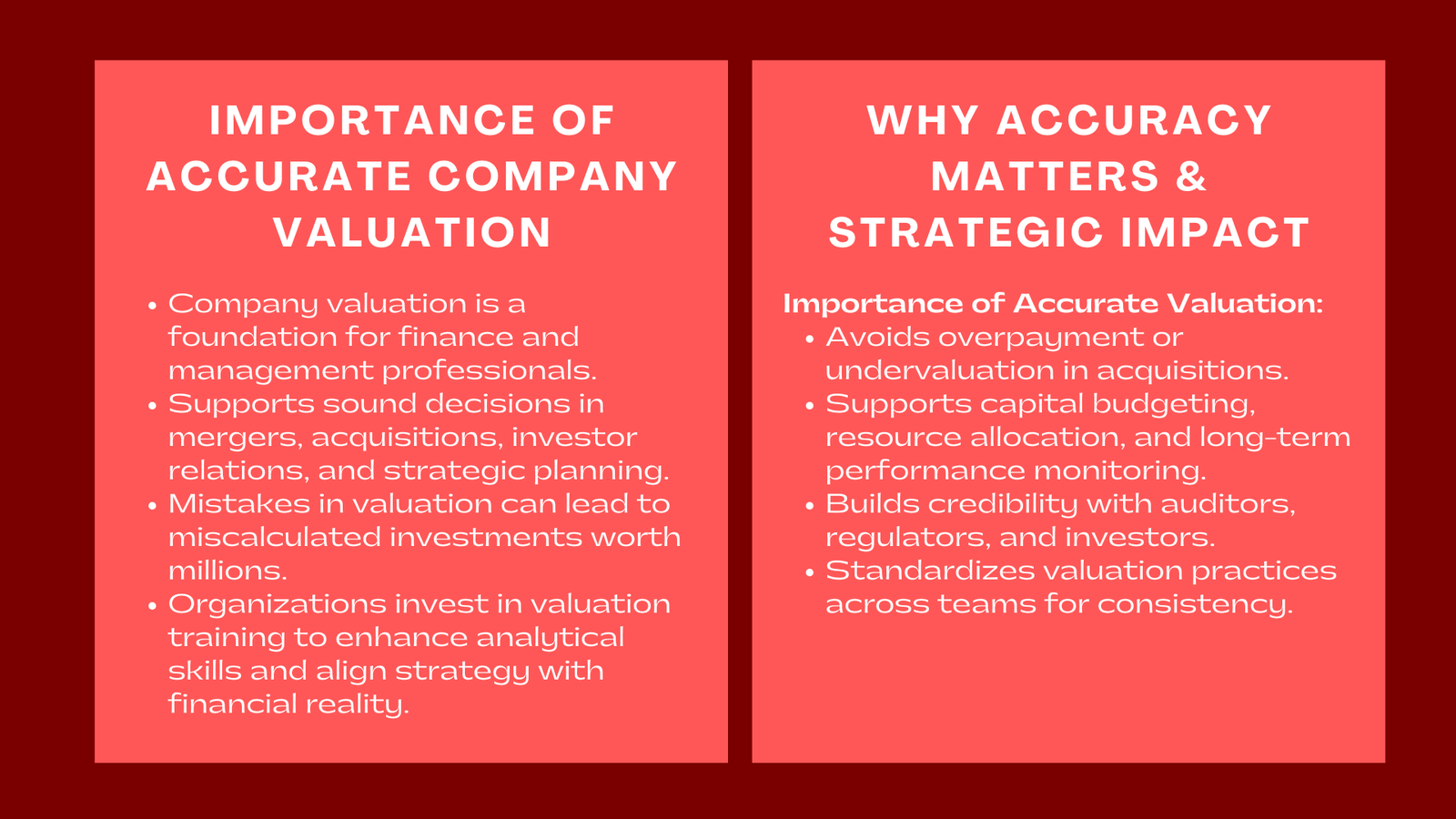

Valuing a company is a profession-wide foundation of a successful professional finance and management. The valuation will be the foundation of making sure that an investor makes sound decisions, whether it is an evaluation of a merger, acquisition of a competitor, or simply to attract investors. Company training on company valuation equips facilitating organizations and professionals with technical skills and analysis models of determining company valuation in a systematic evidence-driven manner.

Even in the high-stakes, high-stakes financial business environment, a relatively simple mistake in the valuation process can translate into millions of funds miscalculated investment. Therefore, more and more organizations start investing in business valuation and financial modelling training Singapore in order to enhance analytical ability of their staff and make sure that the strategic decisions are supported by the financial reality.

Learning the Foundations of Company Valuation

The training on corporate valuation usually starts with a review of why valuation is important not only to the investors but also to the managers, employees and stakeholders. Knowing valuation will help negotiate better with the shareholders, make fair evaluation of their performance, and negotiate with greater bargaining power.

The three major valuations strategies, income-based, market-based, and asset-based are faced to the participants. Using the Discounted Cash Flow (DCF) approach, one highlights future project earnings and calculates them dividing present value by an acceptable cost of capital. Such approach helps organizations to associate valuation and strategic planning over the long term, including considerations for intangible asset purchase price allocation Singapore.

On the contrary, the Market Approach is concerned with the comparison of a company with other similar companies through valuation multiples of EV/EBITDA, P/E or Price to Book. Lastly, the Asset-Based Approach values some of the company liabilities and assets worth judgments on fair market value of company assets and liabilities which is mostly pertinent to capital-intensive firms.

Integrating Real-World Application into Training

Corporate valuation encompasses practical learning of the subject which is more focused on case studies and practical activities. The valuation models are commonly constructed in Excel where the participants operate with real company data to get the picture of the challenges of financial forecasting, capital structure, and choice of discount rate.

In addition to this, trainers also take learners on a tour of real-life obstacles like the importance of highly-growing startups, cyclical businesses or those companies that have been in financial situations. The participants are taught how to manage sensitivity analysis, scenario modeling, and macroeconomic assumptions effects.

Due to personal contact with financial modeling methods, the professionals can be sure of applying valuation frameworks to their relevant corporate situation.

Why Valuation Accuracy Matters in Corporate Decision-Making

Proper valuation does not just set a price, it sets the passion of strategy. The problem of overvaluation can cause the overpayment in the acquisitions or raising expectations on the part of investors and undervaluation can cause growing gaps.

In the case of senior executives, correct valuation facilitates enhanced capital budgeting, resources distribution and long-term performance monitoring. To the professionals in the field of finance, it gives credibility in dealing with the auditors, regulators and external analysts. Business valuation techniques Singapore course also helps establish uniformity within teams, where the standard modus operandi and assumptions are made, guaranteeing that there are no differences in the internal analysis.

Conclusion to Corporate Training How to Value a Company Accurately

Corporate education on evaluation of the company converts the abstract financial theory into the practice. It also equips organizations the power to appreciate the companies in an accurate, confident and strategic way.

Forming a shared perception of valuation principles among departments enables businesses to enhance information on making decisions, investor relations, and financial disclosure. The art of valuation has not only been a technical capability in a competitive marketplace, it has also been a strategic capability.