Course on Valuation Ratios P E EV EBITDA and Their Applications

Course on Valuation Ratios: P/E, EV/EBITDA, and Their Applications

Introduction to Course on Valuation Ratios P E EV EBITDA and Their Applications

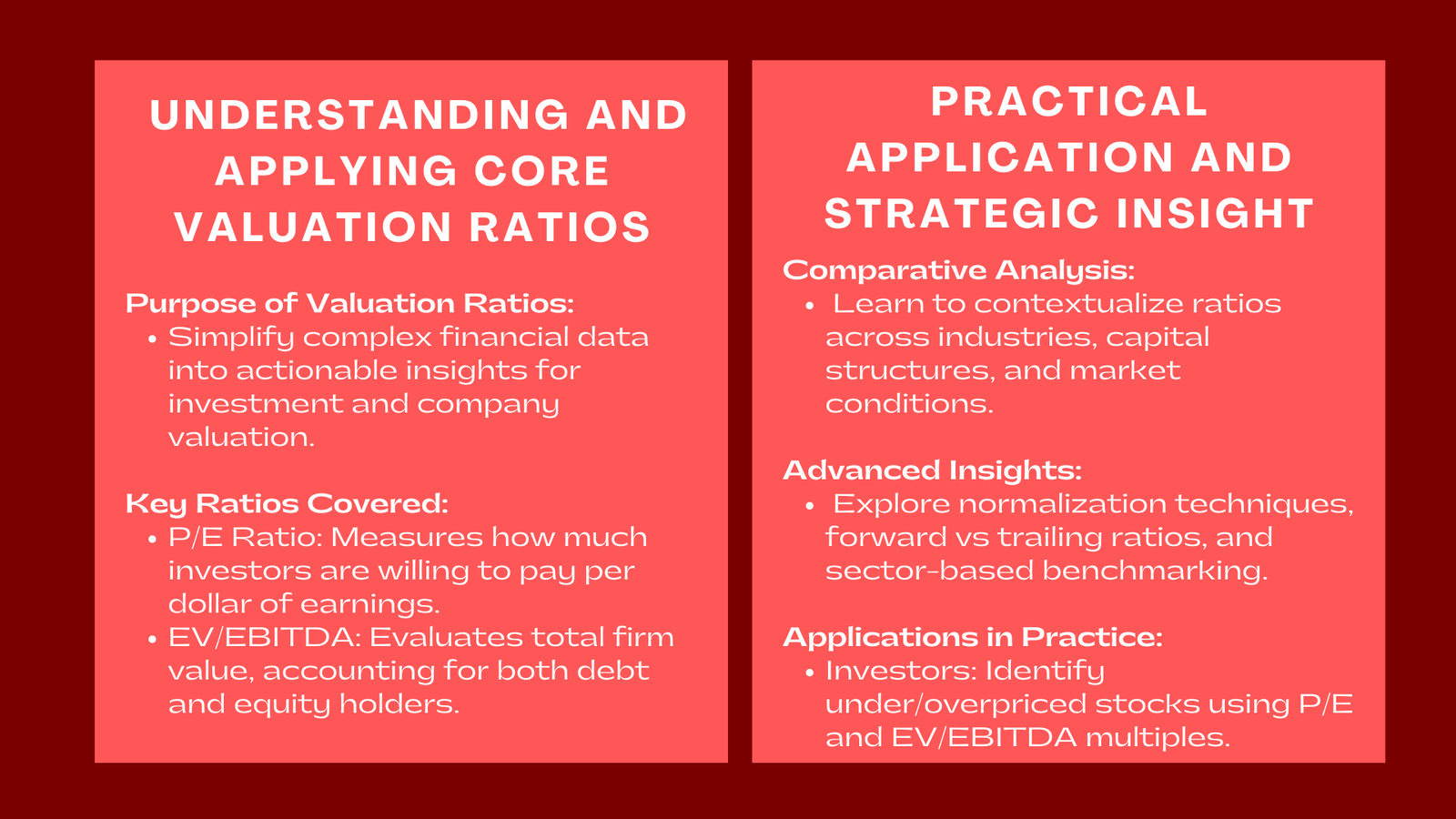

Among the most effective tools utilized by investors, analysts, and people involved in the field of finance are valuation ratios which are used to evaluate the worth of a company in comparison with the earnings, cash flows, and that of the peers used to analyze the company. They simplify complicated financial information into simple to comprehend measures that are used to make investment decisions and company valuation.

A Course on Valuation Ratios: P/E, EV/EBITDA, and Its Applications helps individuals gain extensive knowledge on the application of these ratios in all types of market and companies. In P/E and EV/EBITDA valuation ratios course Singapore seeks to understand the reasoning behind such ratios, the limitations of such ratios, and practical applications, the learners acquire analytical confidence and professionally applicable skills in financial analysis and valuation.

The course is unique to future analysts, fund managers and corporate finance professionals who wish to master the externalities of these ratios in making investment decisions besides valuations of deals, as well as strategic evaluations.

Understanding the Price-to-Earnings (P/E) Ratio

Another of the most well-known strategies of valuation is the Price-to-Earnings (P/E) ratio. It is the ratio of the present share price of a company to the earnings per share (EPS) providing the investors with the rapid idea of the extent to which they will pay a single dollar of profit.

Within the context of this business valuation course in Singapore for corporate participants will be taught how to compute the ratio and see what it means. A large P/E ratio can usually mean that the investors advise that the company will grow tremendously in the future – as the case is in technology or the areas in which it has been found to have high growth rates. On the other hand, low P/E ratio could either imply undervaluation or weak cycles or reduced growth potential.

Nevertheless, in the training it is underlined that context is everything. It is possible that the comparison of the P/E ratio of a manufacturing company and a fintech startup can cause a false conclusion. The participants are taught to manipulate the ratio because of the accounting differences, one off earnings and capital structure differences to make proper comparisons.

It is also related to the course on variations in the P/E ratio: forward P/E ratio (depending on future forecasts of earnings) and trailing P/E ratio (depending on past earnings) to allow learners to evaluate the level of future growth and sustainability of valuation.

The participants study the market sentiment, earnings quality and industry dynamics of the market using case studies to determine the influence of these factors in determining P/E valuation.

Exploring the EV/EBITDA Multiple

Whereas the P/E ratio is concerned with the relationship between the value of equity and the earnings, the Enterprise Value to EBITDA (EV/EBITDA) Times Interest Rate looks at it in a wider perspective. It puts in consideration the whole firm, both debt and equity holders versus its earnings before interest, taxes, depreciation and amortization (EBITDA).

During the training, the participants would be taught regarding the calculation of Enterprise Value (EV) including the market capitalization, total debt and minority interest, and subtracting cash and equivalent. This is more reflective of the fineness of a company as a whole in comparison with companies of varying capital structure.

The EV/EBITDA ratio is specially applicable in an industry characterized with companies that have different degrees of debts like telecommunications, energy, and sealed equity portfolio companies. The participants learn to apply this multiple so that they can make a similar analysis of companies and comparable transaction valuation in the context of corporate finance and M&A.

Other concepts that the course explores are EV/EBITDA normalization in which analysts modify EBITDA normalization to capture sustainable profitability by removing non-recurring expenses/income (or conversely). The practical examples indicate how this ratio can reveal over- or undervalued firms that at the same time may not be interesting when the P/E ratio is considered.

Applying Valuation Ratios in Investment and Corporate Decisions

The last part of the course is oriented towards practicalism. The participants get to know about the application of valuation ratios in equity research, investment banking and corporate strategy. To investors, P/E and EV/EBITDA are used in determining overpriced or underpriced stocks in the market – checking whether the market is too optimistic or pessimistic in relation to the future of a business.

To the corporate finance practitioners, the ratios are advisory in terms of the valuation of deals and negotiation approaches. In a case of acquisition of another business, an acquirer can make use of EV/EBITDA multiples of a related sale to determine a reasonable price of acquisition. Similarly, these ratios are also used by companies intending to go public to put their market expectations in check.

The participants are also taught the role of using ratios as a combination instead of using only one measure. Through compiling P/E and EV/EBITDA values with cash flows measurements, the concept of return on invested capital (ROIC) and growth rates, they have a better insight into intrinsic value.

The training is concluded by live exercises in which the trainees have to compute and analyze valuation ratios of real companies, explain investment implications and support their conclusion- which is simulating how an analyst works in the real world.

Conclusion

The P/E and EV/EBITDA valuation ratios are not just formulas; they are decision-making tools that do not emphasize the differences between financial theory and market reality. The participants take this comprehensive course to learn how to compute, analyze and use these ratios in an analytically accurate and strategically enlightening way.

Learning these basics of valuation allows the professionals to improve their skills in valuation of investment opportunities, assist companies in making decisions, and effectively communicate with stakeholders and investors. Valuation ratios training for investment and corporate finance professionals Singapore ratios are not simply a skill in the current data driven finance world, it is a competitive advantage that determines the quality of financial judgment. By integrating these ratios into broader analytical frameworks, learners gain the confidence to interpret market signals accurately, identify mispriced assets, and make investment or corporate decisions that maximize long-term value. Ultimately, understanding and leveraging valuation ratios transforms participants into professionals capable of turning data into actionable insights and strategic advantage.