Financial Statement Analysis for Business Valuation Training Module

Financial Statement Analysis for Business Valuation: Training Module

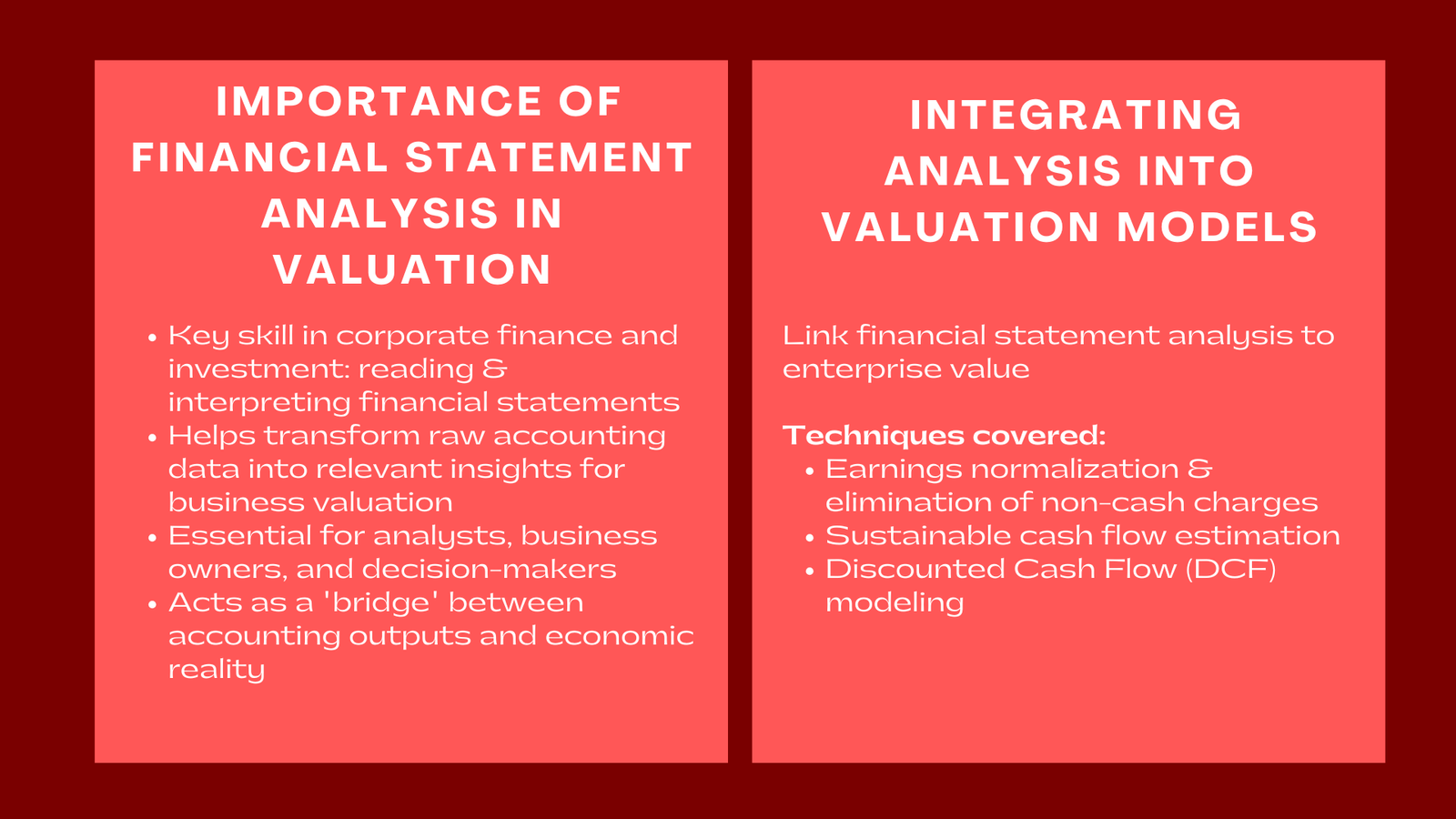

In the realm of corporate finance and investment, being able to read and interpret financial statements is the key to successful business valuation. Whether conducting diligence on an acquisition target, determining investment potential or benchmarking internal performance, it is important to be able to see beyond the numbers. Financial statement analysis training module for business valuation helps professionals transform raw accounting data into something relevant that can be subsequently used to determine the true value of companies.

This form of training is very important for analysts, business owners, and decision-makers who use financial statements as part of their strategic decision-making process. It acts as a kind of “bridge builder” between accounting outputs and the economic reality—helping participants to go beyond reading financial reports, to interpreting them in terms of value creation and risk. This is a key feature of the advanced financial modeling and valuation course Singapore, designed to equip professionals with practical skills for real-world corporate finance challenges.

Understanding the Role of Financial Statements in Valuation

Financial statements – the income statement, balance sheet and cash flows statement – are the basis of any business valuation. Each one tells a part of the story: profitability, liquidity, solvency and operational efficiency. In valuing capital, the participants learn to look beyond the surface of the figures and to get at the underlying financial health and sustainability of the company.

For example, revenue development may seem good, but when considered together with cash flows and margins, a better picture of profitability and efficiency is obtained. Valuation Models – Participants are led through the steps of distinguishing between recurrent and non-recurrent income, what to do about extraordinary items and the working capital moves needed to construct realistic valuation models.

By drawing financial statement analysis directly into valuation models such as Discounted Cash Flow (DCF) and Comparable Company Analysis (CCA), professionals gain an insight into how information from accounting practices is converted into enterprise value.

Analyzing Key Financial Ratios and Indicators

An important component of this training will be to learn financial ratios that identify the company’s performance and risk profile. Profitability ratios – Return on equity (ROE), gross margin express a company’s financial efficiency. Liquidity and Solvency ratios such as current ratio, debt to equity ratio measure the ability of the company to repay obligations and maintain growth.

In addition, they study efficiency ratios such as asset turnover ratios and days sales outstanding (DSO), which offer information about operational efficiency. When combined with the analysis of the ratios over time or in comparison with other companies operating within the same industry, these ratios transform into effective valuation and strategic tools. Through practical exercises, learners experience the interpretation of ratios in context- knowing that a high level of debt, for example, does not necessarily have a negative connotation if it is sufficient for a company to be accompanied by strong and predictable cash flows. This hands-on approach is a core part of factors influencing market value training Singapore, helping participants connect financial metrics to real-world market value considerations.

Integrating Financial Analysis into Valuation Models

The real value of financial statement analysis is its transfer to valuation models. In this case study module, participants gain insight on how to base accounting information on economic reality – eliminating non-cash charges, earnings normalization, and sustainable cash flow estimates.

Also, they learn to make connection between information from financial statements to valuation models like DCF models, where projected free cash flow is being discounted to value present value. This integrated approach means the participants do not view the financial analysis as an end in and of itself, but as a necessary input into value estimation. This methodology aligns closely with brand valuation services Singapore for intangible assets, helping professionals accurately assess both tangible and intangible elements of enterprise value.

Conclusion to Financial Statement Analysis for Business Valuation Training Module

Financial statement analysis is the link between accounting and valuation. Through an organized process of training, the professionals are able to develop analytical rigor and critical thinking skills that can help them unravel the real financial position of a business.

By learning to do this, participants are gaining the confidence that they can make informed investment, acquisition and management decisions. In the cutthroat world of finance, the ability to read financial statements for valuations means not just being good – it means indispensable.