Goodwill Calculation and Impairment Training in M&A Deals

Goodwill Calculation and Impairment Training in M&A Deals

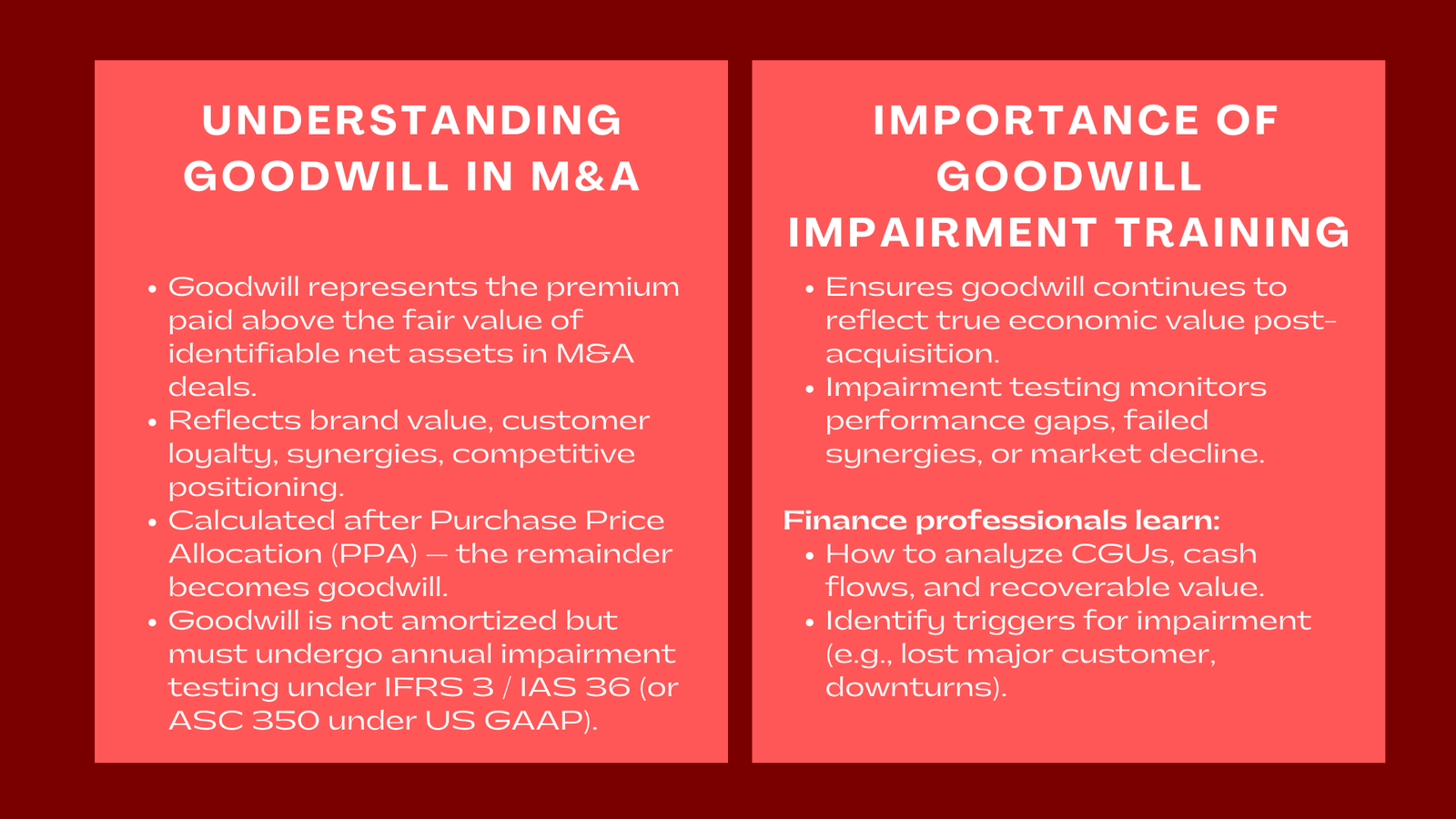

Goodwill can be one of the largest entities in the balance sheet of a company in cases of merger and acquisition (M&A). It shows the high price that an acquirer will pay in excess of the fair value of identifiable net assets of the target – intangible goodwill like brand recognition, customer loyalty, or anticipated synergies. Nevertheless, goodwill is not a fixed amount, it has to be assessed periodically as an impaired goodwill to maintain its reflective economic value. To finance team members who have to deal structure and post merge reporting, it is mandatory to understand how to calculate the goodwill and impairment training of an M&A team to achieve transparency, compliance, and long term value integrity.

The concept of Goodwill in Mergers and Acquisitions.

In the case of a company buying another, the price that is paid normally is more than the fair value of the net assets that are bought. The surplus goodwill is based on the availability of competitive market position, knowledge of the management, intellectual property and expansion opportunities. As an accounting term, goodwill is an intangible asset that cannot be singly distinguished but is usually expected to bring about economic benefits in future, especially when aligned with purchase price allocation Singapore requirements in M&A transactions.

Goodwill calculation starts with a purchase price allocation (PPA) at which time all identifiable assets and liabilities are measured at fair value. The remaining part of this allocation is goodwill. As an example, where the purchase consideration is USD 200 million and identifiable net assets fair value is USD 150 million, then the goodwill would be USD 50 million.

No amortization of goodwill is undertaken although under standards like IFRS 3 and IAS 36 (when using the US GAAP, ASC 350 is used), goodwill must be tested at least once annually. This will make sure that goodwill has a reasonable premium and not exaggerated value.

Why Goodwill Matters in M&A

Goodwill is an important factor in describing the value creation in M&A. It embodies some benefits that may have no direct measure of value in the future in the form of synergies in the integration of operations, penetration of new markets, or an enhanced brand equity. But when the performance of the business after acquisition is lower than the expectation, then the goodwill that will be recorded during the time of acquisition might not be justifiable by the cash flows of the company.

It is at this stage that impairment testing comes in handy. Periodic reviews of impairment enable the organizations to recognize and reflect any reduction in the recoverable amount of goodwill so as to ensure the balance sheet as the true image of economic reality. According to an investor point of view, goodwill impairment is an indication that the integration synergies or market assumptions have not been utilized exhaustively.

Therefore, goodwill impairment training for finance professionals in M&A is vital not only for compliance but also for effective communication with stakeholders. It assists the professionals to make sense of what goodwill is really about not only in terms of strategic achievement but also in terms of future hazard.

Process of Goodwill Calculation.

Goodwill calculation starts as soon as the acquisition is closed after the purchase price allocation is made. Trained specialists in this direction are taught to conduct the following major steps:

- Identify total purchase consideration: This involves cash payments, equity issued, contingent consideration as well as assumed liabilities.

- Fair value of identifiable net assets: Asset that consists of property, equipment, patents, and customer relationships are assessed separately.

- Determine goodwill: The goodwill amount will be determined by the difference between the purchase consideration and the fair value of identifiable net assets.

The training programs have highlighted the significance of applying consistent valuation assumption between pre-deal pricing and post-deal allocation. This makes goodwill a real depiction of the residual value of the original acquisition analysis as opposed to arbitrary changes that may come after closing.

Goodwill computation also plays with the tax consideration since some jurisdiction permits tax-deductible goodwill amortization where others consider it as a reporting remedy. These shades should be known to make correct financial and tax reporting.

Performing Goodwill Impairment Testing.

Goodwill impairment testing is done at least once a year, or more often in the case of triggering events occurring, including bad weather in the market, loss of central customers or poor performance of the acquired business. It is the comparison of the carrying amount of a cash generating unit (CGU) which includes goodwill and recoverable amount.

When the carrying amount is higher than the recoverable amount (the higher of fair value less costs to sell and value in use), then the excess amount is considered as impairment loss. This loss is deductible to the goodwill balance and recorded in the profit and loss statement.

Professionals trained through goodwill calculation and impairment training for M&A teams learn to build robust valuation models for impairment testing. They learn discounted cash flow (DCF) techniques, evaluate the indicators of the market, and understand the macroeconomic changes which can influence recoverable value. Training is also based on the identification of triggering events, including operational setbacks, entry into the market by a competitor, or regulatory changes, as they need to be impaired previously.

The problems of the Goodwill Impairment Analysis.

Goodwill impairment is a subjective and complicated field, even with the transparent regulatory structures. Forecasting future cash flow in a realistic way is one of the major challenges. Excessively optimistic projections may delay the recognition of impairment, and excessively conservative projections may cause writing to be premature.

The other difficulty is the determination of the right rates of discounts, assumptions of growth and CGU definitions. Goodwill in many cases constitutes value in several business units, thus, it is important to allocate it correctly through good analytical power.

Training courses train the finance professionals on how best practices can be used to address these challenges. They are taught how sensitivity tests are used to test the effects of changes in assumptions on recoverables, how to document material judgment in a transparent manner and how to interact with auditors in their review processes.

The Interrelationship between the impairment and Business Strategy.

The impairment of the goodwill is not only an accounting practice, but it is also a result of business strategy. In most cases, impairment when it happens is an indication that integration plans, cost saving programs or market expansion programs have failed in their execution.

Efficient training facilities motivate finance professionals to frame the outcomes of impairment in a strategic manner. Rather than taking impairments as the negative entries in their accounting records, they are taught to work with it as a feedback mechanism, where they can see that their assumptions did not match the reality and where they can enhance their business.

This view makes management of goodwill not a compliance action but a discipline. Majority of the finance teams who are armed with this knowledge play a bigger role in merger reviews, integration strategy, and value creation over the long term.

Consideration of Governance, Disclosure and Compliance.

Goodwill reporting is based on governance and transparency. The process of impairment testing is a close examination under the eyes of regulators as well as auditors particularly in volatile industries. Finance experts should make sure to record the assumptions, approaches, and their supporting data in a way that is easily readable and defensible.

The training programs are focused on the compliance to IFRS 3, IAS 36 and ASC 350 disclosure requirements. The participants are taught how to write comprehensive impairments memoranda, justify important judgments in financial reports and provide the findings to boards and audit committees.

Such stringency is relevant in a setting where investors require accountability because in this context, organizations remain credible and avoid controversies or restatements.

Lifelong Learning to achieve sustainable M&A Success.

Considering the changing international accounting standards and goodwill and impairments valuation, ongoing development in the goodwill and impairment analysis is of essence. Frequent training makes finance professionals abreast with the current renewal of the rules, techniques of valuation, and audit expectations.

Companies that focus on the internal excellence in this dimension have a strategic advantage. They are able to perform impairment testing in an enhanced manner, revert swiftly to shifting market circumstances and are more controlled in terms of their financial reporting procedures.

Conclusion to Goodwill Calculation and Impairment Training in M&A Deals

Goodwill is not just a balance sheet amount but it reflects on the future potential and strategic value an acquirer is likely to achieve through a transaction. But it requires its applicability to be based on disciplined calculation and strict impairment testing. By means of goodwill calculation and impairment training of M&A teams, the finance professionals enhance their technical, analytical and strategic skills to effectively manage goodwill during the deal lifecycle. Learning to impair the goodwill of the finance experts during a merger would help organizations to maintain transparency, secure the confidence of its shareholders and make a wiser management post-acquisition.

There is more to goodwill than compliance in such a complex world as M&A, which is unlocking the value behind every deal.