Professional Business Valuation Learning

Professional Business Valuation Learning

Introduction to Professional Business Valuation Learning

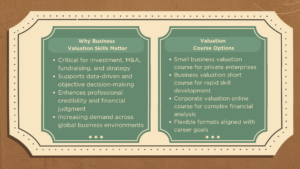

In an increasingly competitive and data-driven business environment, entrepreneurs, financial practitioners, and corporate decision-makers must be able to determine company value accurately and objectively. Valuation expertise is no longer a luxury; it has become a critical capability for investment analysis, mergers and acquisitions, fundraising activities, and strategic planning. As a result, demand for structured learning programs such as a small business valuation course, a business valuation short course, and a corporate valuation online course has grown significantly across global markets.

These courses provide accessible, cost-effective, and practical learning pathways for professionals seeking to build or strengthen valuation skills without committing to lengthy academic programs. During the early stages, participants are introduced to valuation fundamentals and gradually develop the analytical rigor required for real-world application. This article examines the importance of valuation education, compares different course formats, and discusses how to select the most suitable program based on career objectives.

The Increasing Importance of Business Valuation Skills

Business valuation plays a central role in modern financial decision-making. From assessing acquisition targets to determining shareholder value, valuation provides a quantitative foundation for strategic actions. Professionals who undertake a small business valuation course are equipped to analyze privately held companies, where limited data availability and higher uncertainty require specialized valuation approaches.

At the corporate level, valuation capabilities are equally critical. A corporate valuation online course is widely used by financial managers, consultants, and executives to evaluate capital investments, restructuring initiatives, and long-term growth strategies. These competencies support sound decision-making and reduce the risks associated with flawed assumptions or incomplete financial analysis.

As regulatory scrutiny and investor expectations continue to intensify, valuation expertise has also emerged as a benchmark of professionalism and credibility within finance-related roles.

Understanding a Small Business Valuation Course

A small business valuation course is specifically designed to address the complexities of valuing privately owned enterprises. Unlike publicly listed companies, small businesses often lack transparent financial disclosures, standardized reporting practices, and market liquidity. Consequently, valuation professionals must rely on adjusted financial statements, qualitative judgment, and forward-looking projections.

Participants in a small business valuation course typically learn how to apply income-based, market-based, and asset-based valuation methods in the context of small and medium-sized enterprises. Key focus areas include owner dependency, customer concentration, cash flow normalization, and risk assessment. These programs are particularly relevant for entrepreneurs, accountants, financial advisors, and consultants working closely with private businesses.

In addition to technical methodologies, most courses incorporate practical use cases such as business sales, succession planning, and partnership disputes, ensuring strong real-world relevance.

The Practical Value of a Business Valuation Short Course

A business valuation short course offers a focused and efficient learning solution for professionals seeking targeted valuation knowledge within a limited timeframe. These programs are structured to deliver essential valuation concepts without extensive theoretical depth, making them suitable for busy professionals and individuals new to valuation.

Core topics commonly covered in a business valuation short course include discounted cash flow analysis, comparable company analysis, and basic financial modeling. The concise format allows learners to quickly understand valuation logic and apply it to straightforward business scenarios. This makes short courses especially valuable for managers, startup founders, and professionals transitioning into finance-related roles.

Despite their shorter duration, many programs incorporate real-world case studies and applied examples. When well designed, a business valuation short course can serve as an effective foundation for more advanced valuation training or professional certification.

Key Benefits of a Corporate Valuation Online Course

A corporate valuation online course is typically tailored for professionals working in corporate finance, investment banking, private equity, or strategic management. These programs focus on valuing larger and more complex organizations with diversified operations, capital market exposure, and regulatory considerations.

Flexibility is one of the primary advantages of a corporate valuation online course. Online delivery enables participants to balance professional responsibilities while accessing high-quality learning materials, expert instruction, and interactive financial models. This flexibility has contributed to the growing adoption of online valuation education among mid-level and senior professionals.

Course content often includes advanced financial modeling, scenario analysis, merger and acquisition valuation, and sensitivity analysis. A well-structured corporate valuation online course also emphasizes strategic interpretation, enabling participants to convert valuation outputs into actionable business insights.

Comparing Valuation Course Formats and Learning Outcomes

Choosing between a small business valuation course, a business valuation short course, and a corporate valuation online course depends on professional experience, learning objectives, and time availability. Each format offers distinct advantages and outcomes.

A small business valuation course is most suitable for those working directly with privately held companies or entrepreneurial ventures. A business valuation short course provides rapid skill acquisition for professionals seeking immediate practical knowledge. Meanwhile, a corporate valuation online course delivers comprehensive training for individuals involved in large-scale financial analysis and strategic corporate decision-making.

Despite these differences, all valuation courses share a common objective: developing analytical discipline, financial literacy, and confidence in valuation-based decision-making.

Skills Developed Through Valuation Education

Valuation education extends beyond numerical analysis. Participants develop transferable skills such as financial statement interpretation, critical thinking, risk evaluation, and strategic judgment.

Through a small business valuation course, learners enhance their ability to assess qualitative factors such as management quality and market positioning. A business valuation short course strengthens foundational analytical skills and financial communication. Meanwhile, a corporate valuation online course improves strategic insight, enabling professionals to evaluate complex business structures and long-term value drivers.

Collectively, these skills contribute to stronger financial judgment and improved organizational performance.

Valuation Courses and Career Development

Career advancement is a key motivation for enrolling in valuation programs. A small business valuation course can open opportunities in advisory services, consulting, and entrepreneurship. Similarly, a business valuation short course can support career transitions or complement existing managerial roles.

For professionals pursuing senior finance positions, a corporate valuation online course provides advanced expertise aligned with executive-level responsibilities. Employers increasingly value candidates who demonstrate structured valuation knowledge and practical application skills.

In competitive job markets, formal valuation education also serves as a differentiating credential, signaling commitment to continuous learning and professional excellence.

Selecting the Right Valuation Program

When choosing a valuation course, prospective learners should evaluate curriculum depth, instructional quality, practical relevance, and certification outcomes. A reputable small business valuation course should include applied case studies and realistic examples. A high-quality business valuation short course should emphasize clarity, relevance, and immediate applicability.

For a corporate valuation online course, key considerations include financial modeling depth, instructor expertise, and alignment with industry standards. Selecting a course that matches career goals ensures maximum return on learning investment.

Conclusion

In conclusion, valuation expertise has become an essential capability in today’s business environment. Programs such as a small business valuation course, a business valuation short course, and a corporate valuation online course offer structured and accessible pathways to develop this critical skill set. Each format addresses different professional needs while contributing to improved financial insight and decision-making capability.

As organizations and investors increasingly rely on data-driven strategies, professionals with strong valuation knowledge gain a clear competitive advantage. By selecting the right valuation course and applying its principles effectively, learners can accelerate career growth, enhance business performance, and contribute meaningfully to long-term organizational success.