Professional Course on Corporate Valuation Techniques DCF Multiples and More

Professional Course on Corporate Valuation Techniques: DCF, Multiples, and More

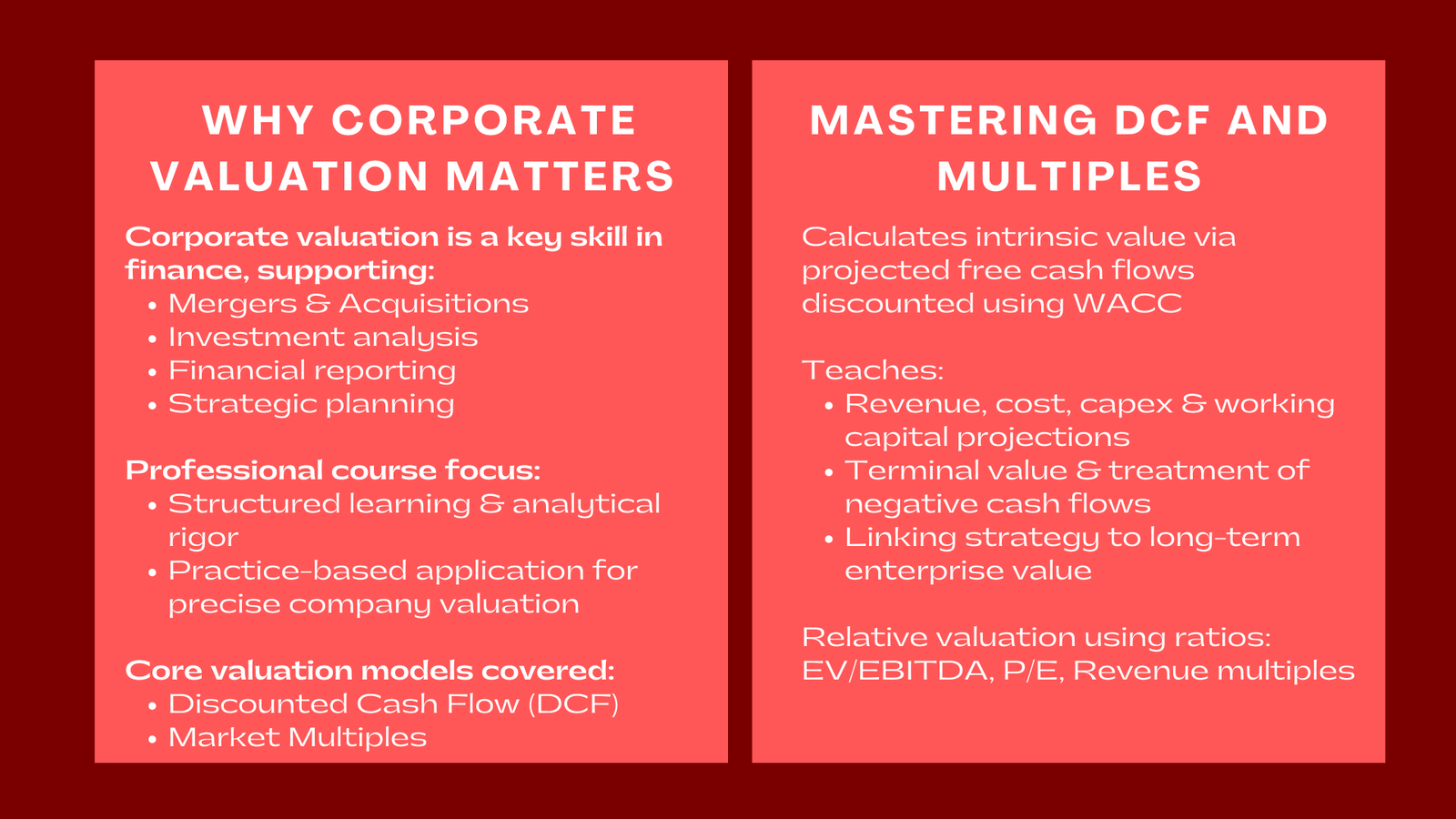

Corporate valuation is among the most important skills in finance. It supports everything from mergers and acquisitions, investment analysis, financial reporting and strategic planning. For professionals seeking to master corporate finance, participating in valuation models like Discounted Cash Flow (DCF), Market Multiples and Asset Based Valuation is an absolute necessity. The corporate valuation techniques professional course teaches structured learning, analytical rigor and practice based application to value companies with precision and consistency. The course combines theoretical frameworks with hands-on modeling exercises, real-world case studies, and data interpretation methods that reflect actual corporate situations. Participants learn not only to construct valuation models but also to critically assess assumptions, adjust for market volatility, and validate their findings through sensitivity and scenario analyses. This business valuation course Singapore for professionals is designed to equip participants with the skills needed to assess company worth accurately and confidently in real-world scenarios.

Mastering Discounted Cash Flow (DCF) Valuation

DCF continues to be the gold standard of valuation. It calculates the value of a company by estimating the future free cash flows and discounting the free cash flow to the present value using the appropriate weighted average cost of capital (WACC).

In professional valuation courses, participants are taught how to create detailed and complex DCF models for themselves—which means beginning from revenue projections, cost monitoring, capital expenditure projections, and working capital assumptions. They examine the impact of changes in discount rate, growth assumptions, and risk premiums on intrinsic value. This training, part of understanding income asset market valuation in corporate finance Singapore, also covers challenges such as the valuation of companies in cyclical industries, the treatment of negative cash flows, and how to perform the calculation of terminal value. By the end, learners understand the contribution of DCF in linking company strategy with long-term enterprise value.

Applying Multiples and Market-Based Valuation

While DCF is an intrinsic valuation approach, multiples-based valuation is a relative valuation approach. In this module, students learn to study valuation ratios such as EBITDA, Revenue, EV, P/E, and how to choose the suitable peer group.

The course puts the focus on the fact that multiples are not numbers—they are an indicator of investor sentiment, growth potential, and market expectations. Conclusions: Participants use similar company data and precedent deal transaction information to arrive at fair value estimates and reconcile the results with DCF outputs. This integrated approach, aligned with due diligence valuation services Singapore, has assisted practitioners in comprehending valuation from both the theoretical and market viewpoint.

Beyond the Basics: Advanced Valuation Considerations

A full course on valuation also examines asset-based valuation, option pricing for high-growth startups, and sum-of-the-parts analysis for diversified conglomerates, providing participants with a broad toolkit for tackling complex valuation scenarios.

Participants interpret complicated situations such as valuing distressed assets, private firms, and businesses intensive in intangible assets, while learning to adjust for liquidity, market conditions, and industry-specific risks. They also explore how ESG performance, corporate governance quality, and market volatility influence both perceived and intrinsic value in modern financial markets.

The course integrates practical case studies and real-world financial modeling, allowing participants to simulate valuation exercises for mergers and acquisitions, IPO readiness, and strategic investment decisions. Learners develop the ability to incorporate macroeconomic trends, currency fluctuations, and sector-specific challenges into their valuation models, ensuring that their analyses reflect dynamic market realities.

Conclusion to Professional Course on Corporate Valuation Techniques DCF Multiples and More

A professional course on corporate valuation techniques converts theoretical knowledge of finance into practical, actionable insights. It provides professionals with the skills to evaluate company worth accurately, communicate findings clearly, and support strategic decision-making with confidence.

By learning to use DCF, multiples, and other advanced valuation techniques, participants become not only better analysts but also strategic thinkers who can take responsibility for financial value creation. They gain the ability to assess investment opportunities, forecast financial performance, and measure risk effectively.

The course also emphasizes real-world application, using case studies, financial modeling exercises, and scenario analysis to ensure that participants can translate classroom knowledge into practical business solutions. In the current digital age of business, organizations have demonstrated that the ability to value companies accurately is not just a competitive advantage but a fundamental requirement for sustainable growth and long-term success.