Purchase Price Allocation PPA Training for M&A Transactions

Purchase Price Allocation (PPA) Training for M&A Transactions

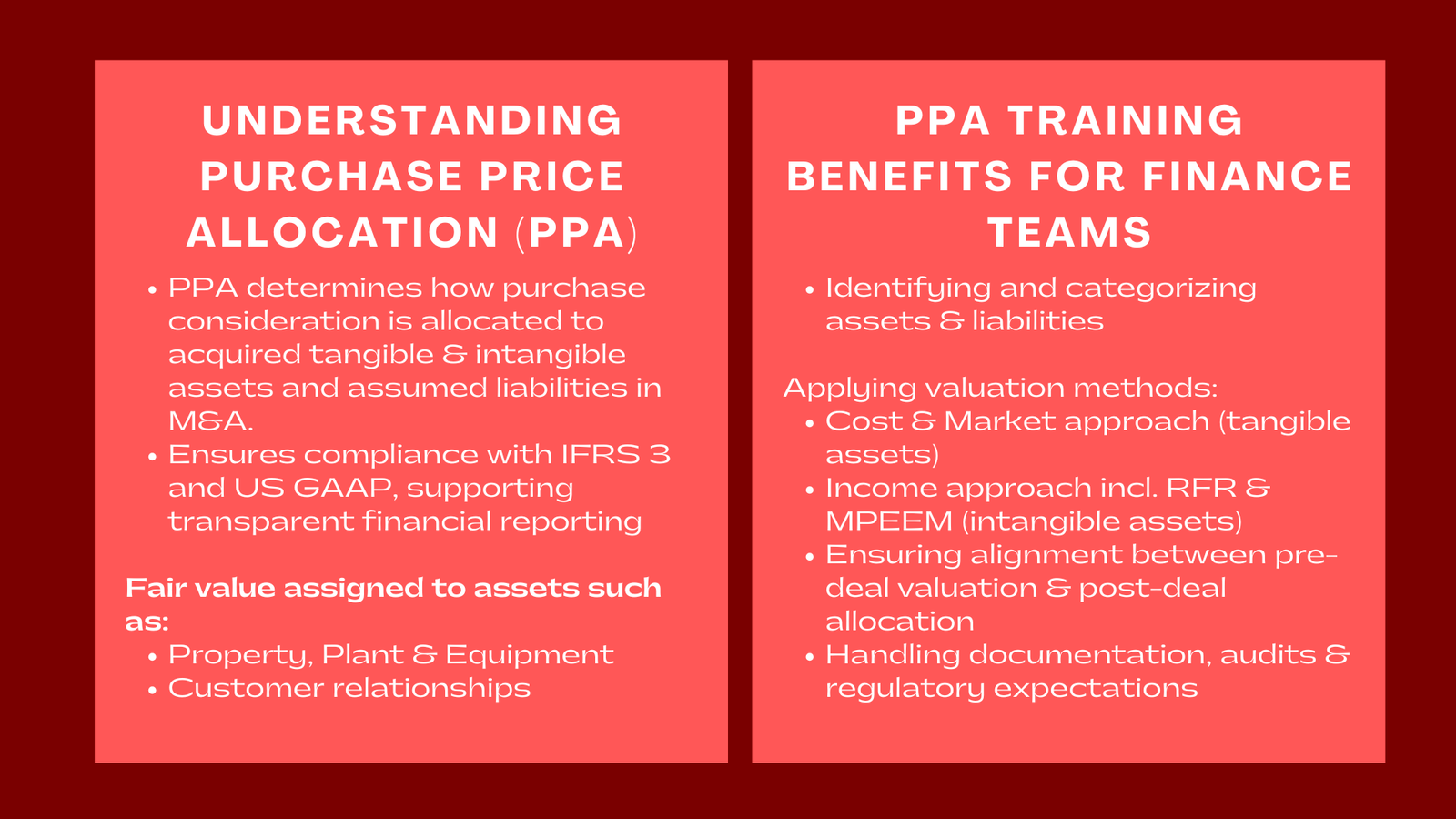

Purchase price allocation (PPA) is one of the most important processes undertaken after a merge or acquisition (M&A). Once an acquisition is done, companies have to decide what should be done with the total purchase consideration based on the acquired assets and liabilities. This process makes sure the accounting standards and principles like the IFRS 3 and the US GAAP are adhered to giving the stakeholders a clear picture of the way value was generated and identified in the transaction. In the context of finance specialists, it is important to understand PPA by means of well-organized purchase price allocation Singapore training of M&A teams to guarantee the accuracy, compliance and strategic insights.

Learning the Concept of Purchase Price Allocation.

In its essence, purchase price allocation is concerned with determining and estimating the fair value of the assets and liabilities obtained in the course of a business combination. In case of a company purchasing another entity, the total amount consideration made should be divided among tangible and intangible assets and any assumed liabilities.

Physical property, plant and equipment can be in the form of tangible assets whereas identifiable intangible assets can be in the form of customer relationship, trademarks, patents, or proprietary technology. The value of anything that has been allocated to the aforementioned is treated as goodwill- the synergies, reputation and future growth potentials that cannot be quantified individually.

PPA is not a formality in accounting as it affects the future financial reporting, amortization schedule and taxation. That is why, the trainings include the technical and the strategic aspects of allocation, and the professionals learn not only how to conduct the valuation, but also why it is important in the framework of the M&A processes.

Why PPA Matters in M&A

Effective purchase price allocation promotes the transparency, regulatory compliance and valuable information to investors. Correct allocation also affects such financial ratios like earnings before interest and taxes (EBIT), the return on assets (ROA), and the equity valuation.

When the allocation is not managed right, the financial statements can give the wrong economic value of the acquired organization. To illustrate, overpricing of goodwill may conceal future defeats, whereas underpricing identifiable intangibles may misrepresent the profits.

The training programs contribute to making finance professionals cognizant of the ripple effects of PPA decisions. They understand the impact of the valuation assumptions on the reported earnings, how to easily assess fair value and communicate the results to the auditors and regulators.

The Key Components of Purchase Price Allocation

A comprehensive PPA training for M&A professionals covers every aspect of the process — from identifying assets to calculating goodwill and recognizing deferred tax effects.

The initial one is to ascertain the amount of the purchase consideration (sum of all payments) that needs to be made, contingent liabilities and assumed debts. Then, money experts will have to determine all assets and liabilities obtained, and separate between tangibles and intangibles. Intangible resources like brand names, non-competition agreements, and customer contracts are usually intricate to quantify but are very significant to the determination of enterprise value.

When these factors are established, valuation methodologies are used. In the case of tangible assets, the cost method or the market method can be adopted whereas in the case of intangible assets, the income method ( e.g. Multi-Period Excess Earnings Method or Relief-from-Royalty Method ) is prevalent. The difference between the purchase price and the fair value of net identifiable assets should be included in goodwill.

Professional PPA training is focused on this structured and step-by-step methodology, which allows the finance teams to create correct and audit-ready valuation.

Combining PPA and Valuation and Financial Reporting.

Purchase price allocation is not a standalone practice. It is directly related to pre-deal accounting and after-deal accounting. In valuation, analysts attempt to estimate the total value of the target company in order to come up with the price of acquisition. PPA after the deal is made sure that this price is reasonably allocated to identifiable assets and goodwill.

One of the central lessons which are highlighted during training is consistency on pre-acquisition valuation assumptions and post-acquisition allocation. As an example, when the original valuation of the company used high values of intangible assets, the same should be captured in the PPA outcome. In other cases, auditors can be concerned with the integrity of the analysis.

Professionals also get to know the effect of PPA on the later accounting treatments. Intangible assets that are identified in the allocation are amortized through their useful lives whereas goodwill undergoes testing to impairments on annual basis. Such aspects will impact on the future earnings and may have a significant effect on the way investors view the company in terms of its financial performance.

Difficulties in PPA Conducting.

The theoretical framework of PPA is a very simple one, but the practical implementation may be complicated. Estimation of fair value of intangible assets that in most cases do not have active markets is one of the greatest challenges. The calculation of the right discount rates, cash flows forecasts, and royalty rates needs both technical skills and professional judgment.

The other issue that is shared is the fit of the internal stakeholders: finance, legal, and operations teams, in the data collection process. PPA is a multi-functional operation, and there must be in place, effective collaboration. Further, the regulatory review is an additional complexity that presupposes in-depth documentation and adherence to the international standards of accounting among the auditors and the government.

Through purchase price allocation training for M&A teams, participants gain hands-on experience tackling these challenges. They train on constructing valuation model, generating audit ready report and reconciling accounting adjustments of IFRS 3 and ASC 805.

The Strategic advantages of good PPA.

Besides compliance, a healthy PPA process provides strategic knowledge that beneficially impacts post-merger decision making. Knowing the value drivers of each asset, the management may focus on integration work, resource allocation, and measure performance more efficiently.

As an illustration, in the case where the customer relations constitute significant percentage of the acquired intangible assets, post-acquisition plans can be centered on retention programs and customer services. In the same way, when the value of technology assets is high, an investment in innovation and R&D can be used to maintain the lead.

PPA-trained finance professionals can also make useful contributions to future acquisitions so as to establish uniformity in valuation practices and make the organization build a disciplined, data-driven M&A practice.

Documentation, Audit, and Compliance Issues.

A major component of any PPA exercise is proper documentation. Clear evidence to support all the assumptions and valuation decisions is expected by regulators and auditors. The best practice of recordkeepings is greatly emphasized in the training programs, whether it is the maintaining of working papers and sources of data, or it is the preparation of valuation memos and audit responses.

The participants also discover how to deal with auditors, defend important assumptions, as well as respond to inquiries regarding the fair value measurements or amortization policies. The skill set is needed in companies that work in very regulated markets or have to comply with cross-border regulations.

On-the-job Training and Development.

Consistent study within PPA is inseparable in the changing nature of accounting rules and principles of valuation. Frequent training will make the finance professionals remain current with IFRS changes, valuation best practices and regulatory expectations.

Specializations Advanced programs can also include impairment testing, tax implication of PPA and fair value measurement of complex instruments. Organizations can also guarantee adherence through investment in professional development, as well as developing internal expertise that helps generate value in the long term.

Conclusion to Purchase Price Allocation PPA Training for M&A Transactions

Purchase price allocation is not just an accounting requirement but a crucial process that constitutes the gap between valuation and compliance as well as strategic management. By training M&A teams on purchase price allocation finance professionals learn to do valuations correctly, to comply with the IFRS and GAAP system and to draw strategic conclusions on the post-acquisition data. Through PPA training of M&A professionals, organizations enhance the capability to handle acquisitions in a transparent manner, in order to hasten the integration results and be credible by both regulators and investors.

Accuracy in the allocation of purchase price in modern competitive M&A environment is not merely an issue of accounting accuracy, but rather, it is about making smarter business decisions and generating sustainable value.