Share Price Analysis Training Factors Influencing Market Value

Share Price Analysis Training: Factors Influencing Market Value

In the ever-changing world of capital markets, the ability to understand what affects a company’s stock price is a necessary ability for financiers, investors and business leaders. Share prices are influenced by market perception, investor sentiment and fundamental performance, but most experts fail to recognize the analysis tools necessary to successfully interpret these cues.

Stock trading for beginners covers essential topics such as understanding basic analysis, technical analysis as well as managing risk and diversification to grasp fundamental principles of the market and give traders an advantage over time in equities trading.

This training is not limited to theoretical finance – it diverges towards the practical aspects such as earnings, macroeconomic trends, and human behavioral patterns which can drive the valuation of shares of a company in the practical market, similar to business valuation and financial modelling training Singapore that equips professionals with hands-on skills in analyzing and interpreting financial data.

Understanding the Fundamentals Behind Share Prices

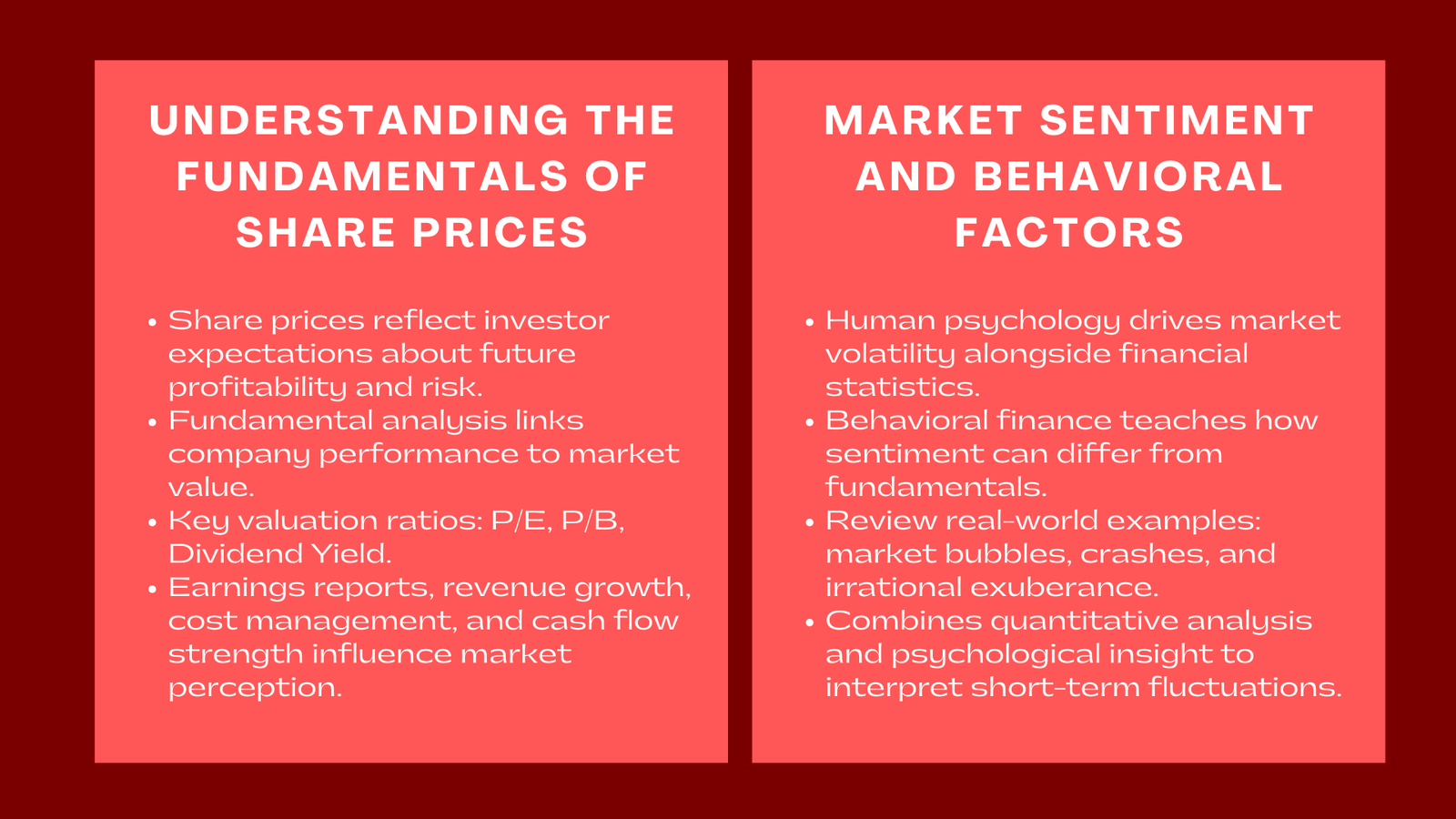

A company’s share price is a reflection of what the forcibly collective investors expect from the company in terms of its future profitability and risk profile. In share price analysis training, the trainees get to understand first and foremost how fundamental analysis is linked to market value.

Trainers teach important valuation ratios such as the Price-to-Earnings (P/E) ratio, Price-to-Book (P/B), and Dividend Yield which helps learners understand whether a stock is trading at a premium or at a discount compared to the stock market peers. Participants also explore the significance of earnings reports, revenue growth, cost management, and cash flow strength in as much as it affords the market perception, similar to insights gained from business valuation services Singapore.

Additionally, macroeconomic factors. Understanding these relationships enables professionals to interpret the effects that developing economic trends have on the performance of stocks.

The Role of Market Sentiment and Behavioral Factors

While financial statistics are important, markets are also affected by human psychology. Share price analysis training: Look at the behavioral finance — how the environment of underlying markets and investor behavior can lead to volatility in the price.

By reviewing real-world examples of market bubbles, crashes and irrational exuberance, the participants gain an understanding about how the facts of sentiment can differ from underlying fundamentals. It is a combination of quantitative analysis with psychological insight which helps the reader to interpret fluctuations in the short-term with a long-term value framework.

This view is precious in the face of uncertainty for the strategies of analysts, traders, and corporate leaders who are required to make decisions based on these factors.

Applying Share Price Analysis in Corporate and Investment Contexts

Training programs also emphasize on practical application. Participants learn to use analysis tools and software to track stock movements, do regression analysis and monitor trading patterns.

In corporate, the ability to understand what drives share prices is useful for helping executives communicate effectively with investors and to manage investor expectations in the market. For investment professionals, it helps in identifying some undervalued opportunities or in determining when to enter or exit the market, similar to business valuation training Singapore for professionals which equips participants with practical skills to analyze and interpret company value.

Conclusion to Share Price Analysis Training Factors Influencing Market Value

Share price analysis training is the management of the gap between the market data and strategic decision making. It allows professionally to not read price movements as random noise but as mirroring performance, perception and potential.

By learning both the basics and the behavior of market value, the learners are more confident, analytical, and insightful participants of capital markets. In an age where perception is reality, having an understanding of share price dynamics is a significant skill to possess in order to be successful in any financial context.

By gaining this knowledge, learners become more confident and analytical in their approach to capital markets. They develop the ability to distinguish short-term noise from long-term signals, assess risk, and make strategic investment or corporate decisions based on sound reasoning rather than speculation.