Training Module Private vs Public Company Valuation for Investors

Training Module: Private vs Public Company Valuation for Investors

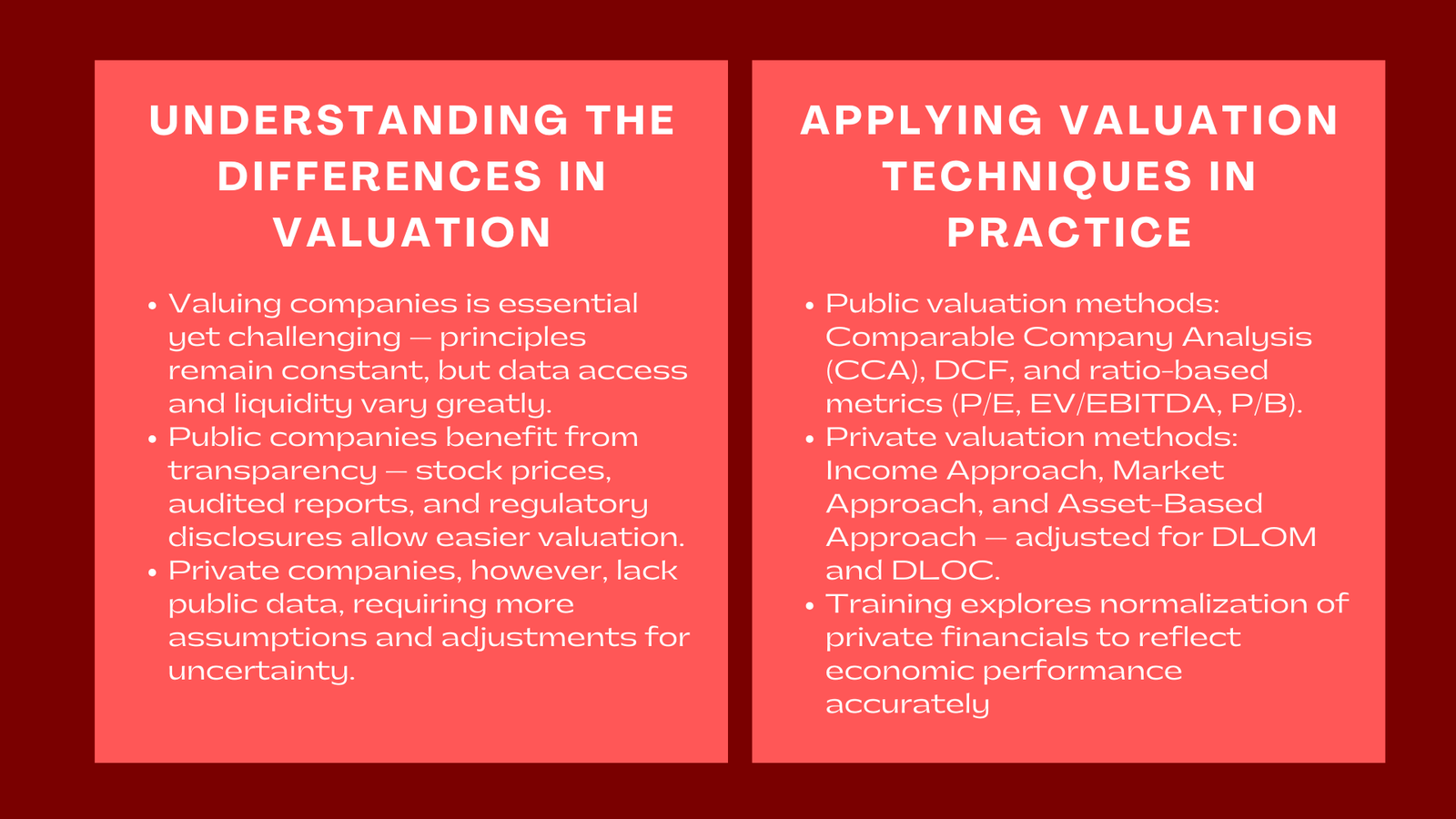

One of the most difficult and necessary duties in finance is to value companies. However, even though the principles of valuation are the same in theory, the implementation of the same in practice varies greatly when it comes to private companies versus the practical cases of a publicly traded company. The prices of the stock of a public firm can be viewed on the stock exchange, the financial reports are audited, and there are disclosures of the regulations. These data points often are not available in private companies, though, and hence evaluation is more arbitrary.

One of the ways these issues can be resolved is through the help of a Training Module on private vs public company valuation training Singapore that provides its participants with the instructions on how valuation frameworks can be used effectively in various types of companies. It is concerned with the knowledge of major distinctions between data availability, liquidity, control premiums, and discount rates all these are known to determine the value of a company.

This is the kind of training which suits best investment professionals, those working in a private equity analysis role, venture capitalists and corporate finance advisors who conduct frequent analyses of both listed and unlisted organizations.

Valuation of Public Companies: Transparency and Market-Driven Metrics

The advantage of transparent market pricing can be enjoyed by the public companies. Their price in the market, financial reports and disclosure of investors are easily accessible enabling the analyst to apply the market approaches of valuation of their business ventures including Comparable Company Analysis (CCA) and Discounted Cash Flow (DCF) models without doubt. This level of transparency is also a key factor emphasized in company valuation Singapore for investors and corporates, where accurate data and disclosure enhance the reliability of valuation outcomes.

In this section of the training, the participants will be trained on how the public market data will give them a point of reference on valuation multiples, such as the P/E, price-to-Equity (EV/EBITDA) and the P/Book (P/B) ratios. They also explore the manner in which the stock market efficiency has integrated into current prices expectations of future growth, risk and profitability.

Nevertheless, even the training emphasizes the peculiarities of the valuation on the side of the people. Intrinsic value may be distorted by market sentiment, short-term trading and speculation. The participants are taught to calculate the departure of fundamental value and market noise, to calculate the fair value in stock market, independent of the stock price changes using the approximations from DCF models.

Listed company cases are useful in guiding the learner to study up and down valuations, learn how to interpret financial statements, and when market prices have fallen beneath the underlying value, a crucial skill in being an equity-based investor or a corporate strategist.

Valuation of Private Companies: Adjusting for Data Gaps and Risk

Valuation of a single company presents special issues because there is no readable financial data on the company, and the single company is not listed publicly. It is in this part of the module that the participants will learn some of the practical methods of estimating fair value despite such constraints.

The valuation methods presented by the Trainers are usually applicable to a private entity; such as Income Approach (DCF), Market Approach (Comparable Transactions) and Asset-Based Approach. The participants are taught on the basis of how to choose the method which is appropriate according to the maturity of the company, the industry and the reliability of data.

Because the value of minority interests cannot be determined through a market where listed securities are traded, analysts have to use the level of discounts due to lack of marketability (DLOM) and lack of control (DLOC). The training gives a reason behind derivation of these discounts through empirical studies and surveys on investors.

The participants also investigate adjustments of normalizations of company financials to private firms such as owner pay being adjusted to market salaries, non recurred personal expense being corrected, etc to give a more accurate picture on the actual economic performance of the company.

Through systematic solution of these problems, the learners will be enabled to formulate defensible but transparent valuations which are in tandem with the investment expectations and the realities of the transactions.

Bridging the Gap: Using Public Comparables for Private Valuation

The last section of the module is devoted to the use of the publicly available data to appreciate privately owned firms, the trick necessary to the work of private equity and venture investors. The participants are taught to find similar looking companies (comps) in the market with number of companies in terms of industry and size, growth rate and then use relevant multiples like EV/EBITDA or Revenue multiples to estimate the price.

The training extends to the process of modifying such multiples downwards into consideration of the risk of and illiquidity discounts of a particular company. As an example, a small company in the process of its launch may be estimated at a discount 2030 percent compared to other comparable companies in the market since it is too small and not liquid.

The participants are involved in exercises that involve practical valuation and by comparing a privately owned company against its publicly listed counterparts and adjusting it against variations of the corporate finance course on valuing private and public companies Singapore in terms of profitability, growth, and standards of governance. This will make them confident enough to defend valuation conclusions to investors, boards and auditors. By the end of this module, learners gain the skills to perform robust private company valuations that are credible, defendable, and aligned with industry best practices.

Conclusion to Training Module Private vs Public Company Valuation for Investors

The importance of private and public companies is not achieved without thorough knowledge of the financial theory and the market reality. This form of training will enable the participants to handle such differences through critical rigor and professional judgment.

Investors also acquire the instruments to make correct decisions in the private and public markets by learning the adjustments to counter risks, liquidity, and control. It is this skill of distinguishing and implementing the correct valuation strategy that makes expert analysts unique when assessing a private acquisition, managing a portfolio of stocks and bonds in a stock market or advising their clients on fair value.

This training gives the professionals to go beyond formulaic valuation and get a picture of strategic insight, as to what a company is worth but why it is worth such and such, and how that understanding can be used to make smarter investment decisions. This holistic approach ensures that analysts and investors are not just technically competent but also strategically astute, capable of creating value through informed, evidence-based judgment.