Understanding Income Asset Market Valuation in Corporate Finance

Understanding Income Asset Market Valuation in Corporate Finance

Understanding Income Asset Market Valuation

The use of business valuation for professionals is a necessary business practice during decision-making by an owner, investor, buyer, lender, and the regulator. Be it mergers and acquisitions, strategic planning, litigation, taxation, or compliance, to obtain the real value of a company needs a formalized formula with a base on the financial principles and market realities. There are so many models of valuation, but three fundamental approaches hold the sphere of working professionals; these are the income approach, the asset-based approach and the market approach.

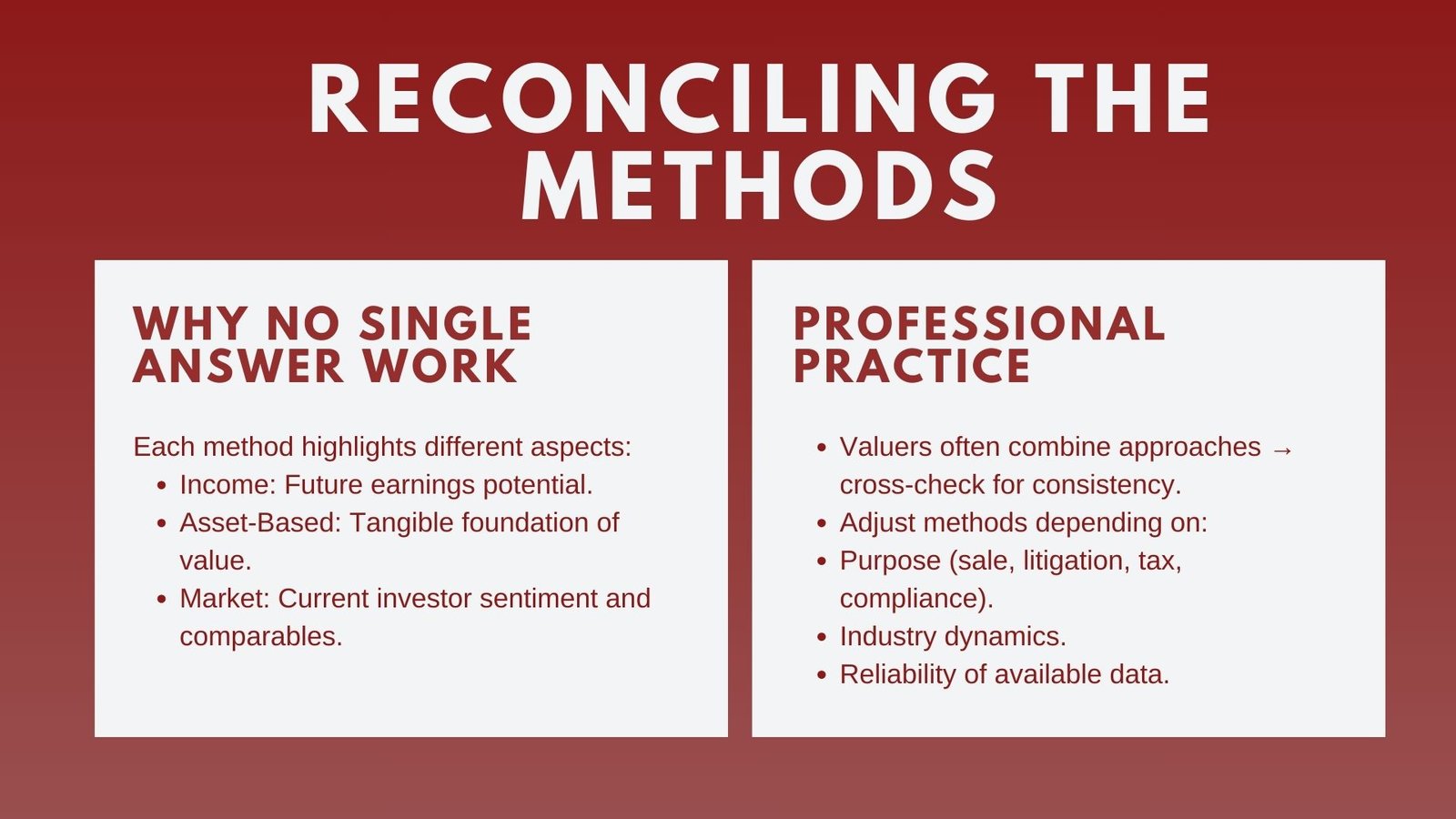

Each approach has its theoretical basis, practical applications and constraints and knowing the three is critical to any one who deals in business transactions or financial reporting. The approaches are not substitutable and the application is based on the intended use of valuation, business of the company, and the quality of information available. Very often, professional valuers incorporate two or more approaches to triangulate a sufficient and sound value estimate, to achieve the fact that the estimated figure represents the nature of the business itself as well as the economic conditions of the world.

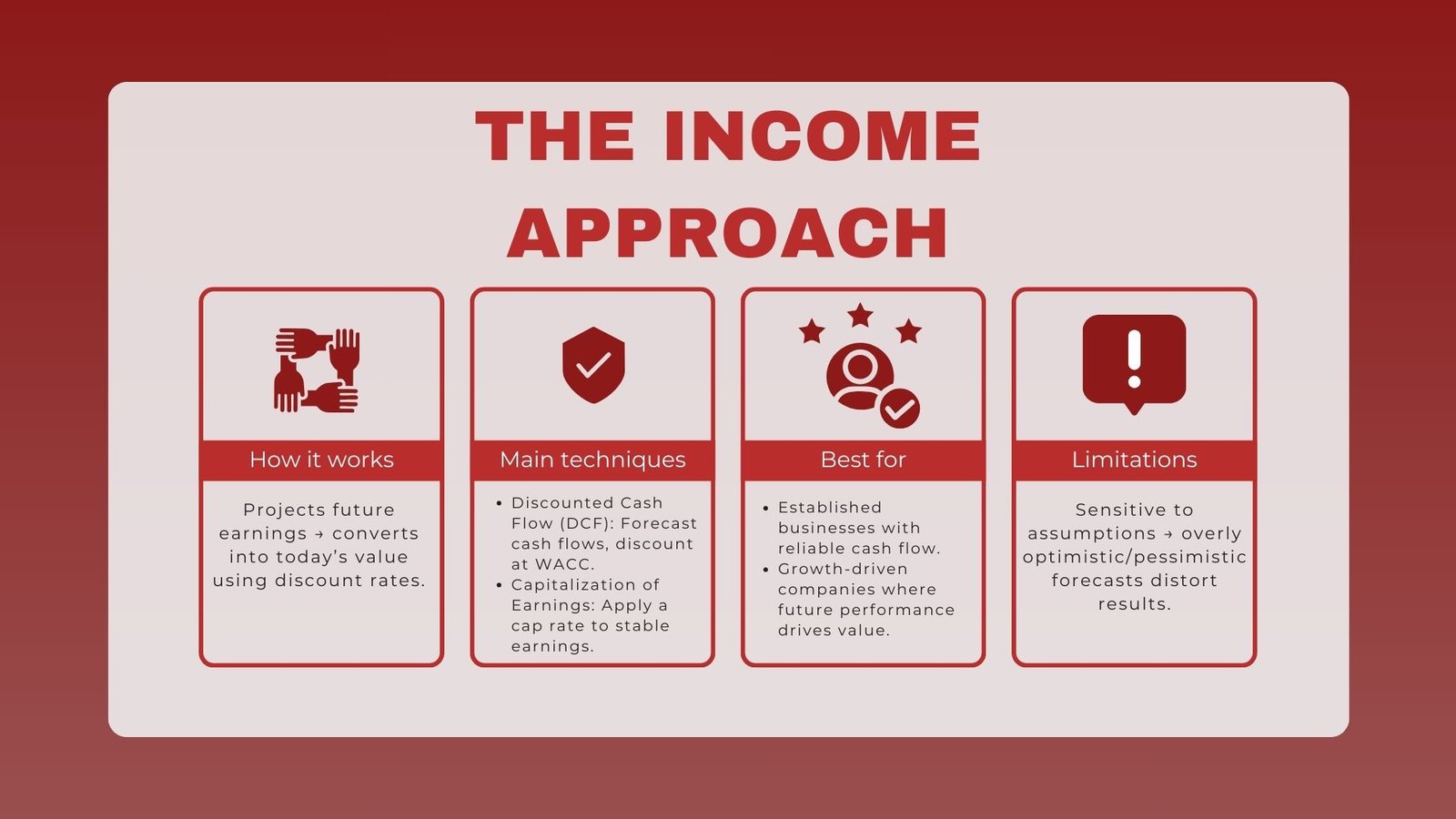

The Income Approach: Projecting Future Earnings into Present Value

The income approach is founded on a premise that the value of a business is such that the organization is an embodiment of economic benefits expected in the future and that such future benefits can be computed as a present value. The approach is based on the capability of a company to earn revenue over a period of time making this technique most applicable to companies whose businesses have a long history of operation, whose cash flow is reliable and there exists stability in the industry. Discounted cash flow (DCF) method and capitalization of earnings method are the most popular methods of the income approach.

The DCF technique estimates cash flows obtained in the future, considering a specific forecast horizon after which cash flows estimate is used to calculate present value that is discounted at a rate indicating the riskiness of the business and the cost of capital. The capitalization of earnings however finds more application in firms with stable and consistent earnings; a constant measure of expected earnings is converted into value by use of a capitalization rate. In each method, estimates of revenue growth, operating expenses, working capital requirements and capital expenditures are to be done carefully and the discount or capitalization rate has to be determined thoughtfully.

The income method is very flexible and can even be modeled such that any risk within the company, in the industry, and in the macrojournal are taken into consideration. Its precision is, however, very much dependent on how accurate the forecasts are and on whether the discount rate is suitable. The forecast of a valuation could be misleading especially when we are excessively optimistic or pessimistic. Furthermore, with young enterprises or those operating in the volatile industries, it is hard to predict the future income with a certain degree of confidence and this method is not so effective without solid scenario plans.

The Asset-Based Approach: Valuation Grounded in the Company’s Net Assets

Assets-based method of establishing the value of a business measures the net fair market value of its assets less its liabilities. This is because the method basically addresses, what would the business be sold / scrap value today upon the sale of all its assets and satisfaction of all its debts. It applies especially to asset-intensive enterprises including manufacturing companies, property holdings or ladder but also in liquidation procedures where the business is not likely to continue in the future as a going concern.

The asset-based approach also has two main variations; which include, the going concern and the liquidation method. Going concern method is a technique of setting values of the assets and liabilities on the balance sheet at a fair renormalization degree and to motivate the proceeding of the business. The liquidation approach calculates what the company would receive as net proceeds in case their assets were sold off at often discounted prices and the liabilities repaid in full.

Among the advantages of the asset-based approach is that it does not use guesses in the form of unreliable predictions but resorts to real and provable figures. It is less vulnerable to swings in market psychology or to expectations regarding future performance.

Nevertheless, this approach is heavily flawed since it can severely underestimate the value of companies whose values happen to be mostly based on intangible assets like brand reputation, intellectual property, or customer relations, none of which are necessarily reflected on the balance sheet. It also fails to put a direct consideration to the earning potential that a company has and may therefore be less applicable among profit-making firms whose basis of business may be either service oriented or technology-related.

The Market Approach: Comparing to Similar Businesses

The market approach uses the performance of a company and compares it to other companies that are of like kind whose value is calculated using the value of recent transactions or the trading price in the market. It applies the principle of substitution: an informed buyer will not overpay to exacerbate a business and it is a rule that the amount of money spent on a business with nearly the same advantages and risks should not exceed the money taken to buy another business of a similar nature.

The valuation experts frequent recourse to transaction multiples, on basis of similar sales or market multiples of publicly traded firms in the same sector. Price-to-earnings (P/E), enterprise value-to-EBITDA (EV/EBITDA), price-to-revenue (P/S) are common multiples. Valuers can use these multiples on financial metrics of the subject firm in order to provide an approximate market value.

The market-based valuation makes a very convincing argument since that indicates the market pricing and investor mood. It may be especially beneficial in such industries as M&A that have an active market environment, or multiple publicly traded companies of similar profile. Nevertheless, in some cases it is hard to find similar businesses, particularly those that are niche or unique. The difference in size, growth rates, profitability, geographic markets and the capital structure may all influence comparability of the chosen multiples. Market data may also be distorted by current economic trends or strategic premiums involving some transactions that may not apply in the case of a subject company.

Selecting and Reconciling the Appropriate Method

Practically, none of the valuation techniques will give an ideal result in every situation. It is not unusual to find the professional valuer using two, or in extreme cases all three basic techniques, then combining the outcomes and producing a final opinion of value. The preferable method also relies on the purpose of valuation of the business, the kind of business, business stage, and presence of solid information.

As an example, a young technology company with a high growth rate but little in the way of tangible assets may be hardest to value based on the asset-based and income approaches, whereas a manufacturer with enormous amounts of fixed assets may need an income approach with some use of an asset-based approach. Reconciliation encompasses a process where we put in proportion the outcomes of each of the methods on the perceived reliability and practical bearing on the engagement. This hybrid method also assists in making sure that the valuation captures the practical results of the operation of the business as well as the base asset in addition to being pegged to the reality in the market.

The Role of Professional Judgment and Context

The technical points of such techniques of valuation are well-documented; nevertheless, the application of such techniques needs much professional judgment. Some determinants that can play an important role in determining the future success of a firm and hence the valuation of the same are; economic factors, industry competitive forces, industry regulations as well as management capacity.

Also, valuation purpose may influence not only methodology, but also assumptions; valuation purpose may include sale, litigation, tax reporting, or internal planning. E.g. litigation assessments may be based upon more conservative assumptions whereas strategic plan requires the approach to include optimistic scenarios to assist in long-range investment planning. Experienced valuation specialists will also know that adjustments need to be made to take into account non-operating assets, contingent liability, or a one-time event that may distort the outcome. It is this technical expertise and understanding of the market and the context around it that results in a valuation that is reliable to stakeholders.

Conclusion: Building Confidence in Business Valuation

The three ways of assessing business, which are based on income, asset and market values, are problems that require the attention of someone involved in advanced corporate finance industry, investment or strategic decisions. All of these techniques provide a different window through which company value can be regarded and when applied the right way, each method acts as a complement to offer a more complete and balanced view. The cash-flow methods quantifies the future prospects of earning by the business, the balance-sheet method quantifies the material base of the business and the market approach places that business in the context of the market environment.

When carefully applied and the respective conclusions reconciled in an overlapping manner, the valuation professionals can provide credible, defensible and actionable information. A well supported valuation is no longer a technical exercise in a dynamic economic environment where market and investor expectations may change or market conditions could change swiftly. Be it due to a prospective sale, raising capital, settling disputes, or responding to regulatory necessities, mastering these three fundamental strategies will make sure the decisions that are made related to the business can be underpinned with a defined and clear concept of value.