Valuation for Deals Reporting Tax in Singapore Explained

Valuation for Deals Reporting Tax in Singapore Explained

Understanding Valuation for Deals Reporting Tax

Advanced Business valuation is significant in a lot of corporate, legal, and strategic decisions. Be it a sale, regulatory reporting or tax compliance, the true and fair valuation estimation is a critical factor, as it is always needed to support the position. The procedure includes evaluation of the financial value of a business through evaluation of its assets, earning potential, market circumstances, and future growth opportunities. Although people frequently talk about valuation when addressing issues related to the mergers and acquisitions, this practice is far beyond that scope. Appropriate valuation is also very important in the reports of financial performance, adherence to accounting standards, company share, as well as in tax planning.

It is important to note that the nature of how valuation is used in various activities, whether it is transactions, reporting, or taxation, needs a clear definition of the underlying principles and the very standards that apply in each instance. These applications might have fundamental valuation approaches in common but a lot of differentiation within the purposes, legislative needs, and breadth of the analysis. A well informed method makes a valuation not just fit the current need but stand scrutiny of investors, auditors, regulators or even taxmen.

This paper discusses the valuation of businesses using these three significant purposes that include transactions, financial reporting and taxation. It would also elaborate the processes of common approach query dead man and considerations in respective settings and what does it really mean to be accurate and compliant.

Valuation for Business Transactions

In a merger, acquisition, divestiture, or capital raising of a company, professional business valuation Singapore services form the basis of negotiation. In such situations, valuation determines the price a buyer is willing to offer and the price a seller is ready to accept. Transaction valuations, unlike reporting or tax valuations, are highly market- and competition-sensitive, while also being strategically influenced by the goals of the potential acquirer. To strengthen understanding of these complexities, executives often enhance their skills through a mergers and acquisitions course Singapore, which provides practical insights into valuation and deal-making.

In transaction-based valuation, the whole picture is not just mere financial performance, in as much as there are the synergies, strategic fit and competitive advantages factors at consideration. A buyer can, as one example, be tempted to surpass the price when the company that is targeted has a distinct technology, a high market share, or a complementary operation that would result in cost advantages. However, these premiums have to be supported by elaborate financial modelling and scenario analysis with the knowledge of similar transactions in the market.

The most popular approaches to transactional valuations entail the market approach to valuation where price of similar businesses is analyzed and the cash flows that the business is expected to generate in the future are projected again with the discounting of the denominator. Asset-based approach can be applied in the circumstances when the tangible assets are playing a major role or when a business is facing financial problems.

Whichever approach is used, the valuation must consider the most applicable market statistics, trends in the industry, and prospects that are feasible in financial terms. When the stakes of the transactions are high, it is common to find entities contracting independent valuation professionals to give their fair share of the entire bargain after both parties hire different valuation professionals.

Valuation for Financial Reporting

Accounting standards are applied in valuation that is reported in financial reporting around the world, including; International Financial Reporting Standards (IFRS) and Generally Accepted Accounting Principles (GAAP). In this regard, valuation does not entail agreeing the price to sell but rather that the assets, liabilities, and equity are carried at fair value as required by the applicable guidelines.

The valuation used in the financial reporting is often needed in the case of business association, where there is a need to have intangible assets like patents, trademarks or customer relations to be distinguished as individual and not as goodwill. An example is how when as per IFRS 3, a company acquires another, it is given flexibility on how it should improvise the purchase price on the acquired identifiable assets and liabilities to the fair values of the companies. This necessitates a comprehensive valuation practice which in most cases, entails the use of income based valuation techniques such as the multi- period excess earning method or relief- from royalty techniques in valuing intangible assets.

In contrast to transaction valuations, where strategic premiums are allowed, financial reporting valuations have to be neutral and always are guided by the principles of fair value. It implies that the price being paid is on the basis of assumptions made by market participants as opposed to the one that the acquirer expected, which is in the form of unique synergies. Moreover, the reporting valuations may be audited and therefore it is important to document and follow recognized practices. There is also continuous evaluation that should occur in the accounting reporting process like annual impairment testing e.g. IAS 36 or ASC 350, so as to ascertain that the carrying value of assets is recoverable in the future.

Valuation for Tax Purposes

Valuations performed to comply with local tax laws, strategise corporate restructurings or to settle disputes with tax authorities can be tax-related. Here, valuation might be needed in transfer pricing, estate and gift tax planning matters or basis calculation in records of assets following a sale or acquisition.

The tax valuation process should comply with the standards and definition of the authority governing the taxation process like the Internal Revenue Service (IRS) in the United States or similar authority in other jurisdictions. These valuations usually come into question during audits, thus it becomes possible that it should be well documented and based on objective evidence.

As an example, the valuation of shares in an Employee Stock Ownership Plan (ESOP) or that under an equity-based compensation scheme will be subject to tax inspection with the tax body likely to expect there to be a tenable fair market value that takes into consideration the market conditions, profitability and the appropriate discounts towards the lack of control or inability to market the shares.

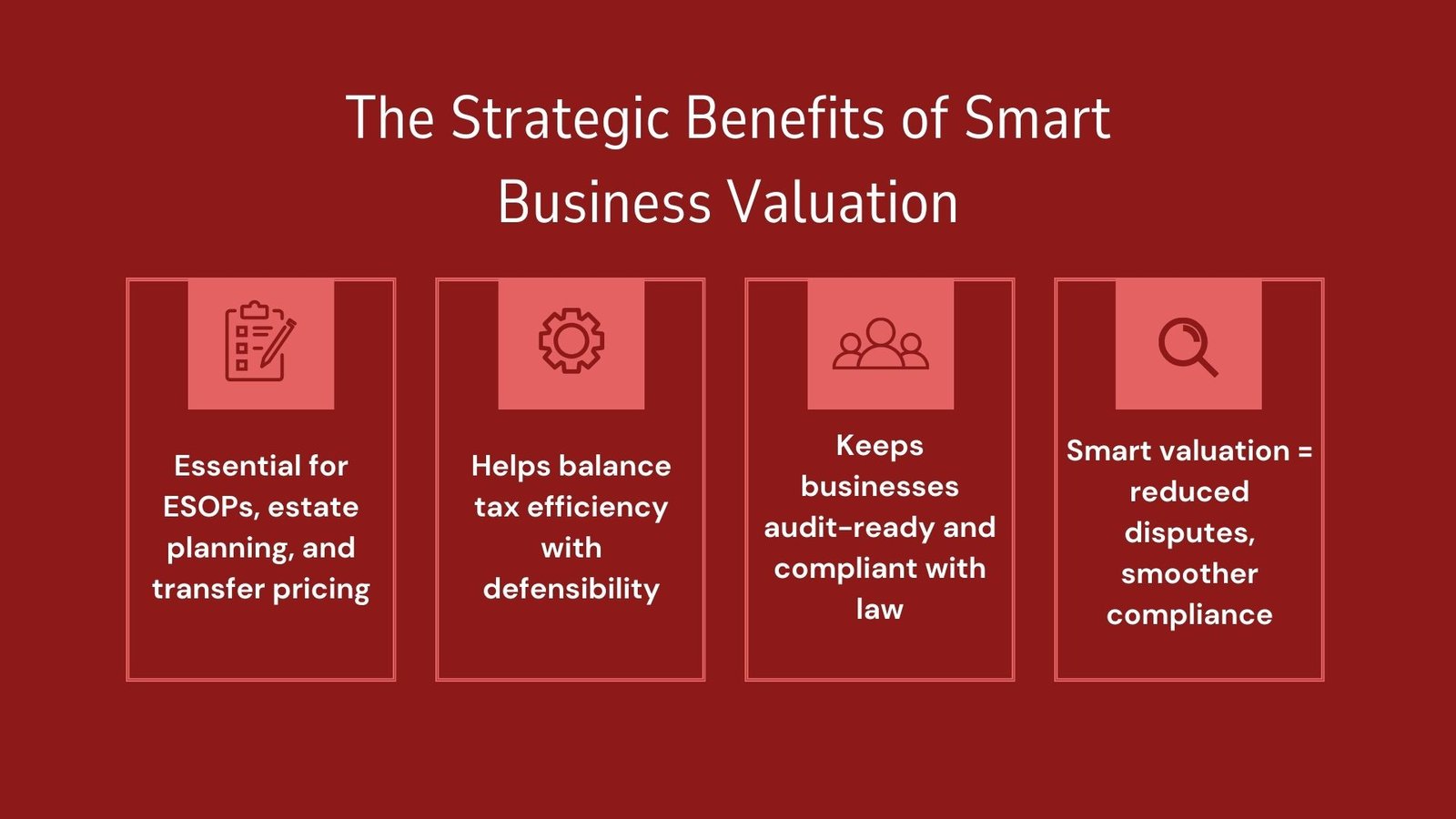

Tax valuations tend to affect the manner with which the purchase price is accounted across the different types of assets during corporate acquisitions. Such an allocation may carry serious repercussions as regards to depreciation schedules and subsequent tax payments. Valuations may also be commissioned to enable the companies to find out the fair value of intangible assets so that maximum tax deduction can be achieved by using an amortization method. Nonetheless, such aggressive tax valuations, that are outside of market normality, may raise the interest of the authorities; the optimal choice is to find the balance between tax efficiency and tax defensibility.

Methodological Consistency Across Purposes

Although valuation motives vary in transactions, reporting and taxation, similarities are usually seen with the basic processes. The three most predominant methods, the income approach, market approach and asset-based approach, are applied in all settings but with the differences based on the purpose.

The income approach assumes the future economic advantage of the company and discounts to the present value and thus can only be applied to the business with steady cash flows. The market method uses the company compared to the other enterprises that are similar in terms of value known to the public or determined by sales. Asset based approach concentrates on the Net asset value of the company and this might apply most to an asset intensive industry or sometimes during a liquidation process.

These variances are on the assumptions, adjustments and compliance required in each of the cases. In the example of a transaction environment, synergies may support higher valuation, but under a financial reporting system, such synergies would not be considered. In the same way, on a tax basis a certain valuation discount or regulation types would be imposed to have certain formulas which may not be applicable in any other scope.

The Importance of a Defensible Valuation

The end result is produced as a matter of fact and defensible result of any valuation regardless of the purpose. This implies that the valuation process should be open, relying on quality data, and efficient documentation. In high value or high risk instances, use of independent valuation professionals will assist in providing objectivity and compliance.

Valid defensible valuations would be not only great enough to pass the scrutiny of audit teams, regulators, and tax officers but it will also win the assurances of stakeholders. However, when valuation is however done in a poor manner, there may be disagreement, failed deals, restatement of finances, or tax impositions. With the awareness of the specific needs of valuation in transaction, reporting, and tax purposes, business can overcome complicated circumstances and make judicious strategic decisions.

The need to adjust pricing mechanisms to a particular situation is another essential skill in the environment where the markets change quickly, and the degree of regulatory supervision is tight. When coming up with a purchase price in a competitive acquisition, fulfilling disclosure requirements under accounting principles, or ensuring tax regulations are followed, there is no change of the principle that meticulous analysis, rigorous research methodology and clear reporting must be applied.