Valuing Intangible Assets Brands IPs and Customer Relationships Training

Valuing Intangible Assets: Brands, IPs, and Customer Relationships Training

Introduction to Valuing Intangible Assets Brands IPs and Customer Relationships Training

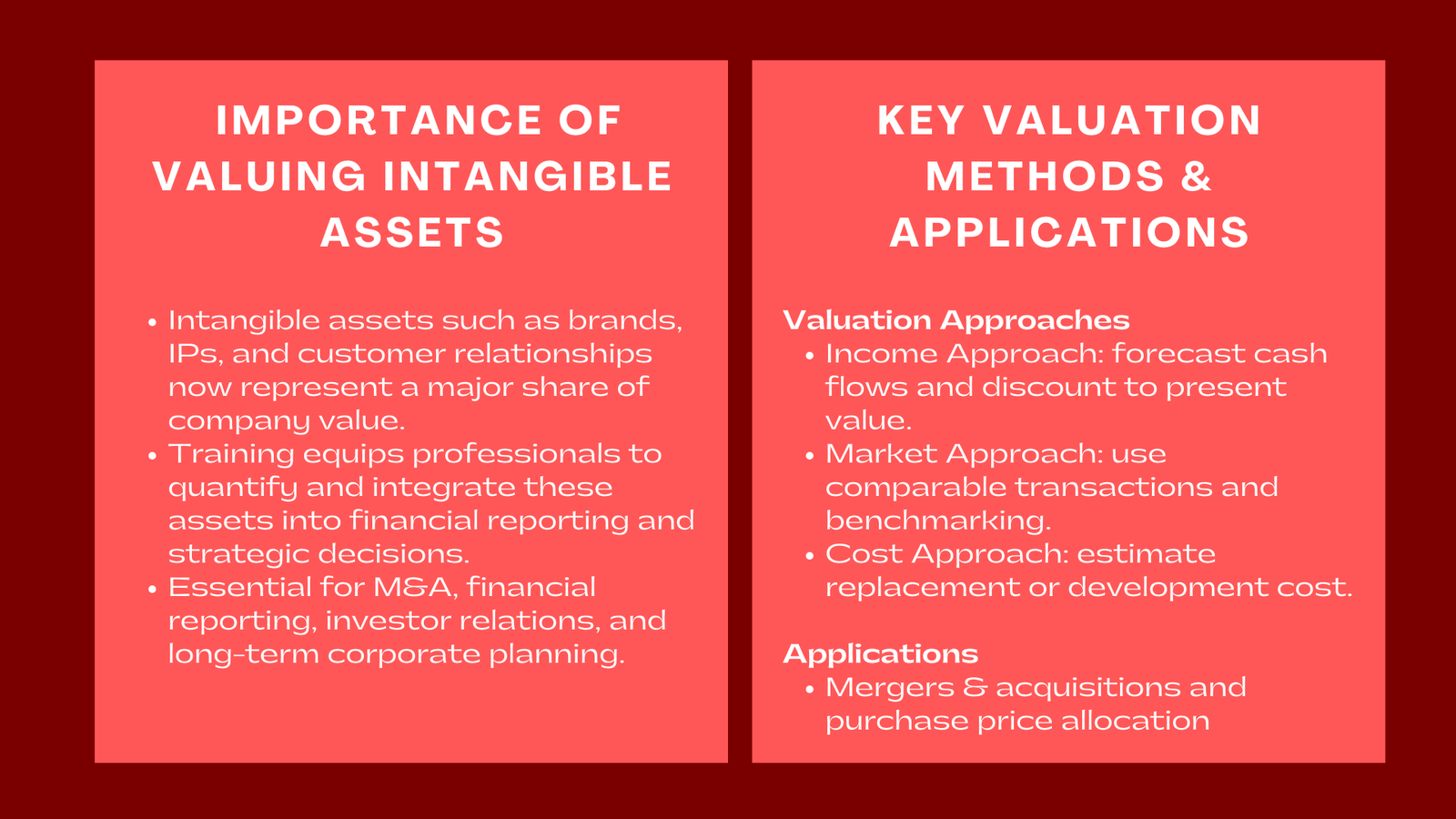

In the modern business environment, intangible assets such as brands, intellectual property (IP), and customer relationships often represent a significant portion of a company’s value. Unlike tangible assets like machinery or real estate, these intangibles are less visible yet critical to long-term competitiveness, revenue generation, and market positioning. Training focused on valuing intangible assets equips finance professionals, valuation specialists, and corporate managers with the skills needed to quantify these assets accurately, integrate them into financial statements, and make informed strategic decisions, especially in contexts where businesses rely on intangible valuation services Singapore for brands, IP and customer relationships.

Understanding how to value intangible assets is increasingly important for mergers and acquisitions (M&A), financial reporting, investor relations, and strategic planning. Professionals trained in these valuation techniques gain the ability to assess the contribution of brands, patents, copyrights, trademarks, and customer loyalty to overall enterprise value. This expertise not only enhances analytical precision but also strengthens credibility when advising management, investors, or regulators on financial and strategic matters.

Understanding Intangible Assets

What Are Brands?

Brands are the reputational and perceptual elements associated with a company’s products or services. They influence customer loyalty, pricing power, and competitive positioning. Valuing a brand involves estimating its ability to generate future economic benefits, often through methods such as royalty relief, excess earnings, or market-based approaches. Training on valuing intangible assets Singapore helps professionals understand brand equity, brand strength indices, and how brand perception translates into measurable financial value.

Intellectual Property (IP) Assets

Intellectual property includes patents, copyrights, trademarks, and trade secrets that protect a company’s innovations and creative output. IP contributes directly to revenue generation, differentiation, and market share. Proper valuation of IP requires understanding the legal protections, remaining useful life, and potential for licensing or enforcement. Training in IP valuation covers methodologies such as cost, market, and income approaches, emphasizing scenario analysis and risk assessment to determine the economic value of proprietary technologies or creative works.

Customer Relationships

Customer relationships, including contractual agreements and loyalty-based networks, represent another critical intangible asset category. These relationships generate recurring revenue, reduce acquisition costs, and support market expansion. Valuation of customer relationships typically involves estimating future cash flows derived from contracts, retention rates, and customer lifetime value. Training equips professionals to model these cash flows, incorporate attrition risks, and quantify the economic contribution of customer assets to overall enterprise value.

Methodologies for Valuing Intangible Assets

Income Approach

The income approach is widely used for valuing intangibles by projecting the future economic benefits they generate and discounting them to present value. Training programs emphasize building robust financial models, estimating incremental cash flows attributable to the asset, and applying appropriate discount rates to account for risk. This method is particularly effective for brands and customer relationships, where revenue streams can be reasonably forecasted.

Market Approach

The market approach determines value based on comparable transactions or market prices for similar assets. Trainees learn how to identify relevant transactions, adjust for differences in scale or quality, and interpret market multiples. This approach is often applied to patents , brand and IP valuation for finance professionals Singapore or trademarks where active licensing or sale markets exist, enabling professionals to benchmark valuations against real-world market data.

Cost Approach

The cost approach estimates the value of an intangible asset based on the cost to recreate or replace it. Training covers the identification of historical development costs, replacement expenditures, and obsolescence adjustments. While this method may underestimate value in highly innovative sectors, it provides a conservative baseline and is particularly useful for IP assets with limited market comparables.

Applications in Corporate Finance and Strategy

Mergers and Acquisitions

In M&A transactions, intangible asset valuation is critical to determining purchase price allocation, goodwill recognition, and post-acquisition integration planning. Professionals trained in these techniques can accurately assess the contribution of brands, IP, and customer relationships to the total transaction value, supporting negotiation strategies and regulatory compliance.

Financial Reporting and Compliance

Accounting standards such as IFRS and US GAAP require companies to recognize intangible assets and disclose their fair value in financial statements. Training helps finance teams implement compliant valuation practices, document methodologies, and support audit processes. Accurate valuation ensures transparency for investors and stakeholders while mitigating regulatory risks.

Strategic Planning and Investment Decisions

Beyond reporting and transactions, intangible asset valuation informs strategic decisions such as brand expansion, IP monetization, and customer retention initiatives. Training programs enable professionals to model scenarios, evaluate potential returns on investment, and prioritize initiatives that maximize the value of intangible resources. This analytical insight contributes to more informed resource allocation and long-term corporate growth.

Components of an Effective Training Program

Understanding Asset Categories

Training begins by providing a comprehensive overview of intangible asset types, including the legal, financial, and operational aspects that affect valuation. Participants learn to differentiate between assets that are separable, contractual, or integral to business operations, ensuring a structured approach to analysis.

Valuation Methodologies and Modeling

Programs emphasize building financial models tailored to intangible assets, incorporating income, market, and cost approaches. Trainees practice forecasting cash flows, applying appropriate discount rates, and conducting scenario and sensitivity analyses to assess valuation robustness.

Risk Assessment and Validation

An essential component of training is evaluating risks related to obsolescence, legal challenges, market acceptance, or customer attrition. Participants learn to adjust valuations based on probability-weighted scenarios, validate assumptions against industry benchmarks, and stress-test models for realistic outcomes.

Reporting and Communication

Finally, training emphasizes translating complex valuations into actionable insights for management, investors, or auditors. Participants develop skills in documenting methodologies, explaining assumptions, and presenting findings in a clear, professional manner that enhances decision-making and credibility.

Benefits of Intangible Asset Valuation Training

Training in valuing intangible assets equips professionals with advanced analytical capabilities, improving accuracy and reliability in business valuation. Participants gain the ability to quantify brand equity, IP, and customer relationship contributions to enterprise value, supporting strategic decisions and investment analysis. The expertise enhances credibility in corporate finance, M&A, consulting, and auditing, positioning professionals as trusted advisors. Additionally, mastering these valuation techniques strengthens career readiness, allowing finance specialists to navigate complex transactions, comply with regulatory standards, and contribute to sustainable corporate growth.

Conclusion

Intangible assets such as brands, intellectual property, and customer relationships represent critical sources of value for modern businesses. Training in their valuation equips finance professionals with the technical expertise, analytical rigor, and strategic insight necessary to quantify, model, and communicate their worth. By mastering methodologies such as the income, market, and cost approaches, and integrating scenario and sensitivity analysis, participants can provide accurate, defensible valuations that inform investment, reporting, and strategic decisions. Ultimately, proficiency in intangible asset valuation not only enhances organizational decision-making but also strengthens professional credibility, positioning participants for leadership roles in finance, consulting, and corporate management.